European Union policymakers have started to prepare the public for siege conditions this winter if gas supplies from Russia are completely cut, an effort to demonstrate diplomatic resolve as well as avoid panic later in the year.

In recent weeks, officials from Germany and other EU member states have begun to talk openly and urgently about the need for immediate reductions in consumption in advance of the peak winter heating season.

They have also started to plan publicly for compulsory allocation, including rationing and prioritization among industrial users, as well as sharing among member states in the event there is not enough gas to supply everyone.

The stated reason is to accelerate the accumulation of inventories over the remainder of the summer to ensure European countries enter the winter with the highest possible inventories.

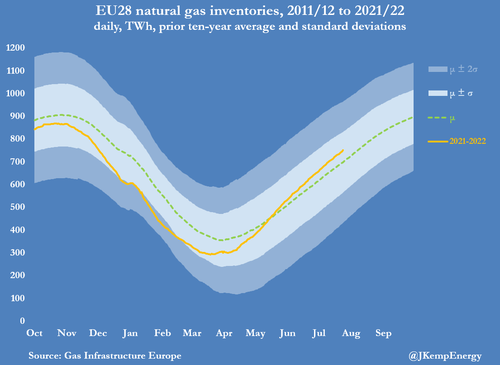

In reality, inventories are rising relatively rapidly and are already above the long-term seasonal average in most member states and across the region as a whole.

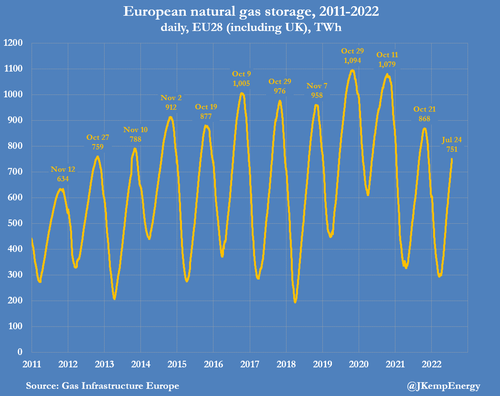

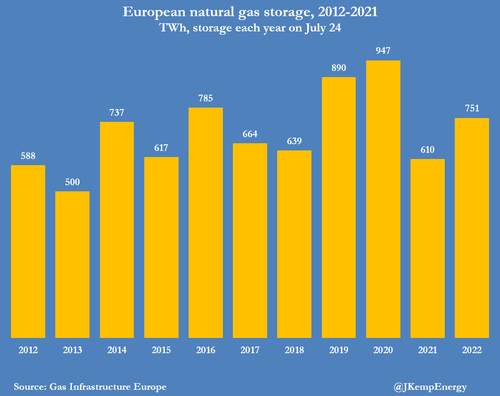

Inventories across the EU and the United Kingdom (EU28) stood at 751 terawatt-hours (TWh) on July 24 compared with a ten-year seasonal average of 698 TWh.

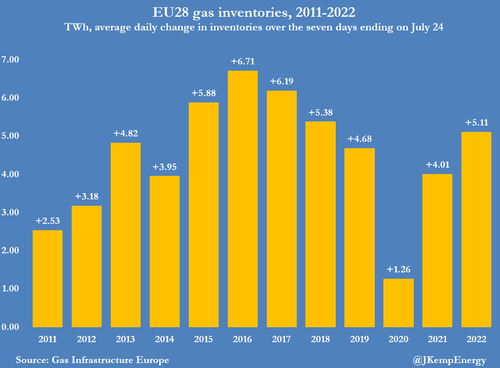

EU28 stocks were rising at a rate of 5.11 TWh per day in the seven days to July 24 compared with a ten-year seasonal average of 4.61 TWh.

