Breaking News:

OPEC Oil Reserves in Decline

Rystad Energy disputes OPEC’s claim…

Oil Moves Higher on Crude, Fuel Inventory Draw

Crude oil prices ticked higher…

Oil Perks Up As US Hints It May Delay Mexico Tariffs

Oil prices rose on Thursday afternoon after reports surfaced that the United States may consider delaying the tariffs it has threatened to impose on its Latin American neighbor, according to Bloomberg.

The threat of tariffs of Mexico’s goods came as US President Donald Trump tries to stop the flow of migrants coming into the United States.

At 3:12pm EST, WTI was trading up $0.99 at $52.67 (+1.92%), while Brent crude was trading up $1.14 at $61.77 (+1.88%).

Earlier, Former Commerce Secretary Carlos Gutierrez said that he expected that the 5% version of the tariffs would be imposed on Monday, because Mexico would not have had time over the weekend to come up with an immigration plan, according to CNBC.

Art Cashin of UBS Financial Services told CNBC on Thursday that the market would tolerate the tariff being imposed on Mexico—it just wouldn’t tolerate it if it lasts. He expects the tariffs would last no longer than a week.

“They’re assuming it may be too late to either postpone it or change it, so they’ll get imposed. But they assume they’ll come off within a week,” Cashin told CNBC.

The original plan was to eventually increase the tariffs to 25% by October, with incremental increases if Mexico fails to successfully implement a plan to stop migrants from flooding into the United States.

Related: Oil Just Had Its Worst Run Since 2008

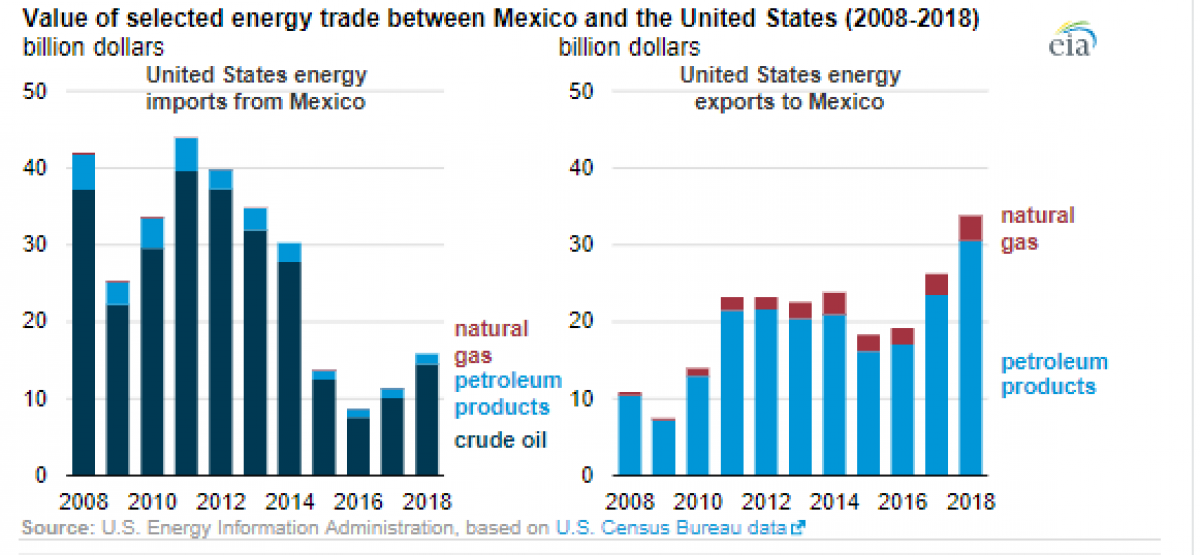

The United States imported an average of 712,000 barrels per day of crude oil and petroleum products in March 2019, according to the Energy Information Administration (EIA), most of which is crude oil. The value of the oil imported from Mexico to the US totaled about $15 billion in 2018.

(Click to enlarge)

US refineries rely on this Mexican crude oil—which is of the heavy variety--particularly now that its other sources such as Venezuela—also heavy crude—have dried up. Canada supplies—also heavy crude oil—are also maxed out already thanks to their pipeline constraints. While Saudi Arabia also produces heavy oil, it has reduced its shipments to the US, in line with its desire to stick to the production cut quota it laid out as an OPEC member.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- World Bank Cuts Russia 2019 Growth Outlook On Oil Cuts

- Oilfield Services Feel The Pain As Crude Prices Drop

- OPEC+ Has Only One Choice As Oil Prices Slide

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B