|

Louisiana Light • 2 days | 81.18 | +0.12 | +0.15% | ||

|

Bonny Light • 29 days | 86.00 | -0.62 | -0.72% | ||

|

Opec Basket • 2 days | 81.37 | -0.08 | -0.10% | ||

|

Mars US • 266 days | 75.97 | -1.40 | -1.81% | ||

|

Gasoline • 7 hours | 2.461 | -0.007 | -0.29% |

|

Bonny Light • 29 days | 86.00 | -0.62 | -0.72% | ||

|

Girassol • 29 days | 87.27 | -0.38 | -0.43% | ||

|

Opec Basket • 2 days | 81.37 | -0.08 | -0.10% |

|

Peace Sour • 14 hours | 72.28 | +0.69 | +0.96% | ||

|

Light Sour Blend • 14 hours | 72.28 | +0.69 | +0.96% | ||

|

Syncrude Sweet Premium • 14 hours | 79.18 | +0.89 | +1.14% | ||

|

Central Alberta • 14 hours | 72.28 | +0.69 | +0.96% |

|

Eagle Ford • 3 days | 74.07 | +0.63 | +0.86% | ||

|

Oklahoma Sweet • 2 days | 75.00 | +2.00 | +2.74% | ||

|

Kansas Common • 3 days | 67.75 | +0.50 | +0.74% | ||

|

Buena Vista • 4 days | 83.27 | -2.82 | -3.28% |

Iranian Oil Exports Have Risen Sharply, Facilitated By Malaysia

Whether or not the U.S.…

Why China’s Commodity Imports Rise amid Struggling Economy

Chinese purchases of LNG, coal,…

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

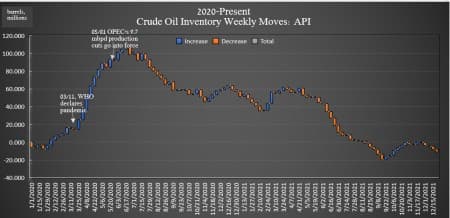

Oil Prices Hold Gains Following Crude Inventory Draw

By Julianne Geiger - Dec 28, 2021, 3:57 PM CSTThis week, the American Petroleum Institute (API) estimated the inventory draw for crude oil to be 3.09 million barrels.

U.S. crude inventories have shed some 68 million barrels since the beginning of the year.

In the previous week, the API reported a draw in oil inventories of 3.670 million barrels, compared to the 2.633-million-barrel draw that analysts had predicted.

Oil prices were trading up on Tuesday in the run-up to the data release, with WTI trading up 0.49% to $75.94 on the day, but up $6 per barrel on the week. Brent was trading up by 0.51% at $79.00 $72.56 on the day, and up $6.50 on the week.

U.S. oil production has been on a slow but steady climb. For the week ending December 17—the last week for which the Energy Information Administration has provided data—crude oil production in the United States came in at 11.6 million bpd—an increase of 600,000 bpd since the start of the year.

The API reported a draw in gasoline inventories of 319,000 barrels for the week ending December 24—after the previous week's 3.701-million barrel build.

Distillate stocks saw a decrease in inventory of 716,000 barrels for the week, after last week's 849,000-barrel decrease. Cushing saw a 1.594 million-barrel increase this week.

At 4:40 pm, EST, WTI was trading at $76.09, with Brent trading at $79.12.

By Julianne Geiger for Oilprice.com

More Top Reads from Oilprice.com:

- U.S. Gasoline Prices Haven’t Peaked Just Yet

- Cocaine, Guns And Gushers: Colombia’s Oil Industry Struggles To Reactivate

- Waste Disposal Back In The Spotlight As America Ramps Up Nuclear Sector

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Related posts

EXXON Mobil

-0.35

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

BUY 57.15

Sell 57.00

The materials provided on this Web site are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Nothing contained on the Web site shall be considered a recommendation, solicitation, or offer to buy or sell a security to any person in any jurisdiction.

Merchant of Record: A Media Solutions trading as Oilprice.com