Breaking News:

Venezuela Has a Natural Gas Problem

Venezuela's natural gas production has…

EU Leverages Frozen Russian Assets for €1.5 Billion Aid Package to Ukraine

The European Union has transferred…

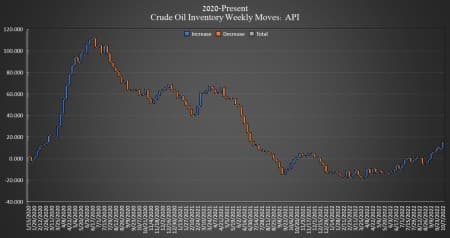

Oil Falls After API Reports Large Crude Inventory Build

The American Petroleum Institute (API) reported a large build this week for crude oil of 7.054 million barrels. U.S. crude inventories have grown by roughly 28 million barrels so far this year, according to API data, while the U.S. Strategic Petroleum Reserves fell by nearly seven times that figure, at 184 million barrels.

The build in crude oil inventories was made possible by the Department of Energy’s release of 7.7 million barrels from the Strategic Petroleum Reserves in the week ending October 7, leaving the SPR with 408.7 million barrels.

In the week prior, the API reported a draw in crude oil inventories of 1.770 million barrels after analysts had predicted a much build of 1.966 million barrels.

WTI fell further on Tuesday, continuing the price slide that began earlier in the week. At 1:49 p.m. ET, WTI was trading down $1.99 (-2.23%) on the day at $87.36 per barrel—up just $0.60 per barrel from the prior week, with the OPEC+ bump now evaporated. Brent crude was trading down $1.85 (-1.96%) on the day at $92.44—an increase of $0.40 increase on the week.

U.S. crude oil production has remained flat for months. For the week ending September 30, U.S. crude oil production stayed at 12.0 million bpd, according to the latest weekly EIA data. This is just a 300,000 bpd rise from the levels seen at the start of the year, and still a 1.1 million bpd shortfall from the levels seen at the start of the pandemic.

The API reported a build in gasoline inventories this week of 2.008 million barrels for the week ending October 7, compared to the previous week’s 3.474 million-barrel draw.

Distillate stocks saw a draw this week, with a loss of 4.560 million barrels, on top of last week’s 4.046-million-barrel decrease.

Cushing inventories fell 750,000 barrels in the week to October 7. In the week prior, the API saw a Cushing increase of 925,000 barrels. Official EIA Cushing inventory for the week ending September 30 was 25.956 million barrels, up from 25.683 million barrels in the prior week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- U.S. Looks To Punish Saudi Arabia For Large OPEC+ Cut

- OPEC Slashes Global Oil Demand Forecast

- Oil Prices Slide As OPEC+ Bump Wears Off

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

-

The American Petroleum Institute (API) reported a large build this week for crude oil of 7.054 million barrels??? And the a few lines later "the Department of Energy’s release of 7.7 million barrels". 7.05 - 7.7 million bbls = 0.65 million bbls draw. Why does the media continue to try and bail out this failed Biden administation with misleading headlines like "Large Crude Inventory Build" when in fact this is just another inventory draw when you count everything?

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B