Breaking News:

Centrica's Profits Decline Amid Return to Market Normalcy

Centrica, the owner of British…

Tajikistan's Debt Crisis Risk Tied to Rogun Dam, World Bank Cautions

The World Bank's latest report…

Oil Prices Unmoved By Small Crude Draw

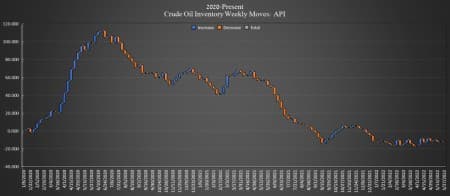

Crude oil from the nation's Strategic Petroleum Reserves may be headed into commercial inventories, but the American Petroleum Institute (API) still reported a draw this week for crude oil of 1.181 million barrels, while analysts predicted a draw of 67,000 barrels.

The draw comes even as the Department of Energy released 5.4 million barrels from the Strategic Petroleum Reserves in Week Ending May 27.

U.S. crude inventories have shed some 76 million barrels since the start of 2021 and about 19 million barrels since the start of 2020, according to API data.

In the week prior, the API reported a small build in crude oil inventories of 567,000 barrels after analysts had predicted a draw of 690,000 barrels.

Oil prices rose on Wednesday as China's financial hub, Shanghai, reopened after two months of Covid-19 lockdowns. WTI was trading up 0.05% on Monday at $114.70 per barrel on the day minutes before data release—up almost $4.50per barrel on the week. Brent crude was trading up 0.18% on the day at $115.80—and up more than $2 per barrel on the week.

U.S. crude oil production stagnated at 11.9 million bpd in the week ending May 20. Crude production in the United States is down 1.2 million barrels per day from pre-pandemic times.

This week, the API reported a draw in gasoline inventories of 256,000 barrels for the week ending May 27, on top of the previous week's sharp 4.223-million-barrel draw.

Distillate stocks saw a rise in inventory, of 858,000 barrels for the week, nearly offsetting last week's 949,000-million-barrel decrease.

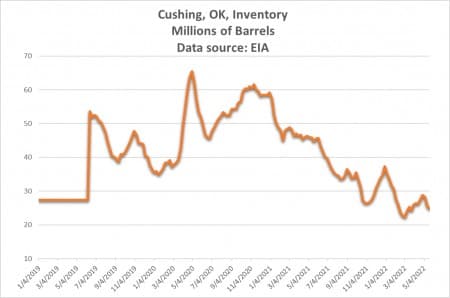

Cushing saw a minor 177,000-barrel build this week. Cushing inventories slipped again to 24.778 million barrels in the week prior, as of May 20, according to EIA data—down from 59.2 million barrels at the start of 2021, and down from 37.3 million barrels at the end of 2021.

At 4:45 pm, ET, WTI was trading up at $114.80 (+0.07%), with Brent trading up at $115.70 (+0.12%).

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Prices Rise As EU Leaders Agree On Partial Russian Crude Ban

- Could Iraq Dethrone Saudi Arabia As Largest Oil Producer?

- Gazprom Cuts Off Gas Supply To The Netherlands

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B