Breaking News:

China's Rare Earths Strategy, Explained

China's recent discovery of new…

The Plot to Further Disrupt Russian Oil Flows Proves That Sanctions Don’t Work

Russia’s oil revenues are still…

World's Largest Copper Miners Leave Money On The Table During Epic Rally

While the trend is clearly downward since hitting record highs a month ago, copper is still trading within earshot of five digits per tonne.

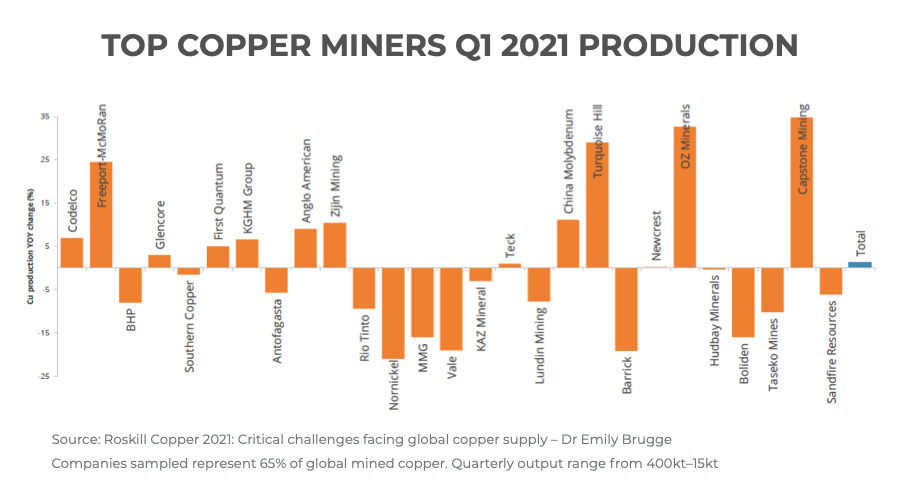

The recovery since the depth of the pandemic lit a fire under copper stocks, but not all miners have been able to take full advantage of the rally. In fact, many big names have seen output drop this year, or showed tepid growth.

Big names like BHP (reduced workforce in Chile), Southern Copper (lower grades), Antofagasta (reduced workforce) and Rio Tinto missed an opportunity, while for Norilsk (suspended operations), MMG (lower grades) and Vale (restrictions and maintenance) the start of the year was nothing short of dismal.

Overall, the 27 biggest producers represented on the graph (from a virtual conference held by Roskill) which are responsible for 65% of global copper mine output hardly moved the needle at the beginning of this year following a year of declining output.

State-owned Codelco through sheer size was able to make the most of prices that averaged some $8,500 during the first quarter of this year compared to $5,640 in Q1 2020.

Tunnel vision

The real standout was Freeport-McMoRan, which upped production by nearly 25% to 910m pounds or 412,000 tonnes during the period, with the Phoenix-based company going underground at the end of Grasberg’s open pit life.

At its average realized price (which at $8,686 exceeded the LME average) during the quarter, the value of the expansion tonnes came to a cool $705 million in extra revenue when others left money on the table.

Related: China’s Oil Imports To Drop After Refinery Margins Near $0

According to Freeeport’s Q1 filing, a total of 50 new drawbells were constructed at the Grasberg Block Cave and Deep Mill Level Zone (DMLZ) bringing the total open drawbells to over 420. The two operations now bring to the surface 98,500 tonnes of ore per day.

Gold production at Grasberg nearly doubled in Q1, to just shy of 300,000 ounces – gold and silver credits helped bring down net cash costs after royalties, treatment charges and export duties to a mere $0.29/lbs ($640 a tonne).

Absolutely fabulous

At full production in 2022, the Grasberg complex will produce 1.55 billion pounds (703kt) of copper and 1.6 million ounces of gold per year.

Freeport CEO Richard Adkerson pointed out during the company’s Q2 conference call last year that at full tilt, Grasberg is the globe’s largest gold mine, even though the gold is a byproduct:

“The high grades of copper combined with this gold component make Grasberg one of the mining industry’s truly most valuable fabulous assets in its history.

“As gold prices approximate $1,800 an ounce, revenues from gold are projected to completely offset the total cost of production at Grasberg.”

Gold today approximates $1,900 and since Adkerson said these words, copper has gained more than 50%.

Most fabulous of all time? Open for debate, but going underground could not have been a better bet. Almost as if it was timed.

By Mining.com

More Top Reads From Oilprice.com:

MINING.com

MINING.com is a web-based global mining publication focusing on news and commentary about mining and mineral exploration. The site is a one-stop-shop for mining industry…

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B