|

Louisiana Light • 2 days | 81.18 | +0.12 | +0.15% | ||

|

Bonny Light • 29 days | 86.00 | -0.62 | -0.72% | ||

|

Opec Basket • 2 days | 81.37 | -0.08 | -0.10% | ||

|

Mars US • 266 days | 75.97 | -1.40 | -1.81% | ||

|

Gasoline • 6 hours | 2.461 | -0.007 | -0.29% |

|

Bonny Light • 29 days | 86.00 | -0.62 | -0.72% | ||

|

Girassol • 29 days | 87.27 | -0.38 | -0.43% | ||

|

Opec Basket • 2 days | 81.37 | -0.08 | -0.10% |

|

Peace Sour • 13 hours | 72.28 | +0.69 | +0.96% | ||

|

Light Sour Blend • 13 hours | 72.28 | +0.69 | +0.96% | ||

|

Syncrude Sweet Premium • 13 hours | 79.18 | +0.89 | +1.14% | ||

|

Central Alberta • 13 hours | 72.28 | +0.69 | +0.96% |

|

Eagle Ford • 3 days | 74.07 | +0.63 | +0.86% | ||

|

Oklahoma Sweet • 2 days | 75.00 | +2.00 | +2.74% | ||

|

Kansas Common • 3 days | 67.75 | +0.50 | +0.74% | ||

|

Buena Vista • 4 days | 83.27 | -2.82 | -3.28% |

Harris Presidency Will Be Bad News for Oil

In the case of a…

Tesla to Focus on Autonomy and AI as Earnings Disappoint

Tesla is facing a slowdown…

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Crude Oil Inventories Rise On Refinery Shutdowns, SPR Releases

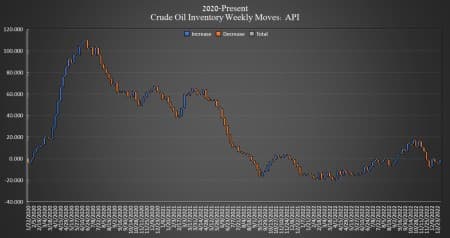

By Julianne Geiger - Jan 04, 2023, 3:49 PM CSTCrude oil inventories rose by 3.298 million barrels, American Petroleum Institute (API) data showed on Wednesday, after a million bpd in U.S. refining capacity was taken offline last week.

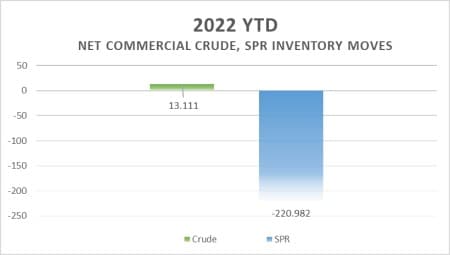

U.S. crude inventories increased just 13 million barrels in 2022, according to API data, while crude stored in the nation’s Strategic Petroleum Reserves sunk by nearly 17 times that figure so far this year—by 221 million barrels.

The SPR now contains the least amount of crude oil since early December 1983.

The build in commercial crude oil inventories comes as the Department of Energy released 2.7 million barrels from the Strategic Petroleum Reserves in the week ending December 30, leaving the SPR with just 372.4 million barrels.

WTI prices fell again on Wednesday as the IMF spoke of slowing economies in the United States, Europe, and China, compounded by China raising its export quotas for refined fuel in a sign that the world’s largest oil importer could be expecting weak domestic demand.

At 4:04 p.m. EST, WTI was trading down $3.90 (-5.07%) on the day to $73.03 per barrel. This is a weekly decrease of roughly $4.50 per barrel. Brent crude was trading down $4.21(-5.13%) on the day at $77.89—a weekly decrease of roughly $4.50 per barrel.

U.S. crude oil production slipped back to 12 million bpd in the final week, bringing the total production increase for 2022 to 300,000 bpd , and 1.1 million bpd lower than peak production seen in March 2020.

By Julianne Geiger for Oilprice.com

ore Top Reads From Oilprice.com:

- Oil Prices Plunge Below $80 As Near-Term Demand Worries Grow

- The Oil Market Crisis Sparked By Russia’s Invasion Is Nearing Its End

- Russian Crude Oil Exports Plummeted At The End Of 2022

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Related posts

EXXON Mobil

-0.35

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

BUY 57.15

Sell 57.00

The materials provided on this Web site are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Nothing contained on the Web site shall be considered a recommendation, solicitation, or offer to buy or sell a security to any person in any jurisdiction.

Merchant of Record: A Media Solutions trading as Oilprice.com