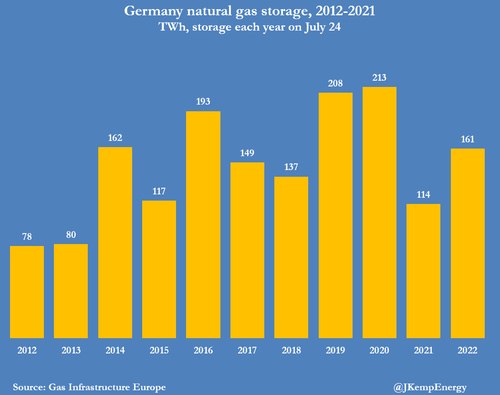

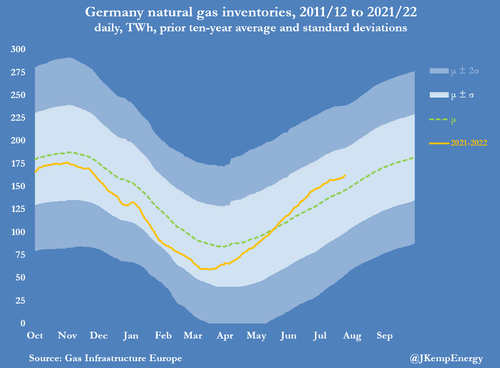

In Germany, the largest stock holder, inventories of 161 TWh were above the long-term average of 145 TWh, and rising at 0.6 TWh per day, compared with a long-term average of 0.72 TWh per day.

On current trends, the European Union as a whole, and Germany in particular, are already likely to enter the winter with above average levels of gas in storage.

The problem is that it will not be enough if pipeline supplies from Russia are cut completely.

EU storage is designed to cope with seasonal swings in consumption not to withstand a war-like strategic blockade.

Related: Traders Are Betting On The End Of The Oil Price Slump

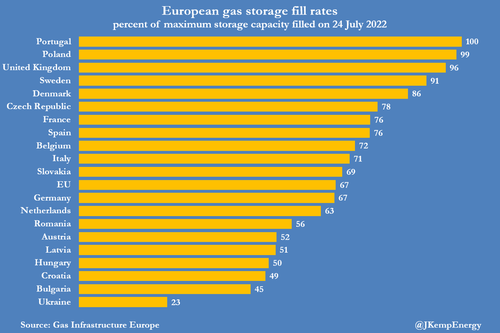

EU storage sites are currently filled to 67% of their maximum capacity, including 67% in Germany, 71% in Italy and 76% in France.

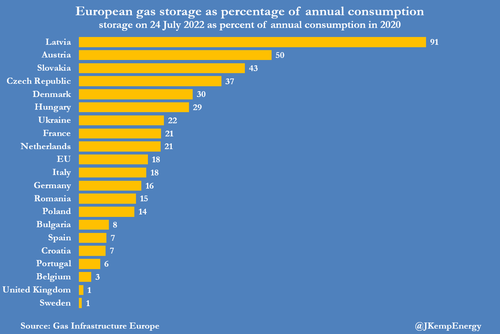

But current storage is equivalent to just 18% of annual consumption for the European Union as a whole, including 16% in Germany, 18% in Italy and 21% in France.

Even if storage sites can be filled to 90% or more of their maximum, inventories cannot withstand semi-blockade conditions for more than a few months without being depleted to critically low levels or exhausted completely. And if storage lasts through the winter of 2022/23 it would still need to be rebuilt before the winter of 2023/24, which would be extremely difficult under siege conditions.

Therefore, the unstated reason for the recent talk about consumption cuts and possible rationing is that large-scale and sustained demand reductions are the only way to withstand a possible gas siege.

Public planning for reduced consumption and compulsory allocation is intended to signal resolve and deter Russia from attempting a siege in the first place.

In the event one occurs anyway, it is intended to harden public opinion for the privations ahead, including some physical discomfort, significantly higher utility bills, and a severe economic contraction.

By John Kemp via Zerohedge.com

More Top Reads From Oilprice.com:

- Gulf Producers Hike Crude Prices Despite Recession Fears

- Manchin Backs Climate Bill In Stunning U-Turn

- Earnings Season Is Here, And Energy Companies Are Booming