Breaking News:

Coal Share of China's Power Output Drops to Record Low

China reached a momentous milestone…

Kazakhstan, Azerbaijan, and Uzbekistan Forge Green Energy Export Alliance

Kazakhstan, Azerbaijan, and Uzbekistan join…

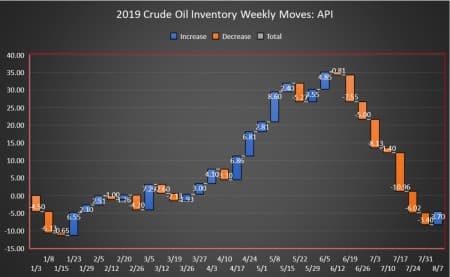

Mixed API Inventory Data Has Little Impact On Oil Prices

This week, the American Petroleum Institute (API) estimated the inventory draw for crude oil to be 815,000 barrels.

U.S. crude inventories have shed some 61 million barrels since the beginning of the year, and while this is the typical time for rebuilding crude stocks, no such additions to crude inventory have been happening on any steady basis.

Analyst expectations for the week were for a larger draw of 2.60 million barrels for the week.

In the previous week, the API reported a draw in oil inventories of 3.089 million barrels, compared to the 2.093-million-barrel build that analysts had predicted.

Oil prices were trading down by more than 1% on Tuesday in the run-up to the data release as Omicron fears hang around the industry's neck, and as a new IEA report suggested that it sees supplies rebounding and demand faltering under Omicron—a recipe that could increase inventories.

With the exception of a string of five straight inventory builds in the month of October, we're not seeing that steady climb just yet.

By 2:19 p.m. EST WTI had fallen more than 1% to $70.47—a more than $1.50 decrease per barrel since this time last week. Brent was also trading down more than 1% at $73.51—nearly $2 per barrel under last week's levels.

While there haven't been any sustained inventory increases to crude oil in the United States, U.S. oil production has been steadily increasing. For the week ending December 3—the last week for which the Energy Information Administration has provided data—crude oil production in the United States rose by 100,000 bpd for the third week in a row to 11.7 million bpd.

Production is still off from the U.S. high of 13.1 million bpd prior to the pandemic.

The API reported a build in gasoline inventories of 426,000 barrels for the week ending December 10—after the previous week's 3.705-million-barrel build.

Distillate stocks saw a decrease in inventory of 1.016 million barrels for the week, after last week's 1.228-million-barrel increase. Cushing saw a 2.275 million-barrel increase this week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- World Leaders Have To Face The Truth About Oil Demand

- Oil Prices Rise As Omicron Fears Fade

- JP Morgan Predicts The End Of Covid, A Strong Economy, And $125 Oil

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B