Breaking News:

Volatility Dominates Oil Markets Amid Mixed Signals

It's been a rollercoaster of…

A Volatile Week for Oil Prices

A very volatile week for…

Oil And Fuel Demand Set To Plummet In April

Global oil demand:

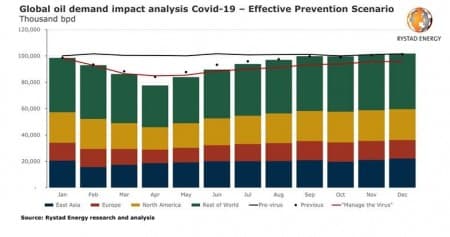

In another consecutive revision of our weekly estimates, our newest forecast for oil demand now projects a decrease of 6.4 percent for 2020, or 6.4 million barrels per day (bpd) year-on-year. Our estimates show that total oil demand in 2019 was approximately 99.9 million bpd, which is now projected to decline to 93.5 million bpd in 2020. To put the number into context, last week we projected a decrease of 4.9 million bpd.

At the moment we expect the month of April to take the biggest hit, with demand for oil estimated at 77.6 million bpd, falling by 22.8 million bpd year on year, a 22.7 percent drop from our pre-coronavirus forecast.

This downgrade takes into account developments that have occurred up to and including Tuesday, March 31.

Road fuel demand:

We believe that global total demand for road fuels will fall by 5.5 percent, or 2.6 million bpd year-on-year, a downgrade from last week’s report, where road fuels were expected to decline by just 4.6 percent.

Road fuel demand in 2019 is estimated to have reached 47.7 million bpd. We now see it reaching only about 45.1 million bpd in 2020.

Most of this reduction will also take effect in April, which will see its road fuel demand limited to just 34.7 million bpd globally, from 47.6 million bpd a year ago.

Jet fuel demand:

Among the various fuel sectors, we expect jet fuel to be hit the hardest. We expect global commercial air traffic will fall by at least 21 percent this year versus the levels seen in 2019, which we estimate stood at around 99,700 flights per day. This number will be revised as operators continue to cut routes.

Many distressed airlines are now facing heavy cost cuts, laying-off unprecedented numbers of employees as many non-essential routes are closed.

As a base case, we now assume that the common summer air travel peak will not occur at all this year. We now see jet fuel demand falling by almost 26 percent year-on-year, or by at least 1.9 million bpd. Last year’s demand for jet fuel was seen at about 7.2 million bpd.

By Rystad Energy

More Top Reads From Oilprice.com:

- Texas Oil Drillers Prepare To Halt Production

- Could Oil Really Fall To $0?

- This Gulf State Faces An Impossible Decision As Oil War Rages On

Rystad Energy

Rystad Energy is an independent energy consulting services and business intelligence provider offering global databases, strategic advisory and research products for energy companies and suppliers,…

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B