A combination of Russia's inactive Nord Stream 2 pipeline and cooler weather forecast through the end of December sparked a rally in European natural gas futures. German power prices surged to a record high while French power prices jumped to a decade high.

Concerns that Nord Stream 2 pipeline won't operate this winter season comes as the new German chancellor Olof Scholz said his government would "do everything" possible to make sure natgas flows continue through Ukraine and not the latest Russian to German undersea pipeline. Last month, German energy regulators suspended Nord Stream 2's certification process. The US has also sanctioned companies affiliated with the pipeline's construction.

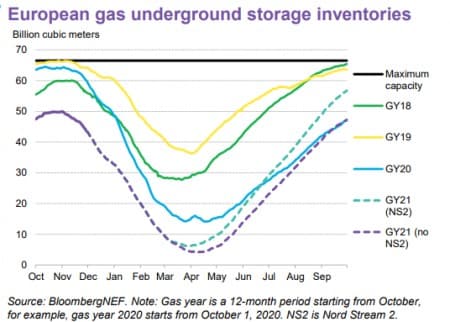

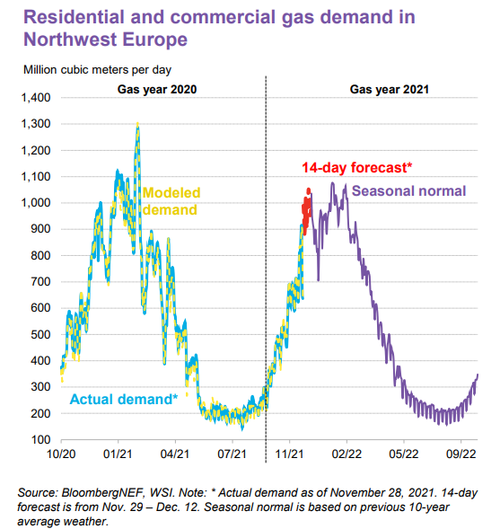

On top of the geopolitical uncertainties, mixed with tight natgas supplies across Europe, some of the lowest in a decade, a new 14-day weather forecast shows cooler than average weather, which will boost natgas demand.

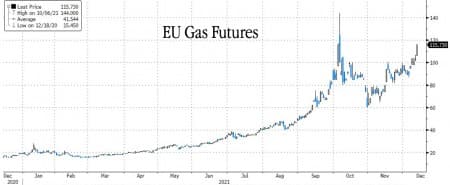

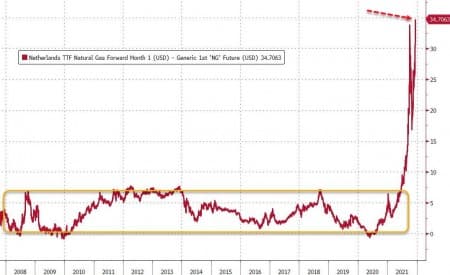

Benchmark Dutch front-month gas futures jumped as high as 10% to 116.39 euros a megawatt-hour on Monday, the highest since Oct. 6.

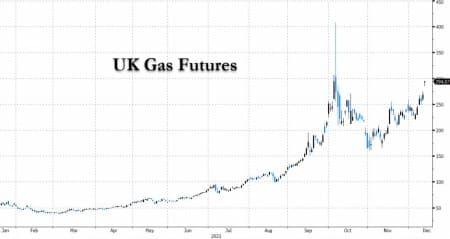

UK gas futures also soared 10% to 294.07 pounds.

Cooler weather on the continent has increased the power demand. German power contracts added 9.7% to a record 205 euros per megawatt-hour. French power contracts rose to 329 euros per megawatt-hour, the highest ever.

EUROPEAN ENERGY CRISIS: Please, keep moving; nothing to see here: just a crazy day of natural gas and electricity prices across all Europe. TTF up to €117 per MWh. Germany one-year forward power above €200 per MWh. And day-ahead electricity prices in France above €300 per MWh. pic.twitter.com/PNnVaIINIC

— Javier Blas (@JavierBlas) December 13, 2021

This winter, Nord Stream 2 was supposed to be Europe's saving grace as stockpiles across the continent are well under seasonal trends. Without extra supplies, as storage is rapidly depleting, natgas prices will likely continue rising, forcing power prices higher.

Citigroup wrote a note Monday that said gas prices in Europe are soaring because of "a nervousness around demand in the remaining months of winter." They noted some positive news: "Physical gas market is less tight than it was 4-6 weeks ago."

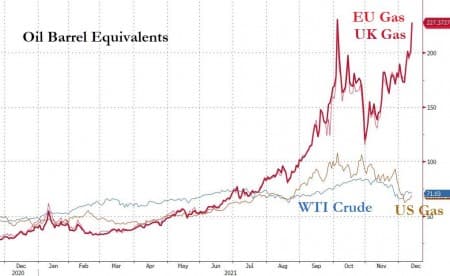

On the other side of the Atlantic, there are no signs of supply tightness or frigid weather. Natgas stockpiles remain in line with seasonal averages. The chart below illustrates how energy markets are tight in Europe but calm in the US.

Another way in examining the energy crisis in Europe is a spread between European gas futures and US gas futures. The spread's extreme outlines the severity of the crisis.

We outlined last week how a possible polar vortex event could emerge in the US in January, which could produce a bullish setup for US natgas.

By Zerohedge.com

More Top Reads From Oilprice.com:

A possible quid pro quo is emerging in which more Russian piped gas supplies will be provided in return for a certification of Nord Stream 2. If the EU is trying to pressure Russia to ship more gas via Ukraine, it will be wasting its time. And if it continue to play politics with Nord Stream 2, Russia might decide to cut its gas shipments via Ukraine altogether.

Neither LNG supplies from Qatar and the United States nor Norway’s gas supplies could on their own satisfy the EU’s gas needs. Only Russia can.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London

"So much for the euro-dollar contract" as well as that ahem "money" ahem ends *IMMINENTLY.*