Qatar Petroleum found itself in the limelight of the LNG scene in 2021, having clinched two major deals with Pakistan and China. All the while media buzz around the supply deal with Sinopec has created ripples in the news, the contract with the Pakistan State Oil Company (PSOC) was absorbed by the media community as if that were the natural state of things. The Qatar Petroleum-PSOC deal is in many ways logical – the two sides already had a 15-year supply deal, as a consequence of which Qatar has catapulted itself into the position of leading LNG supplier to Pakistan throughout the past 5 years. Rendering Pakistan’s LNG imports cheaper, at the same time guaranteeing Qatar’s prime role on the Pakistani market, the QP-PSOC deal fully reflects both sides’ preferences.

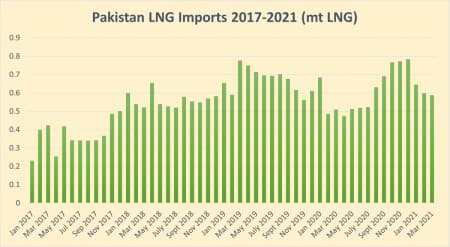

Graph 1. Pakistani LNG Monthly Imports in 2017-2021 (million tons LNG per month).

Source: Thomson Reuters.

Pakistan is a relative newcomer to the LNG market. Its first-ever LNG terminal in Port Qasim, the 600MMCF/day Engro Elengy Terminal, started receiving cargoes in March 2015 and has been utilized at its nominal capacity for most of the time since then. Concurrently with the commissioning of Engro LNG Pakistan started nurturing ties to Qatar, the Persian Gulf’s prime LNG supplier. Labeled Pakistan GasPort, the second LNG import terminal in Sindh started operating in 2017, doubling Pakistan’s intake capacity. GasPort has failed to repeat the relative success of Engro, routinely functioning below capacity. The two LNG terminals’ operations are aided by Pakistan’s massive gas transmission system (at some 140 000km overall) that was edified on the back of the South Asian nation’s 5-6 decades of own gas production.

Related Video: Hydrogen: From Hype to Sudden Reality

Hypothetically, Pakistan could be receiving gas by means of trunk pipelines from neighboring energy powerhouses, too. In contrast to the speed with which Pakistani companies managed to erect their liquefaction terminals, the construction of pipelines from abroad has been as lethargic as it can get. The Iran-Pakistan pipeline was agreed in 1999 yet up to the present day Pakistan did not complete its section of the gas conduit (the Iranian section is ready) and it remains highly unlikely that US sanctions-wary Islamabad would finish it anytime soon. Pakistan’s second-best shot, the 33 BCm per year TAPI pipeline that would bring Turkmen gas all the way through Afghanistan, has seen some traction in 2015-2020, however, the construction of the Pakistani section remains stalled and the commissioning deadline of 2020 will be at least several years off. Thus, with no major trunk pipelines on the horizon, the emergence of LNG triggered several positive developments in Pakistan’s economy despite its negative reputation within the domestic circles.

First and foremost, LNG has allowed Islamabad to buy cheap energy as its population keeps on increasing by 5-6% per year. Second, LNG imports have not only maintained but also extended Pakistan’s CNG utilization within its car fleet (it is estimated that 3+ million cars run on compressed natural gas in Pakistan, up almost 1 million compared to 2011). Third, LNG has helped Islamabad rid itself of its habit of burning oil to produce electricity. Merely 5 years ago oil was the primary electricity source, accounting for up to 37% of total generation – today the same ratio stands at 15-16%. Needless to say, LNG went from zero in 2014 to 25-26% in 2020. The importance of LNG was only underscored by the botched purchasing campaign of January 2021 when Pakistani authorities bought only half of the nation’s assumed LNG needs (3 out of 6 vessels), triggering an immediate surge in crude burns.

For Pakistan, the new Qatar supply deal is an indisputable boon for the economy. Unable to provide for the energy needs of the nation in terms of domestic sources, wary of demand surging quicker than expected, Islamabad needs cheap energy, and a lot of it. Domestic gas production continues to stagnate around 3.6 MMCf per day after it reached a peak of 4 MMCf per day in 2017. Domestic oil production has witnessed a similar story – having oscillated around the 30kbpd mark in 2016-2019, the coronavirus pandemic curtailed oil output even more tangibly than basin maturity ever could. Averaging approx. 24kbpd in the first quarter of 2021, Pakistan’s oil production is a fraction of its crude consumption (400-450kbpd). Related: Goldman Sachs Sees Large Oil Demand Rebound This Summer

The previous QP contract stipulated a 13.37% Brent slope for potential LNG imports. Availing itself of the decreased price slope, PSOC indicated its openness to renegotiating the deal – whilst QP was legally right to maintain that the validity of the contract was immutable, it was also true that spot levels have moved away from the long-term formula. For instance, if one is to look at the April 2021 spot supply deals, Vitol won two deliveries with slopes of 11.05% and 10.89%, respectively for April 05-06 and April 19-20 arrivals, whilst Qatar Petroleum went even lower and outbid its rivals at 10.025% for an April 09-10 arrival. Hence, it should come as no surprise that the new Qatar Petroleum establishes a new slope level of 10.2%.

Source 2. Percentage of Qatari LNG Exports to Pakistan in 2017-2021 (% of total LNG Imports).

Source: Thomson Reuters.

According to recent estimates from energy authorities in Pakistan, its gas shortage is going to double from the current level of 1.5 BCf per day by 2025 and more than triple to 5.4 BCf per day by 2030. Against the backdrop of declining domestic production, this means that Pakistan will need substantially more LNG, ideally backed up by an extension in liquefaction capacity. ExxonMobil was developing the concept of a 3rd LNG import terminal in Pakistan, having signed a heads of agreement with domestic firm Energas, however the US major withdrew from the project in late 2020 as part of its cost-cutting drive. Thus, Pakistan’s ties to Qatar might not only lead to an increase in LNG movements in absolute numbers, Qatar Petroleum would most probably seek to consolidate its foothold with infrastructure-related mergers or acquisitions.

By Viktor Katona for Oilprice.com

More Top Reads From Oilprice.com:

- Forget OPEC Production Cuts, It’s Exports That Matter

- World’s Largest Lithium Producer: Get Ready For A Mega-Rally

- U.S. Oil Production Is About To Climb