Breaking News:

Tajikistan's Debt Crisis Risk Tied to Rogun Dam, World Bank Cautions

The World Bank's latest report…

Geomagnetic Storms Could Devastate Washington DC's Power Supply

New research shows Washington DC…

Oil Slips On Surprise Crude Build

The American Petroleum Institute (API) estimated on Tuesday another build in crude oil inventories, this time of 3.857 million barrels for the week ending June 12.

Analysts had predicted a small inventory draw of 152,000 barrels.

In the previous week, the API shocked the market with a massive spike in crude oil inventories of 8.42 million barrels, after analysts had a far more benign draw in mind, after U.S. production continues to fall.

WTI was trading up on Tuesday afternoon prior to the API’s data release despite fears that the United States may see a second wave of Covid-19. Despite those fears, a second shutdown in most states—the likes of which could stymie further demand for oil—seems unlikely.

Oil production in the United States has now fallen from 13.1 million bpd on March 13 to 11.1 million bpd for June 5, according to the Energy Information Administration—a drop of 2 million bpd.

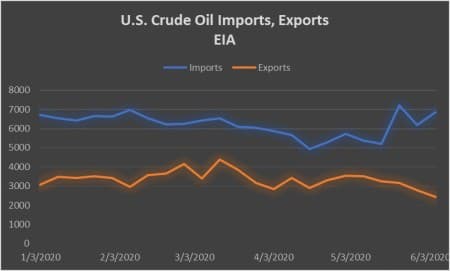

But while U.S. production has fallen each week for the last few months, U.S. imports of crude oil started to increase mid-May, while exports started to fall.

At 3:52 pm EDT on Tuesday the WTI benchmark was trading up on the day by $0.99 (+2.67%) at $38.11. The price of a Brent barrel was trading up on Tuesday as well, by $1.05 (+2.64%), at $40.77—both benchmarks are trading down on the week.

The API also reported a build of 4.267 million barrels of gasoline for week ending June 12—compared to last week’s 2.913-barrel draw. This week’s large build compares to analyst expectations for a 17,000-barrel draw for the week.

Distillate inventories were up by 919,000 barrels for the week, compared to last week’s 4.271-million-barrel build, while Cushing inventories saw a draw of 3.289 million barrels.

At 4:36 pm EDT, WTI was trading at $38.14 while Brent was trading at $40.79.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- The U.S. Has Already Lost More Than 100,000 Oil And Gas Jobs

- Hydrogen Fuel Economy Is Finally Going Mainstream

- Asian Oil Markets Tighten After Saudi Aramco Cuts Supply

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B