Breaking News:

Net-Zero Ambitions Hit Major Roadblocks in Europe, UK, and US

Net-Zero transition targets touted so…

Centrica's Profits Decline Amid Return to Market Normalcy

Centrica, the owner of British…

Oil Prices Fall On Rising Crude, Product Inventories

The American Petroleum Institute (API) reported a build this week for crude oil of 1.618 million barrels, compared to analyst predictions of a 1.2 million barrel draw.

U.S. crude inventories have shed some 73 million barrels since the start of 2021 and about 16 million barrels since the start of 2020, according to API data.

In the week prior, the API reported a larger-than-expected draw in crude oil inventories of 3.479 million barrels after analysts had predicted a draw of 1.167 million barrels.

Oil prices were down on Tuesday after Monday's brief selloff, as China's central bank promised to provide monetary policy support to its economy after the lockdown. The price moves remain a testament to the hyper volatility that exists in the market post covid and post-Russian invasion.

WTI was trading down 3.40% at $99.58 per barrel on the day at 1:18 p.m. ET—down roughly $3 per barrel on the week. Brent crude was trading down 3.40% on the day at $102.30 per barrel on the day—and down nearly $4 per barrel on the week.

U.S. crude oil production stayed at 11.9 million bpd for the third week in a row for the week ending April 29. Crude production in the United States is still down 1.2 million barrels per day from pre-pandemic times.

This week, the API reported a build in gasoline inventories at 823,000 barrels for the week ending April 29—after the previous week's 4.50-million-barrel draw.

Distillate stocks saw a build in inventory of 662,000 barrels for the week compared to last week's 4.457-million-barrel decrease.

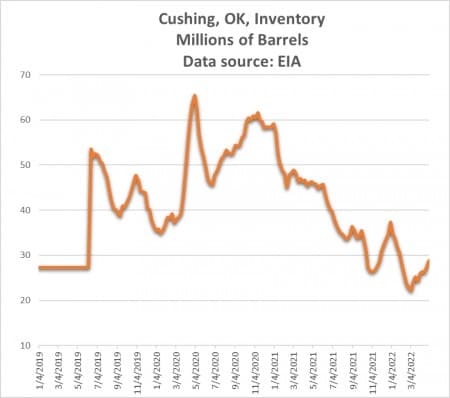

Cushing saw a 92,000-barrel build this week. Cushing inventories rose to 28.829 million barrels as of April 29, according to EIA data—down from 59.2 million barrels at the start of 2021, and down from 37.3 million barrels at the end of 2021.

At 4:35 pm, ET, WTI was trading at $100 (-2.97%), with Brent trading at $102.70 (-3.07%).

By Julianne Geiger for Oilprice.com

More Top Reads from Oilprice.com:

- U.S. Shale Swings From Losses To Record Cash Flows

- China’s COVID Lockdowns Force Aramco To Slash Oil Export Prices

- Saudi Energy Minister: Insufficient Investment To Blame For High Fuel Prices

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B