Breaking News:

Harris Presidency Will Be Bad News for Oil

In the case of a…

What Does Von der Leyen’s Re-Election Mean for Europe’s Future?

Ursula von der Leyen, a…

Oil Prices Slip On Crude, Distillates Inventory Build

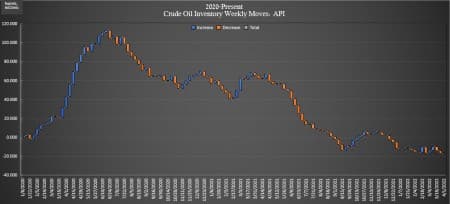

The American Petroleum Institute (API) reported a surprise build this week for crude oil of 1.080 million barrels, compared to analyst predictions of a 1.558 million barrel draw.

U.S. crude inventories have shed some 79 million barrels since the start of 2021 and about 22 million barrels since the start of 2020.

In the week prior, the API reported a draw in crude oil inventories of 3.0 million barrels after analysts had predicted a draw of 1.558 million barrels.

Oil prices were trading down on Tuesday, largely in response to the White House's plan to release 180 million barrels of crude oil from the SPR, and other nations' plans that could release crude in a coordinated measure against high oil prices.

WTI was trading down 2.41% at $100.80 per barrel on the day at 3:47 p.m. ET—down nearly $4 per barrel on the week. Brent crude was trading down 1.96% on the day at $105.40 per barrel on the day—down $5 per barrel on the week.

U.S. crude oil production rose to 11.7 million bpd as of March 25. It was the first increase to U.S. crude oil production in months. Crude production in the United States is still down 1.4 million barrels per day from pre-pandemic times.

This week, the API reported a draw in gasoline inventories at 543,000 barrels for the week ending April 1—after the previous week's 1.357-million-barrel draw.

Distillate stocks saw an increase in inventory of 593,000 barrels for the week, after last week's 215,000 barrel decrease. Cushing saw a 1.791 million barrel increase this week. Cushing inventories slipped to 24.233 million barrels as of March 25, according to EIA data—down from 59.2 million barrels at the start of 2021, and down from 37.3 million barrels at the end of 2021.

At 4:48 pm, ET, WTI was trading at $100.60 (-2.56%), with Brent trading at $105.30 (-2.07%).

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Prices Rebound Despite Biden's Best Efforts

- Why Renewables Can’t Solve Europe's Energy Crisis

- Saudi Arabia Raises Oil Prices To Record Premiums

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B