Via AG Metal Miner

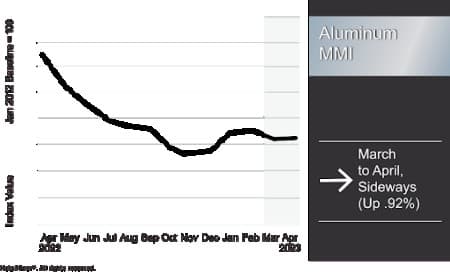

Aluminum prices saw a short-term rebound recently. After declining for much of February, price action found support in March and then began to return to the upside entering April. While the trend is starting to shift upward, the long-term direction for the aluminum market remains unclear.

Overall, the Aluminum Monthly Metals Index (MMI) moved sideways, with a modest 0.92% increase from March to April. Last month, MetalMiner released its quarterly revision to the Annual Outlook. The report consolidates our 12-month view and provides buying organizations with a complete understanding of the fundamental and technical factors driving prices. The report also includes a detailed forecast to use when sourcing metals for 2023. This includes expected average prices, support and resistance levels, and specific buying strategies.

China Steps Up Imports of Russian Aluminum

While the West continues to shun Russian aluminum, China remains an eager buyer. In fact, Chinese aluminum imports from Russia have nearly tripled, with customs data showing imports jumped over 266% during January and February.

The burgeoning partnership between the two countries is not new. Historically, Russia represented a key supplier for China. In 2022 alone, Russia accounted for 69% of total primary aluminum imports to China. So as Western nations increasingly narrowed Russian imports throughout last year, China instead opted to take advantage of discounted material. Moreover, this most recent increase comes at a time when China’s aluminum sector remains slow due to a severe water shortage.

Aluminum Prices: A Tale of Three Premiums

While controversial, the ongoing trade relationship between China and Russia remains a benefit to prices. For instance, it prevented some of the supply tightness (and bullish price direction) a total absence of Russian material would have created. It also represents a shift in global trade patterns. This has led to a mostly sideways trend for aluminum prices, even after the U.S. leveled a 200% tariff. Still, it remains unclear to what extent capacity cuts in China will impact global supply, especially as China’s economy continues to recover. Indeed, the Chinese construction and automotive industries largely drive aluminum demand. And while auto demand appears strong, the same cannot be said for the construction sector, which remains in a downtrend.

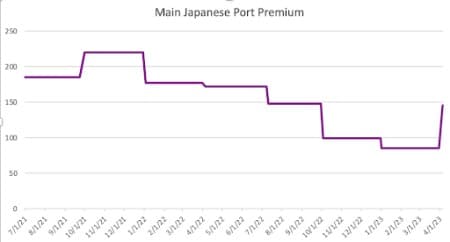

Meanwhile, a rise in the quarterly Main Japanese Port (MJP) premium suggests a recovery of eastern demand. Though the MJP slumped to $85/ton in Q1, reports suggest it rose to $125-145/ton in Q2. Japan is the largest Asian aluminum importer, and this increase marks the first in six quarters.

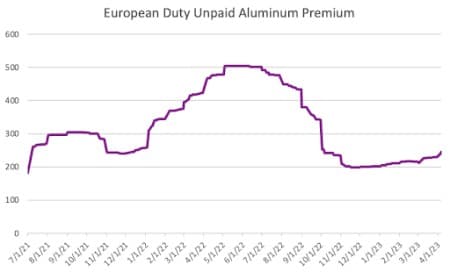

European Duty Unpaid Premium

Moreover, the European Duty Unpaid premium has also begun to trend upward. According to reports, that premium has risen almost 23% since it hit a bottom in November. Indeed, a warmer-than-expected winter in Europe helped support demand in the region while energy prices triggered rampant cuts to aluminum production. The Midwest Aluminum premium continued to diverge from its global counterparts. It remained bullish throughout Q4 of 2022 before finding a peak in late January and inverting down. Since Jan. 24, the premium has fallen over 14%.

The mixed direction among premiums suggests that aluminum demand remains globally uneven. That disparity has likely helped prevent the establishment of a strong breakout for aluminum prices to the upside or down, supporting the ongoing sideways trend.

Get weekly updates on aluminum market trends and other commodity news with MetalMiner’s free weekly newsletter. Click here.

SDI Aluminum Mill Begins Construction

In domestic capacity is on its way in the U.S. as Steel Dynamics (SDI) recently began construction on a new flat-rolled mill in Columbus, Mississippi. The company broke ground on March 7 and aims to start production by the summer of 2025. According to SDI, the mill will boast an annual capacity of 650,000 tons and will serve the automotive, sustainable beverage packaging, and common alloy industrial sectors.

By Nichole Bastin

More Top Reads From Oilprice.com:

- Sinopec Has Big Plans For Green Hydrogen

- America’s Hourly Energy Mix, Explained

- Can E-Sports Help Gulf Countries Diversify Away From Oil?