The Eastern Mediterranean in a decade went from an 'empty sea' towards one of the most promising new frontiers of the global oil and gas industry. The Levant basin contains several impressive hydrocarbon reserves that have brought economic cooperation and peace between political rivals in an unstable region. Chevron in cooperation with Israeli partners is about to invest another $235 million in pipelines to increase production and export to Egypt that will cement ties even further.

The 'rise' of the Eastern Mediterranean is not only determined by the size of the hydrocarbon resources but also due to partly existing infrastructure and vicinity to consumers including export markets. Israel was a resource-poor country that didn't have access to the oil and gas of its Arab neighbors. Therefore, hydrocarbons needed to be imported from afar. The discovery of Tamar and Leviathan has changed that.

Not only has Israel’s energy security position been strengthened, but the geopolitical landscape is changing due to increased cooperation with Egypt and Jordan. Especially the export agreement with Egypt is a gamechanger that will necessitate economic cooperation for several decades.

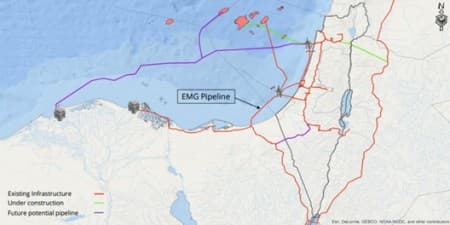

Under the previous agreement, Egypt's Dolphinus Holdings agreed to import 85 billion cubic meters (bcm) of gas, worth $19.5 billion, over 15 years from Israel's Leviathan and Tamar gas fields through the EMG pipeline. With the $235 million investment, the operators of the gas fields will be able to export an additional 7 bcm annually to Egypt. The decision is in line with Chevron’s confidence in the business environment which last year already bought Noble Energy for $5 billion due to its interest in Leviathan. Related: The 5 Best Utility Stocks In 2021

The additional exports would add up to Egypt's imports that will strengthen the country's position as an energy hub and vastly improve its energy security. Although the Arab nation owns the Mediterranean's largest gas field, Zohr, its sizeable and growing population requires ever greater volumes to sustain economic development.

Egypt’s two LNG export facilities, Idku and Damietta, have been sitting idle for years after the gas intended for export was rerouted towards the domestic market. Recent discoveries such as Zohr and the import agreement with Israel will change that. The two LNG facilities have a combined capacity of 12.1 million tons per annum (mtpa) which adds up to 16.4 bcm. Italian Eni, which operates the giant Zohr field, struck an agreement with Naturgy and the Egyptian government to restart the Damietta facility in the first quarter of 2021.

Egypt's large (and expanding) domestic market, vicinity to Europe for export purposes, and existing export facilities justify the strong confidence of Chevron and others in their endeavor. According to Yossi Abu, CEO of Delek, “the fact that we are paying most of the costs involved in building the new pipeline reflects the security and confidence we have in continuing to increase exports to the countries of the region.”

Besides the connection with Egypt, Israeli firms are also capitalizing on the momentum in Europe to diversify sources. The discovery of gas fields in Cypriot waters has improved the business case for a multi-billion subsea pipeline to Greece and further into the EU. The spillover effect of increased Israeli-Greek cooperation is the recent 20-year $1.7 billion defense agreement. The parties have also agreed on a final investment decision on the EastMed pipeline in 2022 for completion in 2025.

The discovery of major gas resources has incentivized the formalization of cooperation in the region. The Cairo-based EastMed Gas Forum is an example of regional multilateralism where Arab countries, together with Israel, and European countries such as Greece, Italy, and Cyprus discuss energy topics. There is a strong momentum on developing these resources. Therefore, expect increased cooperation between producing and consuming countries to reap the rewards of the Eastern Mediterranean.

By Vanand Meliksetian for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Majors Poised To Make Biggest Geothermal Investments In 30 Years

- Biden's Green Energy Boom Could Send These Electric Vehicle Stocks Soaring

- Goldman Sachs: Biden’s Federal Land Drilling Ban Is Bullish For Oil

Egypt is advantaged by having the biggest proven natural gas reserves in the Eastern Mediterranean, a huge domestic gas market and also having the only two LNG plants in the whole region, the Idku and Damietta plants.

Chevron’s and Israeli partners’ investment in an undersea gas pipeline (the EMG pipeline) will further enhance Egypt’s position as a energy hub and also increase Israeli gas exports to Egypt for conversion into LNG and re-exporting to the Asia-Pacific Region or the EU.

However, this new gas pipeline comes at the expense of the EastMed gas pipeline which is

intended to deliver Israel and Cypriot gas exports under the Mediterranean to the EU via Greece and Italy.

The EastMed which is supposed to be completed by 2025 may never see the light of day. The reasons are Turkey’s opposition to it, cost and capacity in addition to Egypt’s reluctance to accept it.

Turkey opposes the proposed EastMed gas pipeline because it believes it undermines its position as the energy hub of Europe by competing with the Turk Stream pipeline bringing Russian gas supplies to Turkey and the EU under the Black Sea and also the Southern Gas Corridor (SGC) bringing Caspian gas from Azerbaijan to Turkey and then to the EU via the Trans Adriatic Pipeline (TAP).

Egypt doesn’t want it since it hopes to receive increasing volumes of both Israeli and Cypriot gas at its two LNG terminals in Damietta and Idku for conversion to LNG and re-exporting along with Egypt’s own LNG to the Asia-Pacific region.

Then there is the construction cost. The EastNed stretching over a distance of 1900 km is estimated to cost $7 bn. If we judge the viability of the EastMed by the current situation, Cyprus has yet to discover sizeable gas reserves to fill the pipeline to capacity. Israel has already signed a deal for Israeli gas exports to be sent to Egypt for conversion to LNG and re-exporting. Cyprus on its own couldn’t muster enough gas to fill the EastMed annual throughput capacity of 20 bcm. Moreover, Turkey will never allow the Greek Cypriots to produce more gas let alone export it without securing a share for the Turkish Cypriots.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London