A year ago, Europe was in the midst of an energy crisis as the continent struggled to adapt to a new post-Russian gas reality. TTF prices, the European benchmark for natural gas, spiraled higher throughout the summer and peaked in late August, with all energy users affected, from major industries to individual households. So far in 2023, natural gas in Europe has stolen fewer headlines, with prices predominantly drifting downwards since December and returning to levels last seen in 2021. Last week, however, was marked with volatile trading on TTF contracts, with prices jumping back above the €40 per megawatt hour mark(MWh) again for the first time since April. In this week’s blog post, we’ll look at the reasons for this volatility and whether it is an indication of further trouble in Europe’s energy market.

Hot Weather Heats Up Demand

One of the most significant factors in Europe making it through the 2022/23 winter without major power outages across the continent was the mild weather, which led to lower-than-average demand for heating and therefore natural gas. Indeed, spring was equally mild through the majority of the continent, but in recent weeks the temperate conditions have given way to the warmth of summer. Most of Europe is now experiencing temperatures above 25 degree celsius or higher, which has led to a sudden increase in demand for air conditioning. A large driver of summer demand for natural gas, this has injected upward price pressure into a TTF market which had otherwise been drifting.

Supply Pressure from Norway and Netherlands

Alongside the increase in demand, there has been simultaneous news of disruptions to Europe’s natural gas supply. In Norway, the Hammerfest LNG export plant had to be closed on May 31st due to a gas leak, while maintenance at processing plants in Nyhamna and Kollsnes had reduced production at both sites, as reported by OilPrice.com. While this news may have had minimal impact on TTF prices a few years ago, in the wake of Russia’s invasion of Ukraine, Norway has cemented its position as the key gas-supplying nation for the rest of Europe. Equinor, which runs the Hammerfest plant and replaced Russia’s Gazprom as the continent’s dominant gas provider, confirmed the plant was due to come back online last week.

Meanwhile, news emerged from the Netherlands last week that the Groningen gas field, the largest of its kind in Europe, will be closing in October this year. The field has produced natural gas since 1963, and while it was due to be closed by October 2024 by the latest due to the earthquakes caused by production at the site, the confirmation that the deadline is this year caused markets to rally. While Groningen only contributes a small amount to Europe’s overall gas output, it remains an important supply buffer for western Europe, as noted by Bloomberg. While the field could be reactivated in future if required due to further energy crises, in the short-term the news of its closure caused sufficient supply-side concern to boost gas prices.

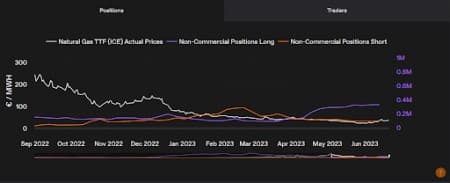

TTF Positions, as shown in ChAI Webapp.

Traders Remain Uneasy

While the hot weather and news of supply disruptions are understandable causes of price increases for natural gas, the volatility witnessed in the past couple of weeks indicate the tension that remains in gas markets even beyond last summer’s crisis. With frequent daily movements of more than 5% in TTF prices, there is a clear twitchiness amongst the speculators at present as the market awaits another sustained upward trend. Despite coming out of winter with record high levels of gas storage, European nations will still need to embark on a refilling programme ahead of the 2023/24 winter which will cause upward price pressure. At present, the ratio of Non-Commercial long positions on TTF stands at 3:1 against shorts, which is the largest long ratio since late Q3 2022, as shown in the graph above. With so many expecting further price rises to come, the recent volatility in gas markets may be a sign of things to come over this summer.

By Chai Predict

More Top Reads From Oilprice.com:

- Iran’s Booming Oil Industry Adds Urgency To Nuclear Negotiations

- Are Oil Prices Set for A Rally?

- China’s Imports Of Russian Crude Oil Hit A Record High