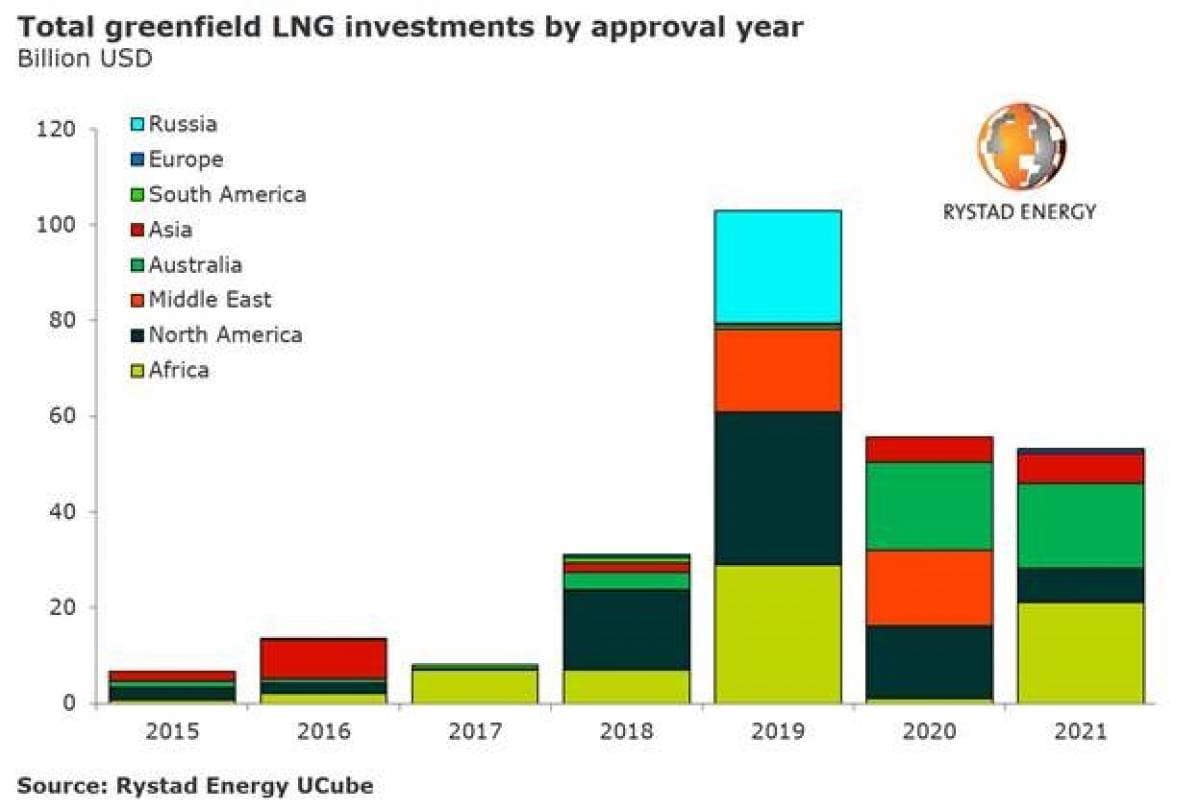

Africa is taking the lead in the next phase of global LNG mega-projects. 2019 will shatter previous records for the industry.

Rystad Energy forecasts that LNG greenfield investment in 2019 will reach nearly $103 billion, the biggest investment year for the burgeoning industry to date.

Mozambique’s Area 1 and Area 4 projects, the latter of which is expected to secure a final investment decision (FID) from operator ExxonMobil by the end of the year, are making Africa the dominant LNG investment destination this year, with nearly one-third of total greenfield investment.

“Last week’s final investment decision by Anadarko for its Area 1 LNG project marks the beginning of a new phase for not only Mozambique and the African continent, but for the industry as a whole,” says Pranav Joshi, analyst on Rystad Energy’s Upstream team.

The greenfield capex for the Area 1 project is estimated at $15.6 billion, putting the project in the same league as the major LNG developments in the US, Russia and Australia. If ExxonMobil’s Area 4 does indeed reach FID this year, that will represent another $14.7 billion in greenfield expenditure in Africa, bringing the yearly total to 28% of the global tally for approved investments in newly sanctioned LNG projects.

