Breaking News:

Kazakhstan, Azerbaijan, and Uzbekistan Forge Green Energy Export Alliance

Kazakhstan, Azerbaijan, and Uzbekistan join…

Rystad: OPEC's Oil Reserves are Much Lower Than Officially Reported

Rystad Energy’s latest research shows…

Oil Rebounds On Surprise Crude Draw

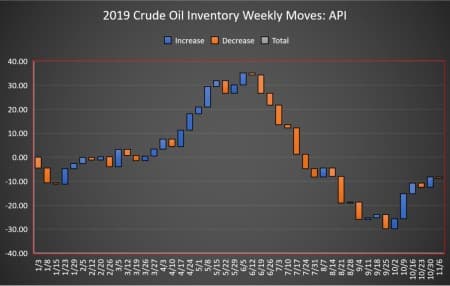

The American Petroleum Institute (API) has estimated a crude oil inventory draw of 500,000 barrels for the week ending November 7, compared to analyst expectations of a 1.649-million-barrel build.

Last week saw a build in crude oil inventories of 4.26 million barrels, according to API data. The EIA’s estimates, however, reported a build of 7.9-million barrels for that week.

After today’s inventory move, the net draw for the year now sits at 8.76 million barrels for the 46-week reporting period so far, using API data.

Oil prices were trading modestly up on Wednesday prior to the data release. After OPEC Chief Mohammed Barkindo suggested that US shale supply growth might slow next year. The positive sentiment for oil prices is dampened, however, by the unresolved trade war between China and the United States that have dampen oil demand growth prospects for next year. With demand growth unlikely to look up without this trade resolution, OPEC’s best hope for lifting oil prices is to paint an even uglier picture for oil supply.

At 4:25pm EST, WTI was trading up $0.43 (+0.76%) at $57.23 per barrel—flat week over week. Brent was trading up $0.44 (+0.71%) at $62.50, down roughly $0.20 a barrel from last week.

Related: OPEC Is Desperate For A Trade War Resolution

The API this week reported a build of 2.3 million barrels of gasoline for week ending November 7, more than double the build that analysts predicted, which was for a draw in gasoline inventories of 1.167 million barrels for the week.

Distillate inventories saw a build of 800,000 barrels for the week, while Cushing inventories fell by 1.2 million barrels.

US crude oil production as estimated by the Energy Information Administration showed that production for the week ending November 1 stayed at the all-time high of 12.6 million bpd for the fifth week in a row.

At 4:44pm EDT, WTI was trading at $57.39, while Brent was trading at $62.61.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- 6 Technology Trends Revolutionizing The Transportation Sector

- OPEC Is Desperate For A Trade War Resolution

- U.S. Shale Will Soon Produce More Oil Than All Of Russia

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B