Solar power is starting to look a little like the internet – way overhyped at first, generally unprofitable initially, but eventually a really big deal. Only time will tell what happens in the space of course, but there are indications that solar is becoming a seriously viable industry in the long-term.

One of the best indications that solar is becoming a real business is the adoption of large scale solar by various big companies. For instance, the SEIA recently noted that solar use by major firms the group tracks expanded from 300 MW in 2012 to over 1 GW in 2016. That total represents 16 percent of all non-residential, non-utility-scale solar PV capacity in the U.S.

Solar power is being particularly adopted by mass big box retailers – Walmart and Target for instance are the largest two users of solar according to the SEIA with 147.5 MW and 145 MW respectively. That makes sense as the large flat roofs of big box stores present an obvious opportunity for solar, and the firm’s low cost of capital thanks to a stable business model means that installing solar should be profitable at most reasonable price points.

(Click to enlarge) Related: Why The Oil Industry Shouldn’t Fear Peak Demand

The chart above shows the biggest corporate users of solar power. Apple, the number four company on the list of biggest solar users, might be installing solar panels to curry favor and environmental credit with its customer base. However, it is very unlikely that Walmart or Walgreens customers, for example, care whether those firms use solar power – solar installations in these situations are going to be done because they are economically sensible, not because they have environmental benefits.

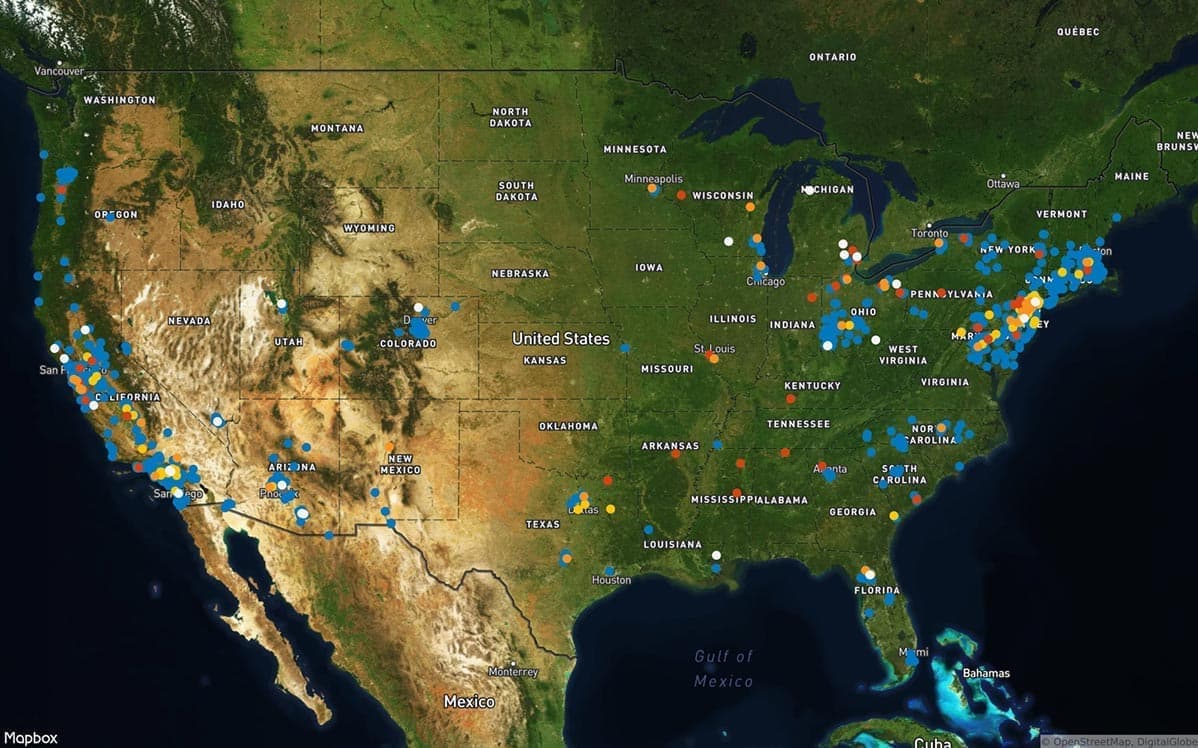

Solar is being widely used by corporations across many of their facilities. Almost a third of Target stores and General Motors plants have solar power installations. These facilities are particularly concentrated in the Northeast and on the West coast. The sunny West Coast probably derives its installations largely from economic benefits, whereas in the Northeast a combination of high local power prices and state government incentives may be behind the installations. None of this is to say that solar power has run out of attractive installation options though. Only 7 percent of Walmart’s more than 5,000 facilities have solar power installed, while only 2 percent of Albertson’s supermarkets roughly 2,000 locations have solar installed.

(Click to enlarge) Related: OPEC Deal Could Trigger Drilling Boom In U.S. Shale

The broader point is that solar power is being used in a variety of settings by businesses and that is a sign that the installations have durable economic value. Companies do not invest large amounts of money into long term capital goods like solar panels without confidence that the projects will pay off over time. As these projects have picked up steam though, it helps to drive down the costs for future projects due to economies of scale.

Yet investors need to be very careful when choosing stocks in the space. Even if solar power really is a durable industry that is here to stay, none of this is any guarantee that solar companies today are a good investment. Those who remember the internet bubble will recall that the vast majority of internet companies failed in the bursting of DotCom bubble. Amazon has been a major player since the start, but other winners like Google and Facebook did not emerge until much later. Similarly, numerous early firms in the space failed while others fell behind new entrants. The same pattern may emerge in solar. Investor beware.

By Michael McDonald of Oilprice.com

More Top Reads From Oilprice.com:

- Winners And Losers Of The OPEC Deal

- U.S. Shale Patch Welcomes OPEC Deal – But Needs $60 Oil

- The SEC Wants To Know How $3 Billion Disappeared At This Coal Mine