Breaking News:

Artificial Intelligence Is Sparking a Copper Boom in Zambia

Zambia is poised to become…

Venezuela Has a Natural Gas Problem

Venezuela's natural gas production has…

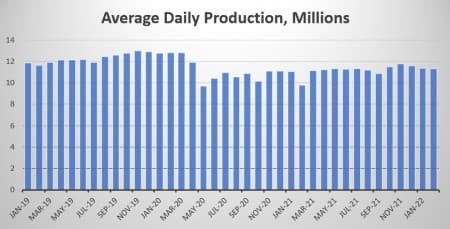

EIA Monthly Data Shows A Dip In U.S. Oil Production

Weekly U.S. crude oil production figures by the Energy Information Administration are a closely watched data set, but monthly production figures—which lag by months—often are seen as painting a more accurate picture of true production. And the most recent data shows that U.S. crude oil production is on the decline as of February.

According to EIA data, U.S. crude oil production dipped in February to an average of 11.312 million barrels per day—a 457,000 bpd decline from November 2021. January’s average monthly production was also down, to 11.362 million bpd compared to 11.604 million bpd on average in December. In fact, the monthly data shows that production has been declining since November 2021.

And data shows that U.S. production is still a far cry from where it was in 2019 prior to the pandemic.

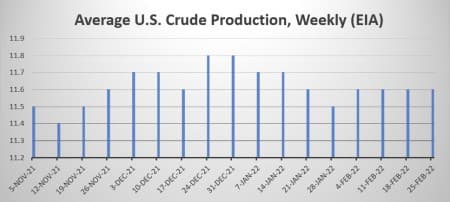

The weekly data that is more frequently followed due to the timely nature of the data releases does show a downtrend in January and February, but not by nearly as much.

Until the EIA published its February monthly on Friday, the only EIA production data available were weekly figures. For each of the four weeks in January, the EIA had estimated that production in the United States averaged 11.7 million bpd, 11.7 million bpd, 11.6 million bpd, and 11.5 million bpd. In February, weekly figures showed that production stood at 11.6 million bpd in each of the weeks. But using this weekly data, those figures look like an improvement on November, and February looks like a slight gain compared to January’s sliding production trend.

Weekly data shows that U.S. production has increased in March and April, and we must now wait months to learn if those figures are accurate.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- German Energy Giant To Pay For Russian Gas In Rubles

- American Oil Refiners Set For A Blowout Year

- Has Oil Lost Its Upside Momentum?

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

The good old days of shale oil are now well behind it. This means that US crude oil imports could only head upwards in coming years.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London