Breaking News:

Goldman Sachs Sees Downside For Copper in The Short Term

China's unwrought copper and copper…

Oil Rig Count Jumps as Drilling Activity Picks Up

The total number of active…

Small Crude Draw Can’t Stop Oil From Plunging

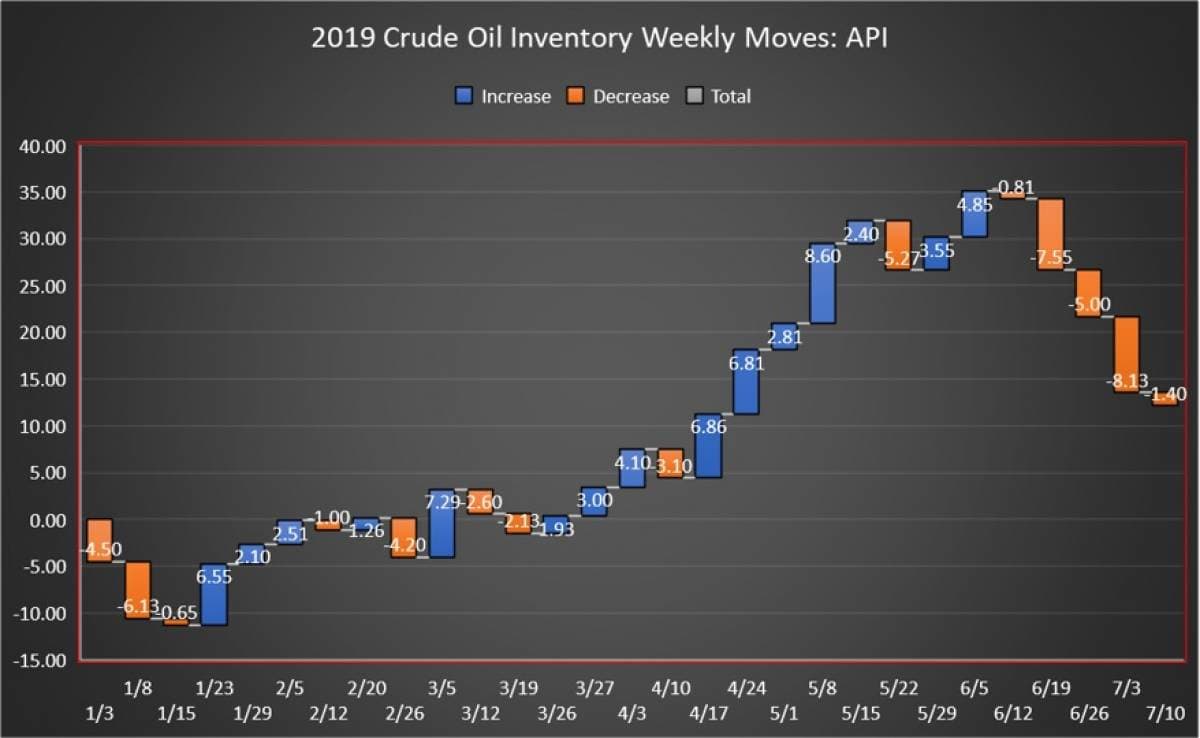

The American Petroleum Institute (API) reported a small crude oil inventory draw of 1.401 million barrels for the week ending July 11, compared to analyst expectations of a 2.69-million barrel draw.

The inventory draw this week is disappointing after last week’s large draw of 8.129 million barrels, according to the API. A day later, the EIA had estimated an even bigger inventory drawdown of 9.5 million barrels.

After a string of inventory draws, the net build is now just 12.16 million barrels for the 29-week reporting period so far this year, using API data.

Oil prices were trading down on Tuesday after shocking reports that US Secretary of State Mike Pompeo announced that Iran was ready to negotiate about the details of its missile program. Tensions over oil flows near the Strait of Hormuz have kept a floor under oil prices that would otherwise have fallen on recent weak oil demand growth projections.

At 3:35pm EST, WTI was trading down by $1.70 (-2.85%) at $57.88—nearly flat week on week. Brent was trading down $1.75 (-2.63%) at $64.73—up slightly from last week.

The API this week reported a 476,000-barrel draw in gasoline inventories for week ending July 11. Analysts estimated a draw in gasoline inventories of 925,000 barrels for the week.

Distillate inventories grew by 6.226 million barrels for the week, while inventories at Cushing fell by 1.115 million barrels.

US crude oil production as estimated by the Energy Information Administration showed that production for the week ending July 05 rose slightly this week to 12.3 million bpd, just 100,000 bpd off the all-time high of 12.4 million bpd.

The U.S. Energy Information Administration report on crude oil inventories is due to be released at its regularly scheduled time on Wednesday at 10:30a.m. EST.

By 4:43pm EST, WTI was trading at $58.12 while Brent traded at $64.97.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Falls Back As Iran Risk Factor Fades

- Tesla Claims Secret Project Has Fallen Into Chinese Rival’s Hands

- EU Slaps Sanctions On Turkey For Illegal Offshore Drilling

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

-

EVs have depressed the oil market...

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B