Breaking News:

Could the UK’s Crown Estate Shake-Up Accelerate Offshore Wind Investment?

The UK government is proposing…

The Dramatic Fall of Mexico’s Oil Giant

Mexico's state-owned oil company, Pemex,…

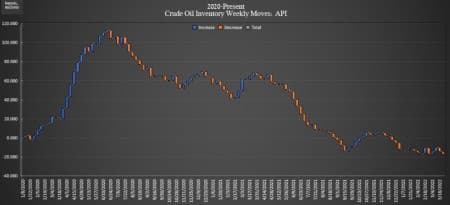

Oil Recoups Losses As API Reports Large Crude Inventory Draw

The American Petroleum Institute (API) estimated that there was a draw this week for crude oil of 3.0 million barrels, compared to analyst predictions of a 1.558 million barrel draw.

U.S. crude inventories have shed some 80 million barrels since the start of 2021 and about 23 million barrels since the start of 2020.

In the week prior, the API reported a draw in crude oil inventories of 4.28 million barrels after analysts had predicted a build of 25,000 barrels.

Oil prices were trading down on Tuesday as it appeared that Ukraine and Russia had made some progress in their peace talks.

WTI was trading down 1.31% at $104.60 per barrel on the day at 2:10 p.m. ET—down nearly $7 per barrel on the week. Brent crude was trading down 1.65% on the day at $110.60 per barrel on the day—down $5 per barrel on the week.

At a time when American consumers are concerned about the prices at the pump and the global crude oil markets remain tight, U.S. crude oil production has not budged in seven weeks from its position at 11.6 million bpd—still down 1.5 million barrels per day from pre-pandemic times as of March 18.

This week, the API reported a draw in gasoline inventories at 1.357 million barrels for the week ending March 25—after the previous week's 626,000-barrel draw.

Distillate stocks saw a decrease in inventory of 215,000 barrels for the week, on top of last week's 826,000 barrel decrease. Cushing saw a 1.061 million barrel decline this week. Cushing inventories rose to 25.2 million barrels as of March 18, according to EIA data—down from 59.2 million barrels at the start of 2021, and down from 37.3 million barrels at the end of 2021.

At 4:36 pm, ET, WTI was trading at $105.00 (-0.91%), with Brent trading at $111.30 (-1.08%).

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Are You Really Being ‘Gouged’ At The Gas Pump?

- Saudi Arabia Hikes Oil Prices Despite Record Discounts For Russian Crude

- Russian Crude Continues To Flow Despite Harsh Sanctions

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

Lumber futures annihilated now wheat futures annihilated soon obviously corn and coal and steel as well as far as US based US pricing. My price target for the oil futures contract still remains $ONE US Dollar per barrel.

Miami Super-Tall real estate looking good tho apparently.

long $nee Next Era Energy

Strong buy