“Area 1 is the largest LNG project that has been sanctioned in Africa to date and will also kick start the wave of sanctioning activity of other bigger LNG projects this year,” Joshi added.

(Click to enlarge)

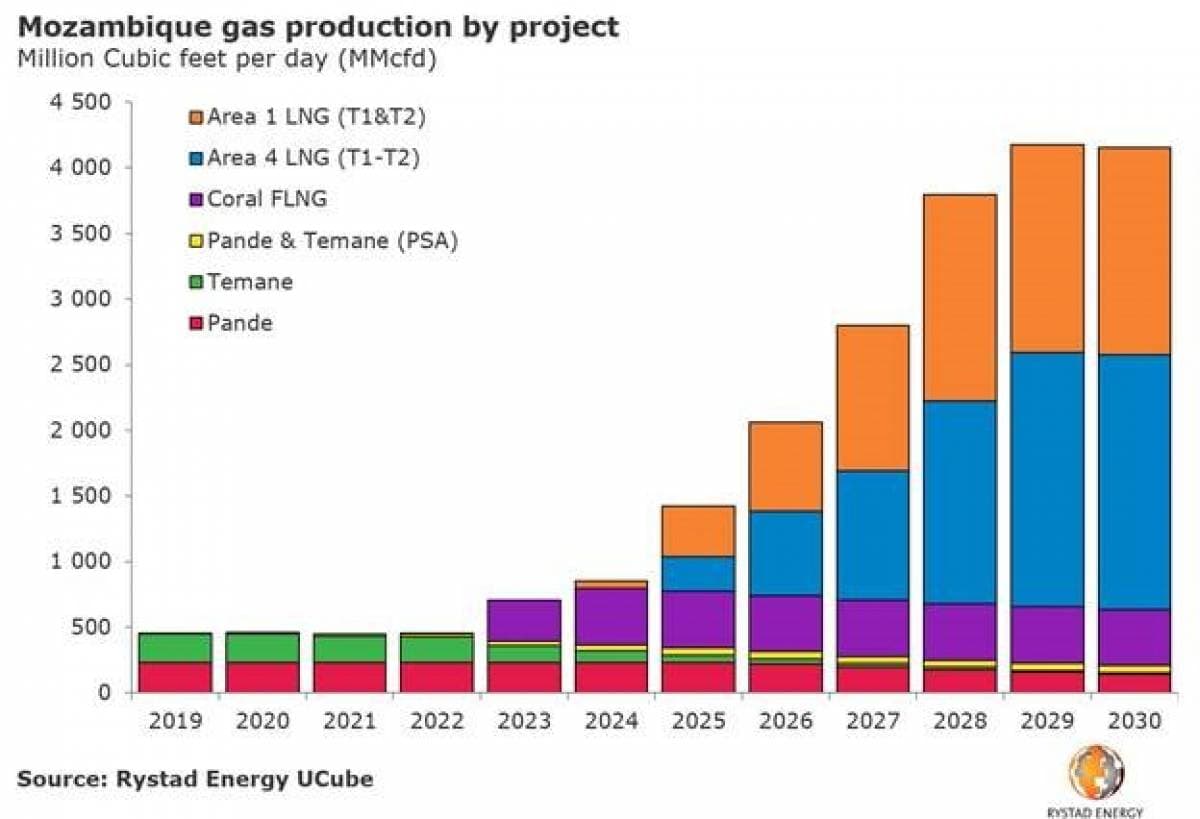

The Area 1 project – expected to start in 2024 and produce 12.88 million tonnes per annum (tpa) – will transform Mozambique into a major LNG exporter. A swath of other projects will also contribute to the meteoric growth in domestic gas production.

(Click to enlarge)

Among the projects anticipated to reach FID in 2019, Area 1 is the third largest in terms of greenfield investment. The Arctic LNG project has the largest greenfield capital investment at $25.75 billion, followed by Qatargas LNG with $17.5 billion.

(Click to enlarge)

More Top Reads From Oilprice.com:

- Protracted Trade War Inflicts Lasting Damage To U.S. LNG

- Is This The Beginning Of The End For Tesla’s Solar Business?

- Solid State Batteries: The Next Big Thing In Electric Cars