Oil prices have been locked in the current price range for months now, with price volatility dropping drastically. It seemed that only inventory reports, OPEC’s compliance rate, and the re-opening of various European countries such as Spain and Italy could trigger price movement. But the current price cannot be justified if we refer to fundamentals alone. It is clear that the draws from inventories that we are seeing aren’t driven by genuine demand. China’s buying spree appears to be slowing down in September after the country has stocked up on cheap crude during the summer months.

Source: https://www.macrotrends.net/2480/brent-crude-oil-prices-10-year-daily-chart

The recent optimism in the markets is an example of the phenomenon Andrei Shleifer and Nicola Gennaioli outline in their book, A Crisis of Beliefs, in which good news is over-represented while tail risks are largely ignored. Then, when those tail risks surface, there is a crisis or a crash. We may soon see a similar situation unfolding in oil markets. That there is no sustainable demand recovery in the U.S., Eurozone, or Asia should be a worrying fact for oil market analysts. A Second COVID-19 wave would only make matters worse and the threat of an escalation in the trade war between China and the U.S. is another near-term risk to consider for oil markets.

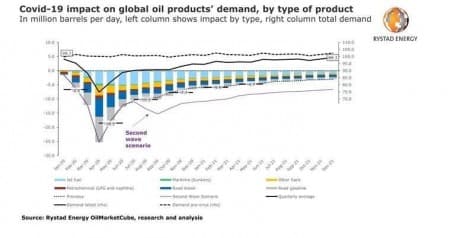

Rystad Energy estimates that another wave of COVID-19 would once again halt the recovery of oil demand. If countries around the world experience a second round of lockdowns, then about 3.7 mbpd of demand for oil could be lost. The case for jet fuel is even worse, as international travel is not expected to recover to pre-COVID levels any time soon.

The unwinding of OPEC+ production cuts will only add to the market glut, with Rystad forecasting a total surplus of 170 million oil barrels being created between August and November. Related: Gold Could Be Heading To $5,000

The Monthly Oil Market Report from OPEC states “The demand for oil is estimated to see significant y-o-y developments; however it will remain far below pre-COVID-19 levels”. It goes on to state that the outlook for recovery remains uncertain. All of this is apparent when looking at climbing global unemployment levels, falling consumer spending, and a wave of small and medium businesses going bust. With all of this data, it is important not to confuse improvement or positive sentiment with a return to ‘normal.

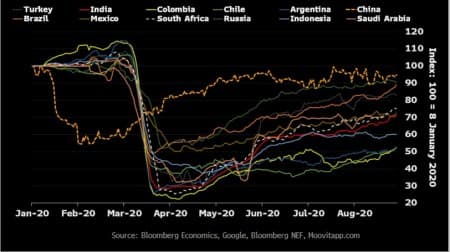

The recovery in global trade is also slowing down as the graph above illustrates. Meanwhile, there is a plateauing in the activity of emerging markets.

Chart by Primary Vision Network

We recently saw prices fall below $40 for the first time since June as the above demand fears began to weigh on oil markets and the summer driving season disappointed. As these demand factors gain more attention, it should be apparent that the current price range cannot be justified by oil market fundamentals.

Slowing economic activity around the world, restricted mobility, and fears of another trade war are just a few of the key factors that will continue to weigh on oil prices and could cause a significant move to the downside.

By Osama Rizvi for Oilprice.com

More Top Reads From Oilprice.com:

- Gold Could Be Heading To $5,000

- Oil Rig Count Inches Higher Amid Price Plunge

- String Of Bearish News Shifts Sentiment In Oil Markets