Breaking News:

A Volatile Week for Oil Prices

A very volatile week for…

Palestinian Political Factions Agree to Reconciliation Government

Palestinian factions Hamas and Fatah…

European Gas Demand Growth To Crash On 'Lockdown' Fears

European gas demand in 2020 is likely to drop by 0.7 percent compared to our pre-coronavirus forecast, according to Rystad Energy’s most likely scenario. Growth will be limited to just about 2 billion cubic meters (Bcm) year on year, short of previous expectations for a 6 Bcm increase.

The continent’s gas demand for last year is calculated at 554 Bcm and Rystad Energy has now revised its 2020 forecast to 556 Bcm, down from 560 Bcm before coronavirus-related restrictions were put in place.

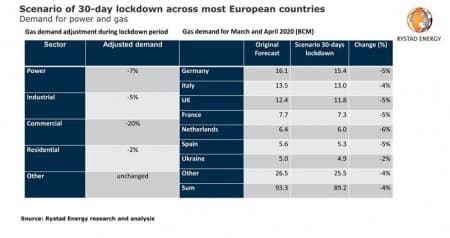

Rystad Energy’s most likely scenario assumes most of the continent’s countries go into lockdown for 30 days during the two-month period of March and April. As people stay home and businesses close their doors, demand will decrease for power generation and for burning in the industrial, commercial and residential sectors.

The two months will see a combined total loss of 4.1 billion cubic meters (Bcm) in expected demand, a 4.4 percent downgrade compared to our pre-coronavirus estimates. That would translate to Europe’s total demand being limited to 89.2 Bcm from a previously expected 93.3 Bcm for the period.

Germany, Italy, the United Kingdom, France, the Netherlands and Spain are will take the biggest hit in absolute volumes.

Related: Oil Plunges As Saudis Boost Exports To Record High

“During the last few days the likelihood of seeing further lockdowns across Europe has increased making this scenario more likely. Also, Italy is about to end its second week of lockdown and it doesn’t seem to be coming to an end yet. It is therefore probable to see reduced commercial and industrial activity in countries for a period of at least four weeks,” says Carlos Torres Diaz, Rystad Energy’s Head of Gas and Power Markets.

If lockdowns last for only two weeks, which Rystad Energy now finds increasingly unlikely, European gas demand for the above two-month period is set to be 1.8 percent lower, or down by 1.7 Bcm, versus what Rystad Energy expected before the virus appeared.

During the duration of the lockdown, power consumption is expected to drop 7 percent overall leading to a similar drop in gas demand from this sector. Gas use for industrial consumption is set to decline 5 percent, for commercial consumption 20 percent and for residential consumption 2 percent.

Rystad Energy’s estimates do not yet assume any demand loss due to lockdowns from May onwards, which of course carries a significant downside risk in the case coronavirus-related restrictions in Europe intensify.

The implications of this bout of lower consumption could have a substantial effect on the region’s balance between now and the end of April. Buyers will most likely adjust down their share of pipeline imports to the extent possible and will also reduce imports of spot LNG cargoes.

The lockdown measures come at a time when European gas prices are already at a record low as a result of the abundant supplies available to the region, combined with lower demand due to the mild winter, and underground stock levels at historically high levels.

Related: Have These High-Reward Oil Plays Become Too Risky?

“With TTF front-month prices currently trading below $3 per MMBtu we see limited downside risk, given that at a lower price, exporters of US spot LNG cargoes would not be covering their short-run marginal cost and would rather divert cargoes to other regions, or adjust down production,“ says Torres Diaz.

However, there is a risk of seeing prices drop to a level of $2.3 per MMBtu for a short period of time while the necessary adjustments to balance the market occur.

The current environment reduces the expectations of seeing a recovery in gas prices any time before next winter. Overall, we believe that there should be enough interest and regasification capacity from Asian buyers to take additional LNG supplies as the current price level continues to be competitive versus coal which could help prices remain stable at $3 per MMBtu throughout this year’s second quarter.

By Rystad Energy

More Top Reads From Oilprice.com:

- Dow Jones Erases All Gains Under Trump, Drops Below 20,000

- Russia Sees Oil & Gas Income Fall By Almost $40 Billion

- Why The Oil Price Crash Won't Save Airlines

Rystad Energy

Rystad Energy is an independent energy consulting services and business intelligence provider offering global databases, strategic advisory and research products for energy companies and suppliers,…

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B