My article last month addressed the importance of the Southern gas corridor in the contexts of pricing and market integration of European gas markets, this article explores both the domestic and international implications of the anticipated PEG-Nord – PEG-TRS merger.

On November 1st 2018, the French gas market shall merge its two virtual trading points (VTPs), PEG-Nord and PEG-TRS, in order to form a single VTP called Point d’échange de gaz (PEG), within a single trading region, Trading Region France (TRF). As such, market participants will be able to deliver to and take gas from the new balancing point, Trading Region France (TRF).

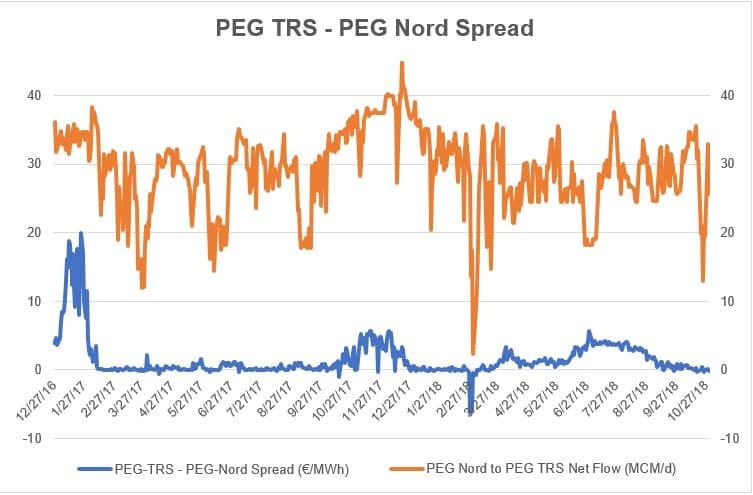

As a consequence, the systematic price difference (Figure 1) between PEG-Nord and PEG-TRS is expected to be reduced, as a single national wholesale gas price is established, with an increase in liquidity, competition, and ultimately market integration anticipated.

PEG-Nord is currently well supplied through direct pipeline linkages to Zeebrugge and NetConnect Germany (NCG) and LNG regasification capacity at Dunkerque and Montoir de Bretagne. However, PEG-TRS has limited pipeline access to other gas sources, with LNG capacity at the Fos terminals supplying a substantial proportion of demand in the South. These stylised facts, combined with capacity constraints of the Liaison Nord-Sud pipeline, which can only carry roughly 40MCM/d, have driven a systematic premium at PEG-TRS in recent years (Figure 1).

(Click to enlarge)

Figure 1: The PEG-TRS-PEG Nord price spread in €/MWh and net pipeline flows from PEG-Nord to PEG-TRS in MCM/d.

As such, the anticipated merger, combined with expected completion of the Val de Saone and Gascogne-Midi pipeline projects, should alleviate capacity restrictions on the Liaison Nord-Sud pipeline and effectively eliminate the premium paid within the day ahead market in Southern France. Related: What’s Behind The Continued Selloff In Oil?

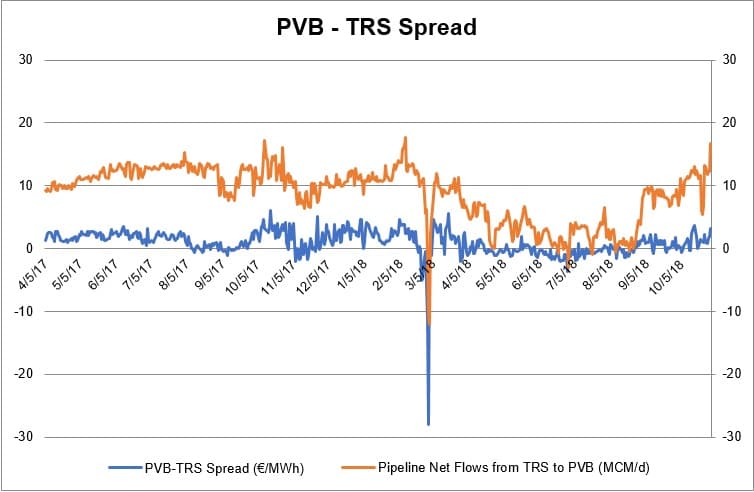

Whilst the merger will undoubtedly impact the domestic French natural gas market, the broader implications for European gas market pricing, integration and security are pertinent. As the French market reaches a new equilibrium price, with an anticipated reduction of pricing within Southern France, cross border arbitrage opportunities between Southern France and PVB (Spain) become more attractive (Figure 2). Given the historically low capacity utilization rates at VIP Pirineos, despite the mean cross border premium of €1.25/MWh over the last year, there is substantial potential for cross-border arbitrage. However, Oxford Institute for Energy Studies (OIES) proffer that transmission capacity between France and Spain is not easily available for players who are not active shippers in those markets and only those who own long term capacity on this route may be able to easily perform arbitrage trading.

(Click to enlarge)

Figure 2: The price spread between PVB (Spain) and PEG-TRS (France) in €/MWh and net pipeline flows from PEG-TRS to PVB in MCM/d.

Based on the premise of reduced wholesale pricing in Southern France and increasing competitiveness of cross border arbitrage into Spain, a key constituent of the Spanish supply portfolio comes into question. Given the Iberian peninsula’s substantial portion of Europe’s LNG regasification capacity, a reduction in pricing in Southern France, and by extension Spain, could impact the price competitiveness of LNG imports into Southern Europe.

As the determination of wholesale market prices of natural gas within Europe has historically been driven by two factors; European LNG imports and flexible oil-indexed pipeline gas from Russia and Norway above take or pay levels, the security of European supply could be adversely impacted by the impending merger. The ability of LNG imports to act as a price setter within Europe is predicated on two factors; Asian hub pricing, and the relative value of Russian or Norwegian pipeline gas above take or pay levels. If pricing is suppressed at PVB (Spain), LNG imports into the Southern gas corridor become less attractive, largely due to the low levels of interconnection between Spain and other European countries. As such, pipeline supplies from Norway or Russia become increasingly attractive, marginally reducing European natural gas security.

By David Woroniuk for OilPrice.com

More Top Reads From Oilprice.com:

- Full U.S. Energy Independence Is Impossible

- Cold Snap Could Send Natural Gas To $5

- Trade War Puts The Brakes On U.S. LNG Dominance