Breaking News:

China's Rare Earths Strategy, Explained

China's recent discovery of new…

What Would the Re-Election of Trump Mean for U.S. Energy?

A potential Trump re-election could…

Second Surprise Crude Oil Draw Sends Prices Higher

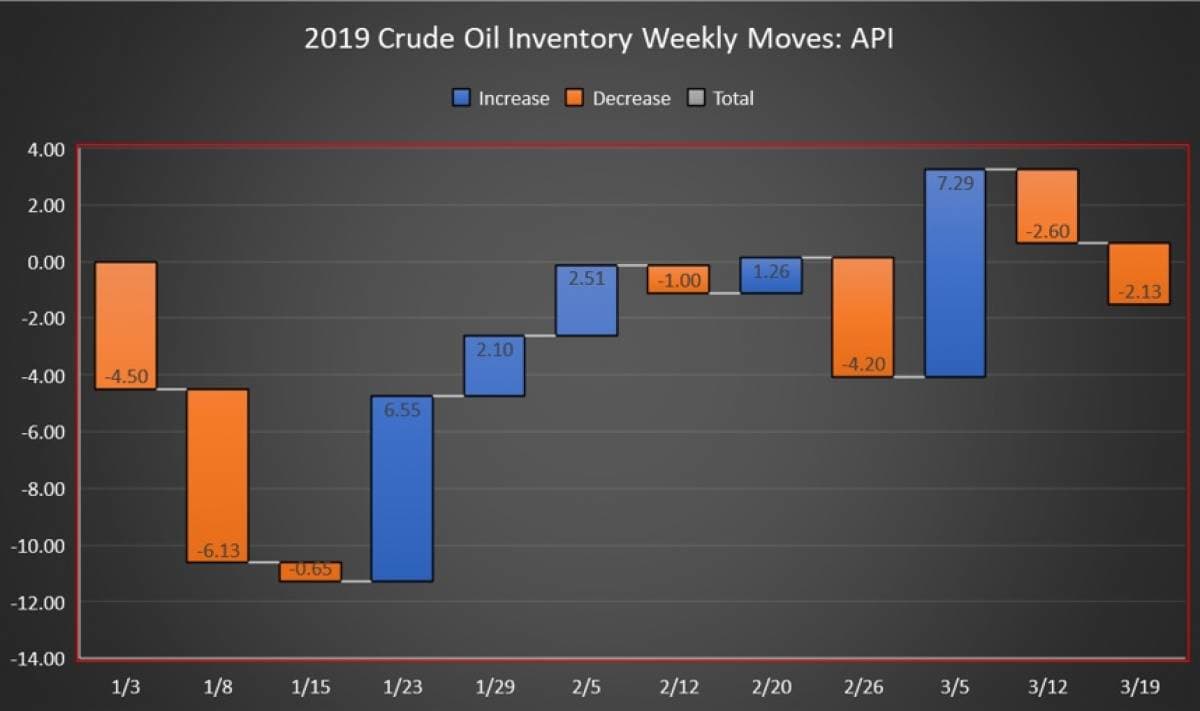

The American Petroleum Institute (API) reported a surprise draw in crude oil inventory of 2.133 million barrels for the week ending March 15, coming in under analyst expectations of a 309,000-barrel build. This is the second week in a row for a surprise draw.

Last week, the API reported a large surprise draw in crude oil of 2.6 million barrels. A day later, the EIA reported a similar figure, estimating that crude inventories had drawn down by 3.9 million barrels.

Including this week’s data, the net draw is 1.5 million barrels for the eleven reporting periods so far this year, using API data.

(Click to enlarge)

WTI was trading down slightly on Tuesday hours before the data release at $59.22, down $0.16 (-0.27%) at 1:59pm. Its counterpart, the Brent benchmark, was trading at $67.57, up $0.03 (+0.04%) at that time, with prices near yesterday’s levels as the market continues to assess with inconsistent outcomes OPEC members’ dutiful adherence to its promised production cuts, Venezuela’s falling oil exports, Iran’s precarious sanction situation, the ongoing trade row with China, and differing analyst opinions on the demand growth outlook in the near future.

Still, oil prices are near four-month highs, and WTI is up over $2 per barrel week on week. Brent is trading at $1 per barrel over last week levels.

Related: Gas Mergers Could Pressure Prices In Europe

The API this week reported draw in gasoline inventories for week ending March 15 in the amount of 2.794 million barrels. Analysts estimated a draw in gasoline inventories of 2.125 million barrels for the week.

US crude oil production as estimated by the Energy Information Administration showed that production for the week ending March 8—the latest information available—dipped slightly to an average of 12.0 million barrels per day after two weeks at an all-time high of 12.1 million bpd.

Distillate inventories decreased by 1.607 million barrels, compared to an expected draw of 1.3 million barrels for the week.

Crude oil inventories at the Cushing, Oklahoma facility fell by 317,000 barrels for the week.

The U.S. Energy Information Administration report on crude oil inventories is due to be released on Wednesday at 10:30a.m. EST.

By 4:39pm EST, WTI was trading down at $59.15 and Brent was trading down at $67.51.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- The Billionaires Battling It Out Over Biofuel

- Pakistan Aims To Become A Natural Gas Hotspot

- U.S. Aims To Bring Iran Oil Exports Below 1 Million Bpd

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

fluctuation in the Dollar Index , Gold should overlook this as it amounts to pennies.