Breaking News:

Iranian Oil Exports Have Risen Sharply, Facilitated By Malaysia

Whether or not the U.S.…

EU Leverages Frozen Russian Assets for €1.5 Billion Aid Package to Ukraine

The European Union has transferred…

Shanghai’s Tesla Factory Could Be Shuttered Until Mid-May

With all of the chaos taking place in Shanghai as a result of a new round of mysteriously overbearing Covid lockdowns, there has been very little attention paid to Tesla's current plant shut down and the effect it may have on the company's operating results.

But analyst Gordon Johnson of GLJ Research is forcing that issue into the spotlight, writing in a note to clients on Monday that on the ground contacts are telling his firm that Shanghai may be closed for a prolonged amount of time.

"In discussions last evening with one of our on-the-ground contacts in China, we were told TSLA’s Shanghai plant will be down until 'at least' mid-May (and not fully-ramped up until 'late 3Q22’ – yes, you heard that right)," Johnson wrote.

He continued: "More specifically, our Shanghai contact says due to TSLA’s plant: (a) being a non critical factory (i.e., not food, medicine and military), and (b) mixing people from multiple districts, which is strictly forbidden because then every district would have to go on lockdown, it will not be given priority vs. other more critical plants."

Johnson told clients he did not think that the closure had been priced into the company's stock or models: "More to the above, in our conversations this evening, our contact, who is a supplier to TSLA, expressed their view that it will take 2-to-3 days to fully re-ramp the factory for each day it is closed. Consequently, in short, with the Street modeling TSLA’s sales/EPS growing from $17.8bn/$2.72 in 1Q22 to $19.597bn/$2.50 in 2Q22, we DO NOT believe this news is priced in (our contact believes TSLA could lose money in 2Q22 vs. the current Consensus est. that they will deliver $2.50/shr in EPS [or $2.873bn in net income])."

GLJ's contact in China, when asked if the factory will close longer than just through the end of April, said:

"Yes, it will shut for a minimum of 4-6 more weeks and most likely at least June 1 absent recession of the Dynamic Zero Covid policy. I also expect re-ramp to take 2-3 days for every day the factory is closed. So a closure through May won’t have Shanghai back to full production until late Q3. It’s a non critical factory (food, medicine and military) and mixing people from multiple districts is strictly forbidden because then every district would have to go on lockdown. My best case estimate for Q1 production is 190k. And that’s based on a mid May open. I fully expect the quarter to come on around 160k and be a loss.”

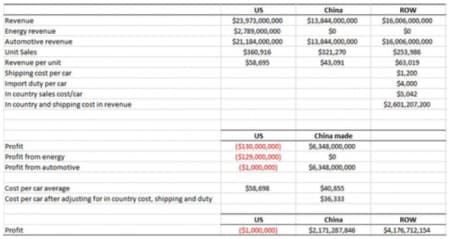

Johnson says he thinks that Tesla's Shanghai plant is >100% of the company's profit and, if this becomes obvious, that the views around Tesla's other factories' efficiency may come under pressure.

By Zerohedge.com

More Top Reads From Oilprice.com:

- Oil Sands Financing From Canadian Banks Doubles

- India’s Russian Dealings Have Left Biden’s Geopolitical Oil Strategy In Tatters

- Tight Oil Markets Are Sending Fuel Margins Through The Roof

ZeroHedge

The leading economics blog online covering financial issues, geopolitics and trading.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B