Having written last week that Venezuela was staggering on through seemingly endless social and economic crises, an end game may finally be insight. It is impossible to predict when a regime will fall, but when it happens it can happen fast, and in Venezuela’s case the impact on the oil market could be substantial.

A reported 3 million people have fled the country, the government has defaulted on its debts, the economy is in the grip of hyperinflation, there are shortages of food, medicines and basic goods, and much of Venezuela’s remaining oil production, now reduced to around 1 million b/d, is in hock to China. The salaries paid by state oil company PDVSA are virtually worthless and many employees simply do not turn up for work.

The announcement on Monday of US sanctions on state oil company PDVSA will disrupt the flow of crude oil to Gulf Coast refineries, and precipitate an even deeper cash crisis for Caracas. Trade flows of heavy crude could be rerouted, but Caracas would be dependent on China and its other customers paying dollars rather than taking the crude in lieu of existing debt.

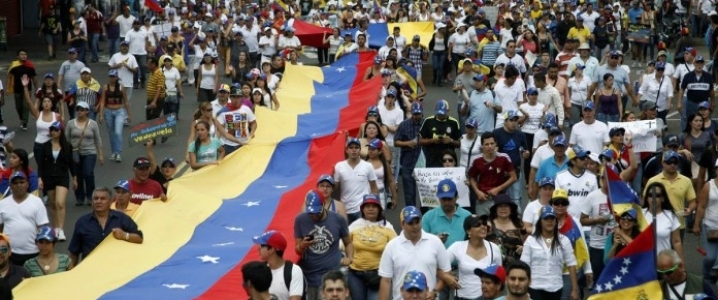

Revolution and state failure are by no means unlikely scenarios, yet it is evident that the Chavista revolution retains some core support, particularly within the military.

So what are the possible outcomes?

Militarisation

The military stands firm behind the Maduro government. This could only be achieved by further repression and heightened levels of…

Having written last week that Venezuela was staggering on through seemingly endless social and economic crises, an end game may finally be insight. It is impossible to predict when a regime will fall, but when it happens it can happen fast, and in Venezuela’s case the impact on the oil market could be substantial.

A reported 3 million people have fled the country, the government has defaulted on its debts, the economy is in the grip of hyperinflation, there are shortages of food, medicines and basic goods, and much of Venezuela’s remaining oil production, now reduced to around 1 million b/d, is in hock to China. The salaries paid by state oil company PDVSA are virtually worthless and many employees simply do not turn up for work.

The announcement on Monday of US sanctions on state oil company PDVSA will disrupt the flow of crude oil to Gulf Coast refineries, and precipitate an even deeper cash crisis for Caracas. Trade flows of heavy crude could be rerouted, but Caracas would be dependent on China and its other customers paying dollars rather than taking the crude in lieu of existing debt.

Revolution and state failure are by no means unlikely scenarios, yet it is evident that the Chavista revolution retains some core support, particularly within the military.

So what are the possible outcomes?

Militarisation

The military stands firm behind the Maduro government. This could only be achieved by further repression and heightened levels of state violence. Human rights abuses would raise the potential costs of capitulation. The Maduro government would, indeed perhaps already has, embark on an all-or-nothing path of no return.

In this scenario, oil production would continue to wither. Output has already become concentrated around the Orinoco belt, with production from the light crude fields in the east and from the light, medium and heavy fields in the west at minimal levels.

PDVSA is heavily dependent on sourcing naphtha and light crude for blending with the Orinoco’s heavy oil. This would be made all the harder as a result of international isolation and a lack of hard currency. The lack of equipment and capital would see further erosion of the operational capacities of the country’s refineries and upgraders, which are the two domestic sources of naphtha.

Field decline, equipment failures and operational incapacities would see oil production steadily decline below 1 million b/d, a price-supportive outcome for the oil market.

State failure

Social protest turns to revolution and civil conflict is sustained as the army divides. Oil production facilities are the target of both sides as a means of raising revenue and denying the opposition funds. The country descends into a period of anarchy in which almost all economic activity comes to a halt including oil production.

Oil facilities – production, pipelines, refineries and ports -- become inoperable as a result of damage and sabotage. Venezuela suffers a fate similar to Libya, where oil production sank close to zero at some points in 2015 and 2016. Oil prices would rise as Venezuelan barrels are lost to the market, adding a new stimulus to US shale drilling and a potential easing of OPEC output restrictions.

The timing of recovery would depend on the length of the conflict and the ultimate victors in the struggle, but a return to former levels of output would be a slow, sporadic, multi-year process. The ability to attract foreign investment would be undermined by security concerns and the unreliable financial and operational capacities of domestic partners.

Peaceful transition

A relatively peaceful and quick political transition would clearly be the best outcome for the Venezuelan people. This could come about by the replacement of president Nicolas Maduro and the holding of new elections to establish a government with public support. Achieving this is likely to require the cooperation of the military, which might accept regime change in return for protection from retribution and a continuance of military figures in positions of power.

Even in this more positive scenario, Venezuela would be bankrupt. A short-term solution could be full-scale dollarization of the economy in an attempt to bring inflation under control. The need to restore oil production, and thus government revenue, as well as the likelihood of a more right-leaning administration, would see the country’s oil patch opened to foreign investment.

The oil sector’s recovery could be relatively quick once social and economic stability is restored, but Venezuela would still have to pay its debts either in oil or money after a period of financial restructuring and multilateral support. Significant field rehabilitation would be necessary before production could return to pre-Maduro levels and recovery would be seriously impeded by the outflow of skilled personnel.

This scenario would have the least impact on the oil market in the short term. However, it is worth thinking of the long-term implications of a US-friendly Venezuela open to foreign oil investment. The country has the world’s largest crude reserves, measured at 303.2 billion barrels at the end 2017, although two-thirds is at the high end of the production cost spectrum. If a new government in Venezuela left OPEC, it would remove 18% of the world’s proved reserves from cartel control and open it to market forces.

Intervention

Such an important oil state cannot escape foreign machinations. US sanctions are one aspect of this reality, as are Chinese loans and Russian support.

Countries such as China, Russia and Iran will oppose direct foreign intervention in a sovereign state. They are likely to block UN-led action even in the case of further humanitarian disaster mainly because the US would be the obvious candidate to lead any effective intervention in this region.

The possibility of an outcome beneficial to the US may well prove a motivating factor behind further support for the Maduro government, in the form of aid, debt postponement or relief, even potentially military aid in the event of state failure. Foreign support in opposition to US interests could bolster a militarised dictatorship in Venezuela, with the country’s crude reserves controlled by proxy.

From the US perspective, ramping up the financial and economic pressure on the Maduro government in the hope of internal regime change is a risky option as there is no guarantee of a relatively peaceful transition. Washington will inevitably stand accused in some quarters of precipitating a crisis to justify its involvement if it intervenes. But if UN-action is blocked, this is a fate it may not escape in the event of sustained civil conflict.