European natural gas pricing is amongst the highest seen in recent years, with the average September price holding a €10.71/MWh premium over the previous year. The uncharacteristically high prices throughout the summer months, driven by the cold-snap of the previous spring, has brought the European market to new highs as we head into heating season.

Following my previous article anticipating higher European gas prices, this article aims to provide a short recap on happenings within the European day ahead market in the month of September, and provide a brief October outlook.

In order to assess market harmonization amongst European day ahead natural gas prices, this article generates a network density term, based on the price returns of 12 markets. From this, a rolling window estimator is applied, assessing the degree of price harmonisation, therefore the tightness of the European gas market, at each day throughout September.

(Click to enlarge)

Figure 1: A network density of time series of European day ahead natural gas prices from 01/09/2017 until 01/09/2018.

Visually, an inverse correlation between average European day ahead gas pricing and the network density term is apparent, indicating that the low current value of network density may indicate further price increases throughout Europe.

In order to understand the dynamics of the day ahead gas markets, the pricing at each hub must be addressed. Figure 2 displays the average premium or discount (over the sample average) at each hub measured, both in September 2018 and September 2017.

Market Sept 2018 Avg. Premium/Discount (€/MWh) Sept 2017 Avg. Premium/Discount (€/MWh)

(Click to enlarge)

Figure 2: Average premium or discount from the average European day ahead gas price, in both September 2018 (left) and September 2018 (right).

It is clear that the majority of the dynamics of European hubs have remained largely similar, however both PVB (Spain) and PEG-TRS (France) have substantially increased in premium above the sample average between September 2017 and September 2018, suggesting a decoupling of the Iberian peninsula from the European pricing network. The respective YoY increases of €0.79 and €0.26 per MWh are considerable, and can be attributed to capacity constraints on the Liaison Nord-Sud pipeline, which had mean net flows of 26.81MCM/d (97.00% utilization) in September 2018, but 23.34MCM/d (84.45% utilization) in September 2017. This also explains the increase in price differential between PEG-Nord and PEG-TRS, which grew from 0.44€/MWh to 0.76€/MWh between September 2017 and September 2018. Related: The Inevitable Oil Supply Crunch

The increase in differential at PVB is more interesting, as the YoY increase of 0.79€/MWh can’t be directly attributed to capacity constraints, as net flows from PEG-TRS to PVB at VIP Pirineos fell from 10.61MCM/d (62.82 % utilization) to 8.46MCM/d (50.10 % utilization) YoY. A lack of liquidity at each of the hubs, combined with a low accessibility of transmission capacity for those not engaged in term contracts, has led to the decoupling of the Spanish natural gas market.

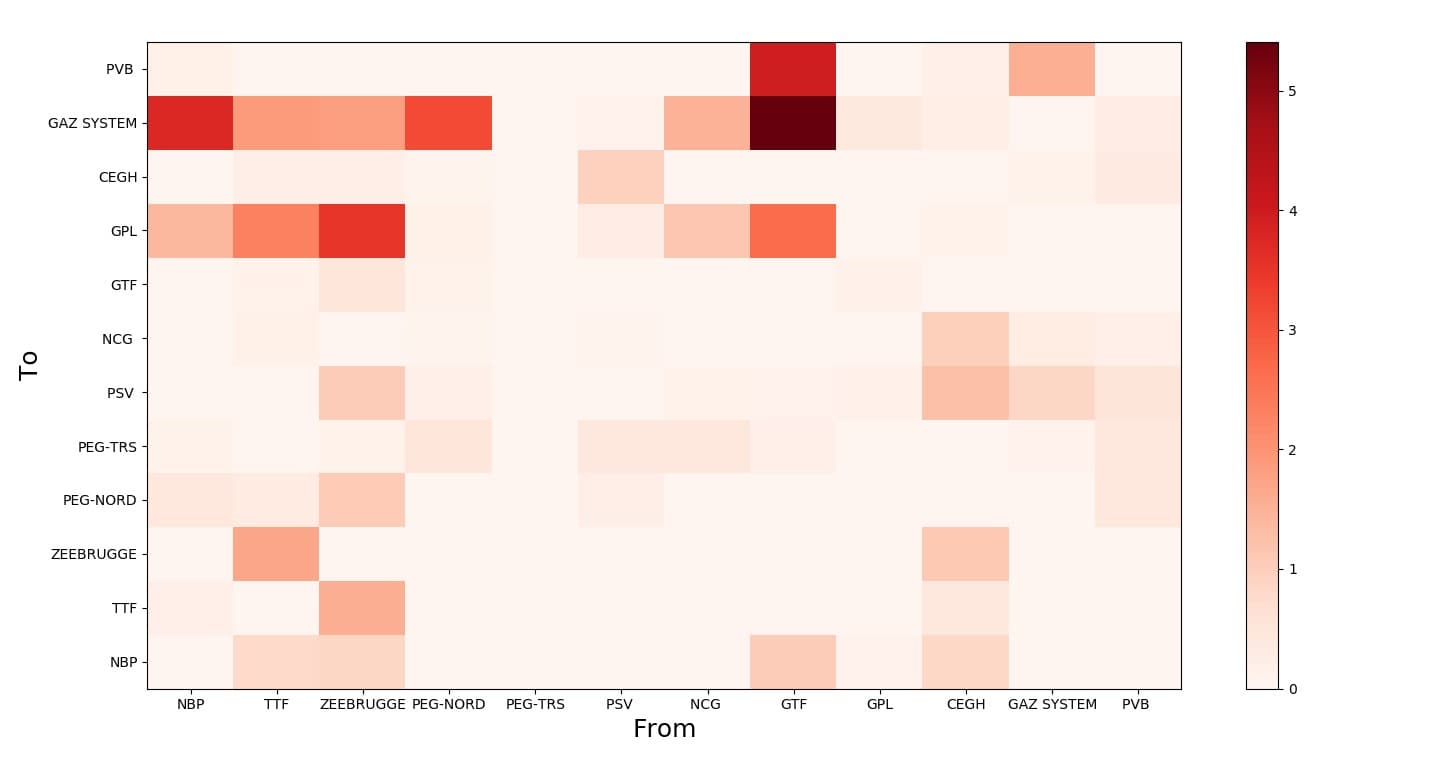

As these markets both hold substantial premia to the day ahead European market average, it can be expected that market participants would engage in arbitrage, with these markets to influence pricing at other hubs, as displayed by the adjacency matrices below:

(Click to enlarge)

Figure 3: A sum of the adjacency matrices of September 2017 (top) and September 2018 (bottom). This indicates the intensity with which each market influenced each other throughout the month of September in 2017 and 2018.

Pricing at PVB displays a considerably larger influence over other markets in 2018 than 2017, with PEG-TRS increasing in influence from a negligible influence in September 2017. From this, it can be deduced that whilst PVB and PEG-TRS trade at a premium to the rest of the European day ahead prices, they shall exert upward price pressure on the overall market.

To conclude, the uncharacteristically extreme temperatures experienced throughout the year, combined with a tightening global LNG market, have driven day ahead prices in Europe to multi-year highs. It is expected that these price increases shall continue into October.

By David Woroniuk for OilPrice.com

More Top Reads From Oilprice.com:

- Saudi Arabia, Kuwait Discuss New Oil Production In Neutral Zone

- Creating Fuel From Thin Air

- The Biggest Wildcard In The Iran Sanctions Saga