While predictions about volatile oil prices abound, one theme keeps popping up: geopolitical risk premium. First it was theories about a closure at the Strait of Hormuz. Then it was fears of an all-out war between Iran and the United States or Iran and Saudi Arabia. All those are merely possibilities, but the reality suggests that a whole different kind of extreme is far more likely: crushingly low oil prices.

In amongst the screams of geopolitical risk premium are far scarier whispers of words such as demand destruction, trade disputes, and economic climate deterioration. And those words describe the current reality in the market, and as such, suggest a similar future reality—a reality where demand destruction continues to push prices down, down, down. Is $10 oil really possible?

Dented Demand Outlook

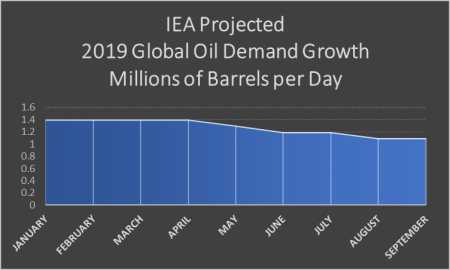

Throughout 2019, it seems like the forecasters can’t revise down their projections for oil demand fast enough.

The International Energy Agency has continued to revise downward its oil demand growth projections for 2019 and beyond.

From the 1.4 million bpd of demand growth the IEA was projecting for 2019 back in January, their estimates have fallen to 1.1 million bpd demand growth this month. These estimates were based on actual global demand, which in May fell by 160,000 bpd year over year, according to the IEA.

For its projections of 2020 global oil demand growth, they, too, were revised downward, starting at 1.4 million bpd in their June report before falling to 1.3 million bpd in their August report. For September, the IEA is holding fast their projections for 2020 oil demand growth at 1.3 million bpd. Related: Oil Slumps Again… Will OPEC Act?

OPEC has its own demand growth projections, which also have been revised downward on a pretty regular basis this year.

While an oil demand growth of a bit above 1 million bpd doesn’t necessarily spell doom and gloom for the oil markets, the downward trend is clear, and suggests weakness going forward.

And we’ve seen this historically, despite the significant geopolitical events that have been specifically tied to oil. Those significant geopolitical events have moved the needle, with prices spiking at each event, but those events are now unable to sustain these higher prices. Instead, we are seeing temporary blips. This suggests that oil prices are beholden to the fundamental realities: sluggish demand paired with robust production. And all indications are that this will continue.

History Repeats Itself

Taking a stroll down memory lane should be enough to sober up those recent predictions that foretold of $100 oil as unrest in the Middle East continues.

Boom and bust cycles are a given in the oil industry. Brent has seen some ugly crashes in the past, and there’s no reason we should expect anything different in the future.

(Click to enlarge)

The pricing booms and busts continue their familiar pattern, stemming from variety of stimuli. The usual suspects that prompt oil price crashes are:

- Strong dollar

- High OPEC crude oil production

- High US crude oil production

- High US crude oil inventory

- Weak economy/collapse in demand

- Speculators

In 2009, oil prices fell from more than $140 per barrel in 2008 to below $40 per barrel in 2009—a fall of more than 50%. And if you think that those prices are in the rearview mirror for good, you might be mistaken. The 2009 crash wasn’t simply the result of collapsing demand. If only it was that easy. No, it was a perfect storm of oil prices that were flying high, spooking traders who thought the peak was right around the corner. It was also the financial crisis, which sparked a global credit crisis. This bolstered the US dollar, which further dented oil demand. As the prices fell, long positions were closed. Panic ensued. More long positions closed as traders wanted to get out, and get out fast. Rinse, lather, repeat. Related: Oil Markets: Everything Is About Weak Demand

In 2014/2015, oil prices saw a similar plunge. From over $100 per barrel to below $40—again a more than a 50% plunge. This time it was economic slowdowns in major oil importers such as China and India.

And then the final blow was dealt by the United States, which had just entered the fracking boom.

We see similarities this time around, too. While oil prices are not at record highs by any stretch of the imagination, US production is at all-time highs. And the global economic outlook is not so great. The trade war between the US and China is threatening to dent demand in the world’s largest oil importer: China. And try as it might, OPEC’s production quotas are just not enough to swing the needle the other way.

And once again, speculators are in control of the market, and hedge funds are making a mad dash for the exit, with money managers offloading 64 million barrels of WTI and 17 million barrels of crude as of October 1. It’s a nervous market with a short memory, and hedge funds have already forgotten the attack on Saudi oil infrastructure. Now, bullish bets on WTI and Brent have dropped to their lowest in eight months, according to Bloomberg. Short of some oil-related disaster, it’s hard to see a major rebound in prices in the short term.

FX Empire has predicted with the help of its Adaptive Dynamic Learning modeling systems has suggested that prices will be below $40 per barrel. Reuters polls and the EIA are expecting that oil will stay in the $60s. Meanwhile, Goldman Sachs’ Jeff Currie is getting on the gloomy train:

“The risk of USD 20 is driven by what we call a breach in storage capacity, meaning that you have supply above demand, you fill every storage tank on planet earth and then you have nowhere to put it,” Currie told CNBC at the Oil & Money conference in London last month. Their base case estimate, however, is for a more robust.

Sure, eventually these ultra-low prices would stymie additional investments in the sector—which would inevitably lead to higher prices as the cycle starts over again, but that is small consolation to any oil and gas players with hefty debt that would be unable to pay back creditors at sub-$40 oil.

The question then is not how high prices could climb. It’s how long will the next boom and bust cycle take to complete, and how many oil and gas companies get swept under in the process?

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Capital Flight Is Killing The US Shale Boom

- Brimming Storage And No Buyers: Venezuela’s Oil Production Tanks

- Oil Bounces Back After Hedge Fund Selling Spree

So if you remove the cause, namely the trade war, the depressing force on oil prices will disappear since the fundamentals of the global economy are still positive. That is why you will never see oil prices crashing to $10 a barrel.

In my seminal work titled: ”The Oil ’Price Rise’ Factor in the Iraq War: A Macroeconomic Assessment” which was published by the United States Association for Energy Economics (USAEE) on the 4th of June 2008, I argued that America plunged headlong into the Iraq war with hopes of obtaining large quantities of cheap oil but those dreams were quickly crushed when crude oil prices spiked from $25 a barrel at the onset of the hostilities to upwards of $130 in mid-2008. Nobel-winning economist Professor Joseph Stiglitz saw a direct link between the great recession of 2008 and the oil price hike.

The minute there is an end to the trade war, oil prices will start surging toward $70-$75. We will not have to wait too long since President Trump badly wants four more years in the White House and he can’t go to the American electorate with a weak US economy and a trade war trailing behind him.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London

The author has really predicted good market move. on my view, due to global economy slowdown and useing of other renewable energy sources for productions, we can expect CRUDEOIL will travel between $54-$51 per barrel this 2019.

Investors however are screwed.