Australia is blessed with large mineral and energy deposits. The rise of China and its insatiable appetite for iron ore and energy, two of Australia's main export products, has ensured uninterrupted economic growth for the past three decades. The COVID-19 pandemic, however, has brought that to an end. Eventually, normality will return to markets and Canberra is adamant to return to growth. Therefore, Australia's National COVID Coordinating Commission was given the task to identify investment opportunities that underwrite a quick economic recovery. The green recovery has become a much-used phrase that highlights the unique opportunity of reaching two goals in one stroke: reducing CO2 emissions and stimulating economic growth. To be clear, Australia's potential in terms of renewable energy is unprecedented. The country has an abundance of sun and the coastal regions are suitable for wind turbines. The vast open spaces ensure low land prices which means Australia could potentially become the Saudi Arabia of hydrogen.

The country’s COVID Commission, however, has other plans. The head of the advisory committee, Nev Power has hinted that a fossil fuel oriented approach is the preferred option. Although business leaders have reached out to the government for a recovery that locks in low-emissions, Power has stated that he doesn’t recommend “a green recovery per se”. According to the committee head, green recovery needs a broader definition which includes low emission fuels such as natural gas.

It is a clear sign that the head of the committee has a strong preference for supporting the domestic consumption of natural gas. Especially in the area of manufacturing Power thinks government support for energy projects could strengthen certain sectors dependent on low natural gas prices to remain competitive.

Related: China Looks To Build Espionage Hub In Iran Under 25-Year Deal

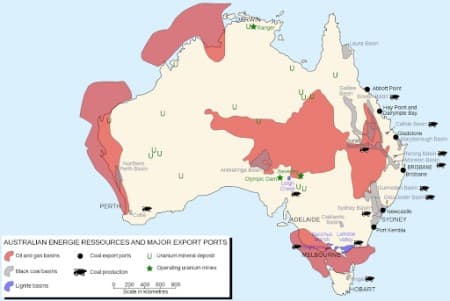

The proposed recovery, therefore, is aimed at strengthening the country’s pipeline infrastructure that would lower transportation costs for energy. The majority of Australia’s population lives in the east and southeast of the island while the majority of the natural gas is produced in the northwest. The vast distances and absence of pipelines mean transportation costs are relatively high.

Australia's Competition and Consumer Commission, the country's competition watchdog, has emphasized the widening price difference for domestic gas. Foreign buyers are benefiting from low international prices while domestic consumers still pay a premium for Australian energy. Asian customers are paying $6 per gigajoule while domestic users were offered prices between $8 and $11. The relatively large discrepancy is fueling the argument to improve domestic connectivity through investments in intrastate pipelines.

The COVID Commission is sensing an opportunity to use the economic downturn due to COVID-19 to set the agenda concerning Australia’s future energy policy. This isn’t a surprise as the Commission was handpicked by Morrison’s government.

Related: Big Oil Sees Major Potential In Suriname

The Commission’s suggestions include the government taking a role in supporting the construction of gas pipelines between the eastern states and the north. Also, potentially the $6 billion trans-Australian pipeline could connect the east with the west. According to the conservative Commission the government doesn’t have to subsidize these projects. It achieves its goals by taking an equity position, minority share, or underwriting investments.

The situation is less friendly for Australia’s coal industry. According to Sam Mostyn, a non-executive depute chair of the Centre for Policy development, "coal's problem is that as the most carbon polluting fossil fuel it is running out of friends." The public has turned against the high pollutant fuel especially after last year's devasting fires that shook Australia's society to its core.

Businesses are also waking up to the turning public opinion concerning coal. BHP Group, for example, is cutting its greenhouse gas emissions from electricity production by 50 percent. The transition towards renewable energy sources and natural gas should replace coal.

In a blow to Australia’s energy industry the country’s largest customer, China, is shifting away due to recent tensions. Work in Pakistan has commenced on a massive $1.9 billion open-pit mine which could supply the Asian giant with coal in the foreseeable future. It is the seventh-largest lignite field in the world with an estimated 175 billion tons of coal.

Therefore, Australia’s economic recovery could take more time than anticipated as countries are facing a second COVID-19 wave and uncertainty.

By Vanand Meliksetian for Oilprice.com

More Top Reads From Oilprice.com:

- Gold Could Be Heading To $5,000

- Oil Rig Count Inches Higher Amid Price Plunge

- String Of Bearish News Shifts Sentiment In Oil Markets