A new research note from battery supply chain specialist and price reporting agency, Benchmark Mineral Intelligence, has a warning for carmakers about the direction of battery prices used in electric vehicles – that they won’t fall indefinitely.

Andrew Leyland, Head of Strategic Advisory at Benchmark, points out that lithium-ion battery cell prices have fallen from $290 per kiloWatt hour six years ago to $110/kWh today, driven by economies of scale and technological improvement.

Some industry forecasts have prices falling as low as $60 to $70/kW. Not so fast, says Leyland:

“Worryingly enough many automotive board members still expect battery costs to continue to decline at pace without understanding the supply chain they are at the end of.

“Price volatility is introduced to the automotive battery supply chain at the mineral extraction phase. Here prices are determined by the market fundamentals of supply, demand, cost and inventory level.”

Given the chasm between future demand for battery raw materials used in electric vehicles and new supply entering the market over the next decade, the current low price environment for lithium, cobalt, graphite and less so nickel is not likely to endure.

Related: An Energy Trade War Is Brewing Between China And The U.S.

Benchmark estimates lithium supply has to double every four to five years to meet demand. For the other metals, additional supply required is of similar magnitude, but incentive for new mining projects is simply not there at today’s prices.

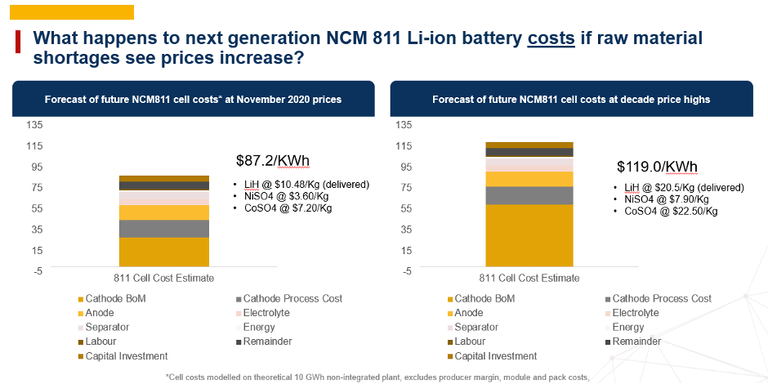

Benchmark calculated the increase in cell costs should prices of battery raw materials return to the peaks seen over the past decade.

Based on the next generation NCM 811 technology (which already uses much less cobalt, the priciest component, than found in many of today’s EVs) the result is an increase in per kW/h costs of more than 36% – from $87.2/kwh to $119.0/kwh.

When a 10% cell producer margin is included, moving from a production cost to a price, in a 70KWh battery pack this adds almost $2,500 to every vehicle, according to Benchmark.

Leyland says carmakers’ ability to pass on these costs to customers is also limited, given EVs are in essence a substitute product for ICE vehicles. That, and the fact that in the battery supply chain auto manufacturers are price takers, are flashing red lights for boardrooms from Silicon Valley to Stuttgart to Seoul and Shenzen.

By Mining.com

More Top Reads From Oilprice.com: