Natural gas storage is at record low levels but prices are falling going into winter heating season. Markets seem to be betting that wellhead supply will be sufficient to cover demand this winter. That may be but at what gas prices? This is a game of natural gas risky business.

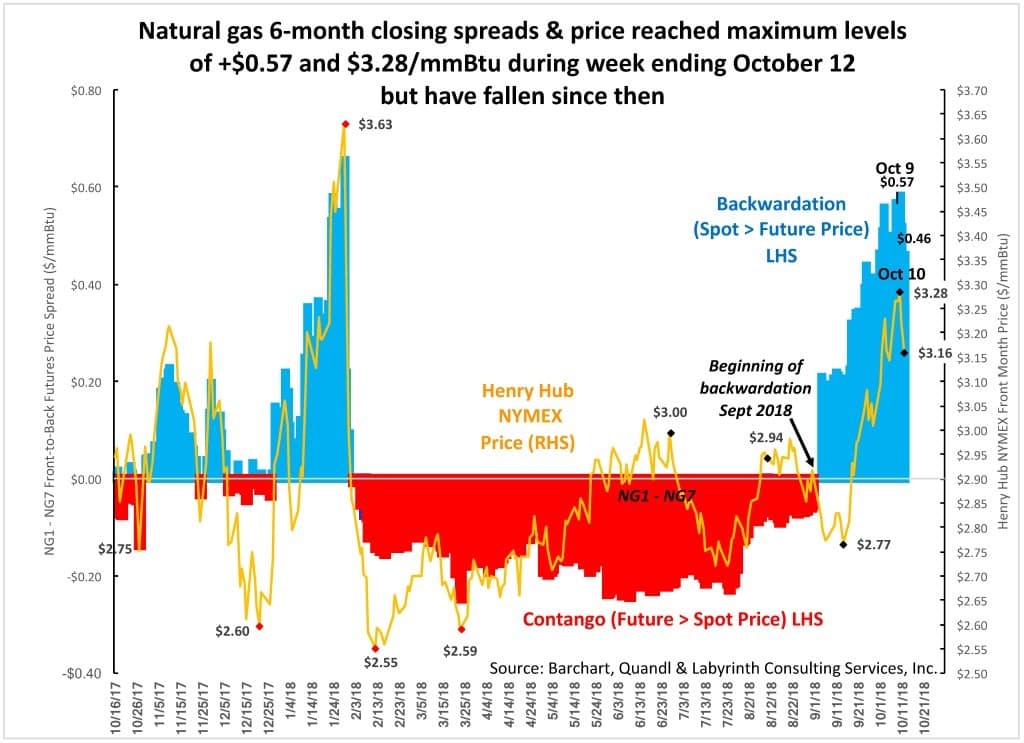

Natural gas 6-month calendar spreads moved in backwardation in early September and climbed to +$0.57 on October 9. Henry Hub spot prices reached $3.28/mmBtu but both spreads and price have fallen since then (Figure 1).

(Click to enlarge)

Figure 1. Natural gas 6-month closing spreads & price reached maximum levels of +$0.57 and $3.28/mmBtu during week ending October 12 but have fallen since. Source: Barchart, Quandl and Labyrinth Consulting Services, Inc.

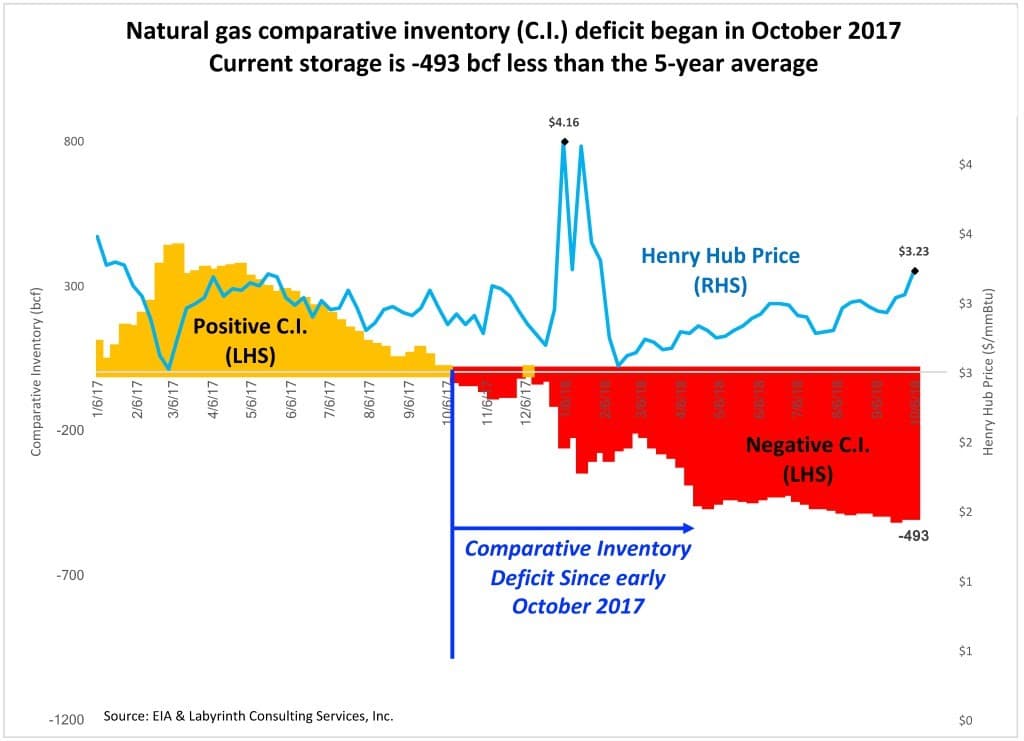

The upward movement of prices and spreads were a long time coming considering the massive storage deficit that began in October 2017 (Figure 2). Current storage is -493 bcf less than the 5-year average and we are only a few weeks away from the beginning of the 2017-2018 winter heating season. Storage is an almost unbelievable -693 bcf less than during the same week in 2017 and yet, markets are seemingly unfazed!

(Click to enlarge)

Figure 2. Natural gas comparative inventory (C.I.) deficit began in October 2017. Current storage is -493 bcf less than the 5-year average. Source: EIA and Labyrinth Consulting Services, Inc.

What, me worry?

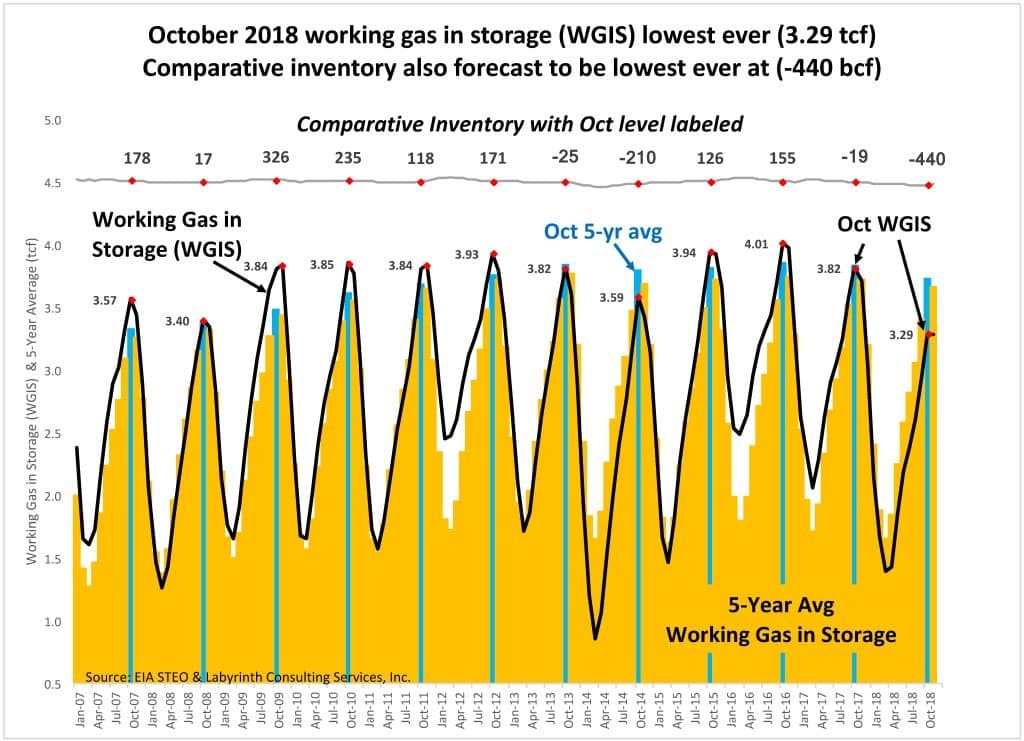

This has led to the lowest end-of-storage (EOS) level in history. October working-gas-in-storage (WGIS) is only 3.29 tcf and a projected monthly average C.I. of -400 bcf is also the lowest in history for October (Figure 3).

(Click to enlarge)

Figure 3. October 2018 working gas in storage (WGIS) lowest ever (3.29 tcf). Comparative inventory also forecast to be lowest ever at (-440 bcf). Source: EIA STEO and Labyrinth Consulting Services, Inc.

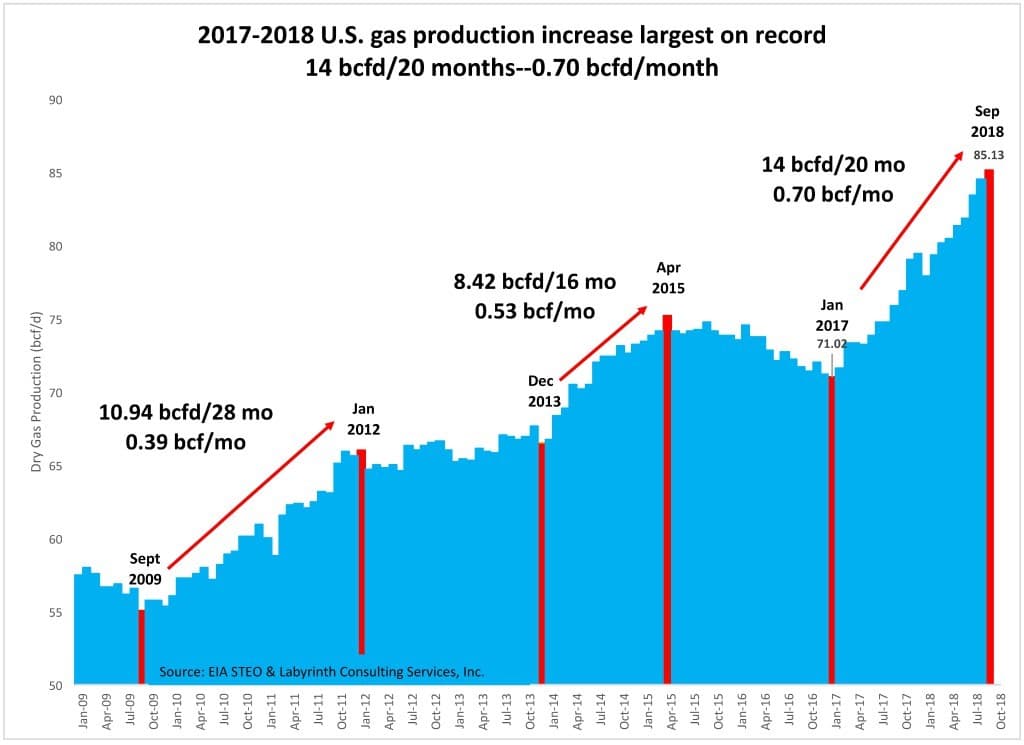

On the other hand, the 2017-2018 increase in U.S. production has also been the largest in history. Dry gas production has increased +14 bcf/d over the last 20 months, an impressive +0.7 bcf/d per month (Figure 4).

(Click to enlarge)

Figure 4. 2017-2018 U.S. gas production increase largest on record: 14 bcfd/20 months–0.70 bcfd/month. Source: EIA STEO and Labyrinth Consulting Services, Inc.

That gas output surge has given markets comfort that wellhead supply may be adequate to compensate for the storage deficit during the coming winter. The problem with that logic is that gross gas supply—production minus exports—is not very comforting. Related: Goldman Sachs: This Is The Next Big Risk For Oil

LNG (liquefied natural gas) exports by tanker and pipeline exports to Mexico and Canada have been steadily increasing. Exports reached 3.25 bcf/d in September and are projected to increase to almost 9.5 bcf/d by November 2019.

The result is that despite growing production, gross gas supply may have already peaked and is on track to decline going into winter (Figure 5).

(Click to enlarge)

Figure 5. Gross natural gas supply may have peaked at 81.88 bcf/d despite production increases because of increased exports. Source: EIA STEO and Labyrinth Consulting Services, Inc.

It is unclear why markets are making what seems like such a risky bet on supply when history suggests a clearly negative outcome for price.

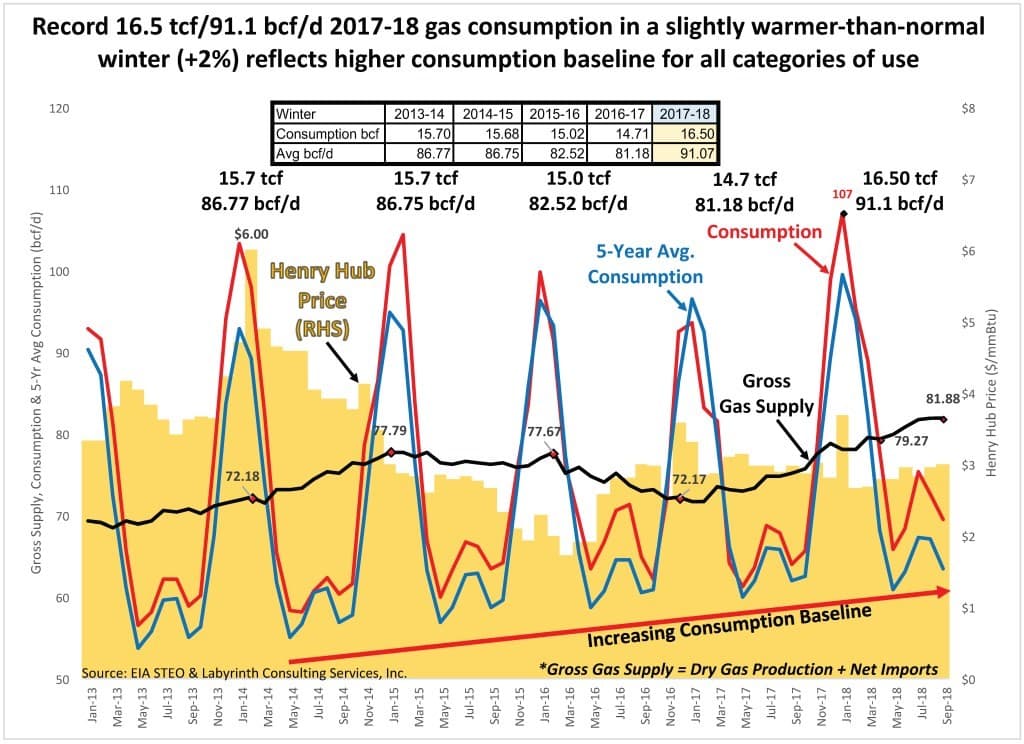

Perhaps the impact of Winter 2017-2018 gas consumption has not been fully appreciated. November 2017 through April 2018 gas use was 16.5 tcf or 91.1 bcfd (Figure 6).

(Click to enlarge)

Figure 6. Record 16.5 tcf/91.1 bcf/d 2017-18 gas consumption in a slightly warmer-than-normal winter (+2%) reflects higher consumption baseline for all categories of use. Source EIA STEO and Labyrinth Consulting Services, Inc.

That exceeds the previous Winter 2013-2014 record by 0.8 tcf or 4.3 bcf/d. During that winter, weekly average Henry Hub prices reached $6/mmBtu.

January 2018 gas consumption was a remarkable 107 bcf/d!

It is unlikely that the U.S. will have an overall gas shortage this winter but it is probable that prices will move higher as inventories are consistently drawn down. A normal winter will lead to short-term price spikes in local markets similar to what occurred last winter. History suggests that prices will almost certainly reach $4.00 to $4.25 weekly averages during the coming winter, and that much higher prices are possible.

Americans have considerable faith in the wisdom of markets. It is worth noting that what markets do best is to force efficiency. That sometimes comes only after they occasionally get things wrong.

By Art Berman

More Top Reads From Oilprice.com:

- Are U.S. Oil Exports Really Unstoppable?

- Saudis Lash Out At U.S. In Complete Deterioration Of Relations

- South Korea Cuts Iran Oil Imports To Zero