The US and British bombing campaigns of Iran-backed Houthis in Yemen marks a significant intensification of the Middle East crisis. This development comes as the region is already dealing with heightened tensions due to the three-month war between Israel and Hamas in Gaza, suggesting a move towards a broader regional conflict.

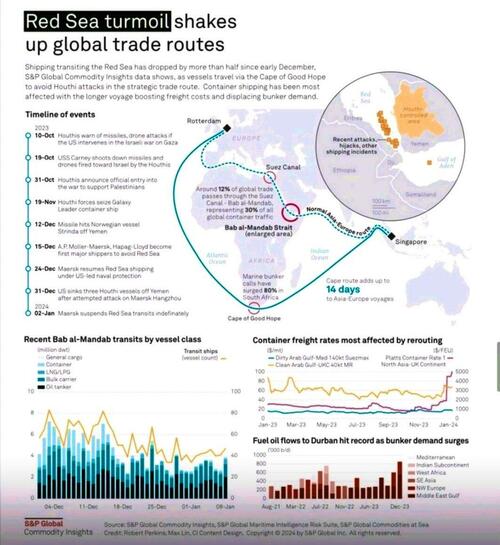

Shipping disruptions across the Red Sea threaten global trade after major shippers, such as Maersk and others, have rerouted vessels to the Cape of Good Hope following a series of drone and missile attacks on commercial vessels by Houthi rebels. The attacks and resulting supply chain disruptions are what forced the US and allies last week to launch bombing raids on Houthi targets.

With US and UK navies in the Red Sea advising commercial vessels to avoid the area, another top shipper has abandoned the critical waterway: The world's second-largest LNG exporter, QatarEnergy, according to Reuters.

LSEG shiptracking data showed that Qatar's Al Ghariya, Al Huwaila and Al Nuaman vessels had loaded LNG at Ras Laffan and were heading to the Suez Canal before stopping off in Oman on Jan. 14. The Al Rekayyat, which was sailing back to Qatar, stopped along its route on Jan. 13 in the Red Sea.

"It is a pause to get security advice, if passing (through the) Red Sea remains unsafe we will go via the Cape," the source told Reuters on Monday regarding QatarEnergy. -Reuters

Qatar is a major supplier of liquefied natural gas to Europe after the US, and disruptions in shipments, or at least delays, due reouting efforts around the Cape of Good Hope might threaten the continent's energy security.

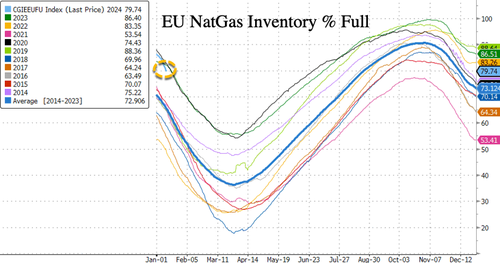

The good news for now is Europe's natural gas inventories are about 79.74%, well above a ten-year average due to the warm start of the Northern Hemisphere winter. However, if cold weather persists...

Front-month European benchmark gas prices on the Dutch TTF hub slid as much as 8.5% on Monday below 30 euros per megawatt-hour (MWh) on lower demand as supply concerns fade.

Possible delays or disruptions of LNG shipments from Qatar are not a concern to European traders (well, not yet).

By Zerohedge.com

More Top Reads From Oilprice.com:

- Is the Texas Grid Ready for This Year’s Polar Vortex?

- More Drilling Slowdowns for U.S. Oil, Gas Industry

- Over 100 Ships Transit Red Sea Route Despite Calls to Stay Away