An elite government-appointed group called the National Conservation Commission is charged with taking a comprehensive inventory of natural resources in the United States and discover where resources are being inefficiently handled and even squandered. They come back to the United States Congress with an alarming report that the national supply of oil will be entirely used by within just 25 or 30 years more at the rate that the country is currently burning through the precious and decidedly finite fuel source. The year is 1909.

What sounds like the story of a dystopian future is, in fact, a now laughable gaff from our past. We now know that the National Conservation Commission’s findings reported back to Congress under the administration of Teddy Roosevelt, got a few things wrong. The domestic oil supply did not, in fact, dry up by 1939. And even though we are now using about 7 billion barrels of oil per year (as compared to just 750 million barrels annually in 1927) the U.S. oil production industry is still going strong. In fact, we are in the middle of a shale revolution and oil from both the United States and abroad continues to fuel the world and to a large degree control international markets and global economies.

Although it’s hard to believe now, there was a time not so long ago that drilling for oil was a completely novel concept. In fact, when the first commercial oil well was drilled in Titusville, Pennsylvania where natural oil deposits were so close to the surface that they were found floating on local waterways, oil had not even been drilled anywhere in the modern-day Middle East. “America’s first commercial oil well was created at Titusville, Pennsylvania when a new technique was pioneered using a pipeline to line the boreholes to allow deeper drilling,” the BBC elaborates. “The success of the well, plus a demand for kerosene, triggered an oil rush and began a major new industry.”

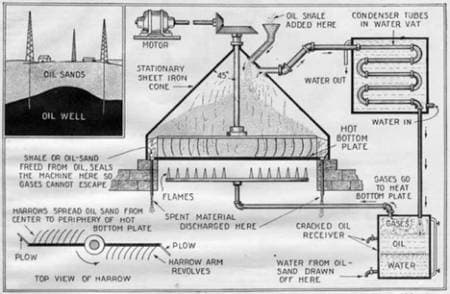

(Click to enlarge)

The Bowie-Gavin process of extracting oil (June 1927 issue of Science and Invention magazine)

The discovery and utilization of oil did not originate with the United States, however. According to a timeline put together by the BBC, “some of the earliest civilisations relied heavily on oil.” The ancient Babylonians, living in what is now modern-day Iraq, lived on such oil-rich lands that crude oil would bubble to the surface, where the locals would utilize it to waterproof their boats and mix into their mortar for construction. China also began utilizing oil at least as early as 600 BC, when they already transported the resource via pipeline--although these ones were crafted from bamboo instead of steel and plastic. Related: Higher Oil Exports Insufficient To Cut Brimming Venezuelan Stocks

That being said, the United States certainly made its mark on the history of oil by quickly industrializing the resource that was now more valuable than ever in an age of rapid mechanization. It didn’t take long after that initial commercial operation In Pennsylvania for oil to become big business across the nation. It also didn’t take long before the first major oil price shock rocked the market.

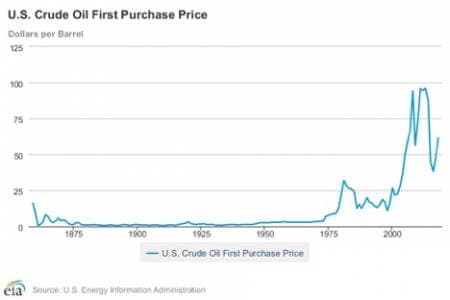

After the Titusville discovery, more oil wells and oil companies quickly sprouted up around the region, catching the attention of a young entrepreneur named John D. Rockefeller, who founded the first iteration of what would become Standard Oil in 1867. Thanks to the rapid expansion in the production of oil and the introduction of pipelines, with Cleveland emerging as the center of oil refining, production and transportation of oil soon became extremely cheap, leading to a price shock and market panic. While the very first barrel of oil sold for $16 in 1859, according to figures from the U.S. Energy Information Administration, prices plummeted to less than 50 cents a barrel by 1861. “When product prices declined,” reports History, “the ensuing panic led to the beginning of a Standard Oil alliance in 1871. Within eleven years the company became partially integrated horizontally and vertically and ranked as one of the world’s great corporations.”

(Click to enlarge)

As we well know, this was not to be the last of oil price volatility in domestic or foreign markets (or the end of major and supermajor oil company conglomerates, for that matter). In fact, 50 years later, oil would receive the shock of its commercial lifetime when the price of crude dropped to the unthinkable price of just over 10 cents a barrel.

Related: Oil Pirates: The Gulf Of Mexico’s Billion Dollar Problem

Yes, you read that right. While you can see from the chart above that oil prices have had quite a bumpy ride throughout the less-than 200 years-long existence of the oil industry, the absolute rock bottom occurred during a perfect storm of unfortunate events, “when the opening of giant oil fields in the United States coincided with the Great Depression to create an enormous glut and sent prices tumbling to just 13 cents per barrel,” according to reporting by Reuters.

While this now seems both far away and unthinkable, comfortably confined to the annals of history, think again--because this quote comes from an article terrifyingly titled “U.S. crude oil stocks return to 1930s crisis levels: Kemp” from just a few years ago, in 2015. Based on more data from our friends at the EIA, Reuters revealed that “commercial crude stocks at refineries and tank farms across the country rose to almost 407 million barrels on Jan 23, up from 398 million the week before [...] the highest since the agency started collecting weekly data in 1982.” The article goes on to qualify these findings, saying that “the parallels are not exact because production and consumption are so much higher now than in the 1930s. In 1931, stocks of 407 million barrels were equivalent to 160 days of nationwide production, while in 2015, the same stocks are just 44 days of production. But monthly records stretching to 1920 show inventories have returned to levels briefly neared in April 1981 but otherwise not seen since the years between 1924 and 1931.”

(Click to enlarge)

The United States oil industry has always been marked by volatility and a struggle between the desire for energy independence and the need to cooperate with global markets that are heavily swayed by powerful foreign interests like OPEC. the future of oil has never been murkier, while the U.S. shale revolution slowing but still producing a tidal wave of cheap oil while global communities and organizations like the UN, the IPCC, and millions of disenchanted youth around the globe call for an end to carbon emissions and a tough stance against climate change. What’s more, if the world carries on business as usual, we are going to keep growing closer and closer to a time when warnings of drying up oil reserves turn out to actually be true. If the history of the oil industry teaches us anything, it’s to expect the unexpected...and to diversify your portfolio.

By Haley Zaremba for Oilprice.com

More Top Reads From Oilprice.com:

- Is This The End Of The Lithium-Ion Battery?

- Electric Vehicle Adoption Overshadowed By SUV Boom

- The Single Biggest Threat To U.S. Oil Jobs