Breaking News:

U.S. Hits Record High Electricity Generation From Natural Gas

Record-breaking natural gas demand for…

Kuwait Looks To Nearly Double Production After Major Oil Find

Sheikh Nawaf al-Sabah, CEO of…

Oil Prices Unmoved By Surprise Crude Build

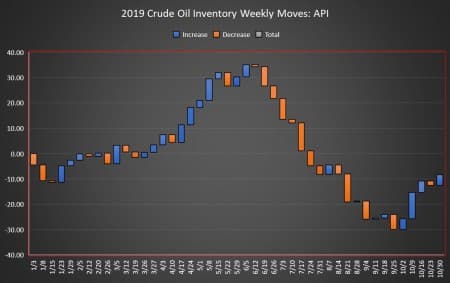

The American Petroleum Institute (API) has estimated a crude oil inventory build of 4.26-million barrels for the week ending October 31, compared to analyst expectations of a 1.515-million-barrel build.

Last week saw a draw in crude oil inventories of 1.7 million barrels, according to API data. The EIA’s estimates, however, reported a build of 5.7-million-barrels for that week.

After today’s inventory move, the net draw for the year has now shrunk to 8.26 million barrels for the 45-week reporting period so far, using API data.

Oil prices were trading up on Tuesday prior to the data release, shrugging off demand growth worry at least for the day due to a renewed optimism that the United States and China may some day come to an agreement on a trade deal—a turnout that would potentially increase the demand growth outlook.

At 1:22pm EST, WTI was trading up $0.55 (+0.97%) at $57.09 per barrel—up nearly $2 per barrel week over week. Brent was trading up $0.63 (+1.01%) at $62.76, up a bit more than $2 per barrel from this time last week.

Related: IEA: An Oil Glut Is Looming

The API this week reported a draw of 4.0 million barrels of gasoline for week ending October 31. Analysts predicted a draw in gasoline inventories of 1.809 million barrels for the week.

Distillate inventories also fell, by 1.6 million barrels for the week.

US crude oil production as estimated by the Energy Information Administration showed that production for the week ending October 25 stayed at 12.6 million bpd for the fourth week in a row—the highest production level that the United States has seen.

At 4:40pm EDT, WTI was trading at $57.25, while Brent was trading at $62.99.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Protect The Oil: Trump’s Top Priority In The Middle East

- Why The Latest Keystone Spill Is Disastrous For Canadian Oil

- Egypt Prepares For A Renewable Energy Revolution

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

It has not been lost on the global oil market that every time oil prices started to surge, either the EIA or the API or both would announce inventory build aimed at depressing oil prices. It is one of the tools the United States uses to manipulate global oil prices.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London