Before we start with this weeks news please do take a moment to look at our latest presentation which analyzes various developments taking place within oil & gas and predicts 5 areas that could see huge booms in the coming years. These could be some of the biggest opportunities available to investors today. You can watch it here: 5 Giant Game-Changing Energy Trends

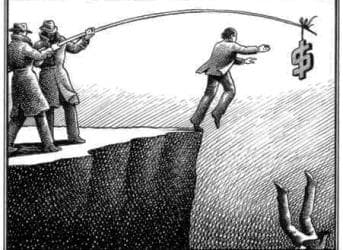

If you are concerned that you don’t seem to fully understand oil prices, how they are set and what affects them—don’t worry too much because no one really has a grasp on this, including the traders and speculators themselves. And any attempt to explain it all inevitably leads to a massive black hole, frustration and, in the end, submission to the oil price beast.

The big story this week is about four New York Mercantile Exchange (NYMEX) traders who are suing some supermajor oil companies and trading houses for manipulating the North Sea Brent crude oil market. The traders were spurred on by an inquiry by the European Commission into the same, but so far the only thing that is clear to anyone is that no one truly understands oil prices.

The traders allege that supermajors Royal Dutch Shell, BP and Statoil, along with trading houses Morgan Stanley, Vitol, Trafigure Beheer, Trafigure and Phibro Trading joined forces to manipulate Brent crude oil prices and Brent futures contracts traded on NYMEX between February 2011 and September 2012.

The European Commission’s inquiry was launched in May and focused on suspected anti-competitive agreements for the submission of prices to Platts. The European inquiry hasn’t reached any conclusions—and isn’t really likely to reach anything concrete.

Platts, a unit of McGraw Hill, runs a global price reporting service that is rather ambiguous in its setting of dated Brent physical oil price benchmarks. The Platts benchmark affects derivatives prices for traders because it is based on transactions, bids and offers made between very specific times (4:00-4:30pm London time) for crude delivery in 10-25 days. It is a tiny window that is pretty easy to manipulate simply by determining whether it’s better to make offers to execute transactions a minute before or after.

Brent is a global benchmark for two-thirds of all the crude oil supplies traded internationally. Physical volumes are traded less these days, but futures contracts are huge.

What the NYMEX traders are claiming is that those supermajors and trading houses listed above used this subjective Platts window to manipulate benchmark prices to boost their own derivatives at the expense of the plaintiffs.

More specifically, the NYMEX traders allege that Shell and Statoil were moving North Sea oil and not telling anyone. We’re not sure this is exactly manipulation, but neither is anyone else.

We like the take on this offered by columnist Matt Levine, who opines that the oil price benchmark is “dumb”, the traders are “whiny”, and the complaint is “full of the technicalities of renting ships to pick up oil cargoes.”

In a column published by Bloomberg, Levine explains: “Did the big traders game those things a bit? I mean, I don't know, probably, right? If nothing else your derivative positions will affect your timing decisions: If you are short derivatives -- that is, you want Dated Brent prices to go down -- and you are also selling physical oil, you will try to sell that oil at 4:01 and will be willing to take a lower price. If you are long derivatives, you'll try to sell the oil at 3:59, to keep the sale out of the Platts window. If you're short, and you're looking to buy oil in a few weeks, you might pick a delivery day 26 days out. If you're long, you might go with 25.”

We’ll let the courts figure it out, but we’re not expecting any ground-breaking conclusions here, unfortunately for the traders involved who throughout the case will most likely find themselves simply admitting that even they don’t know how it is all supposed to work.

For those of you interested in Oilprice.com premium, we have a great letter lined up for subscribers. Dan Dicker our expert trader and legend in the oil markets gives premium subscribers the inside track on the latest case mentioned above (if you want to know what’s really going on then you have to read Dan’s report.) Our corporate intelligence partners have put together a very interesting report on Algeria which is a must read for anyone with investments in the region.

We have our usual geopolitical analysis pieces and our oil market forecast for the coming week.

This is another must read issue and you can do so completely free. We offer a 30 day free trial to readers in which time you will receive 30 reports that look at trading opportunities, unique investments, industry developments, geopolitical updates and much more. You can cancel at any time during these 30 days if you think our research isn’t for you.

You have no risk and need make no payment to try our premium service – we can’t be fairer than that. To find out more about how you can start a 30 day free trial - click here.

James Stafford

Editor, Oilprice.com