Bargain-hunting investors are increasingly scouring the energy sector looking for stocks that might have been beaten down with the crowd, despite having significant medium term potential. One of the biggest bargains that stands to benefit as the energy sector eventually recovers is not in the energy sector at all.

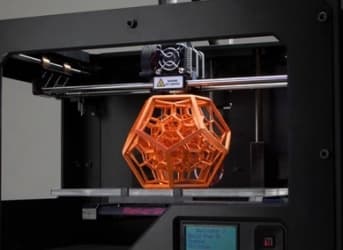

3D printing has been a hot technology area for several years now and the stocks in that space climbed to stratospheric valuations earlier this year and last year. Those valuations have cooled considerably now though, and investors looking for bargains that can benefit from a rebound in the energy sector should consider stocks like Stratasys, Ltd. (SSYS), Voxeljet AG (ADR) (VJET), ExOne Co (XONE), and most of all, 3D Systems (DDD).

The 3D printing sector has substantial potential to upend a lot of long standing practices in manufacturing. The technology has gone beyond hype now and is being widely used by many entities in many different applications, including the energy sector. Related: Better Times Ahead For Oil, If You Can Believe It

3D printing has the potential to change the energy sector across the board from how solar panels are made to how drilling rig parts are created. This type of change takes time though. And firms are less willing to try new technologies and new processes when they are fighting for their very survival; the current conditions in the oil and gas sector.

Earlier this year, Statasys (SSYS) and 3D Systems (DDD) both reported a slowdown in demand from industrial customers. This is a very lucrative market and it is likely that slowdown is related to on-going supply chain reorganization across the energy sector and the industrial sector firms that support it. Related: BP Refinery Outage Could Push Down Oil Prices

3D Systems and its peers have seen their stocks hammered as a result. From a stock price of more than $50 a year ago, DDD is now trading around $14, and its peers are in the same boat. Part of what is probably going on here is that DDD and its peers saw heady growth in recent years and so, like many fast growing industries, the 3D printing field spent too much time focused on acquisitions and growth and not enough time on efficiency and profitability. As a result, 3D Systems, for instance, will likely have more than $700 million in revenues this year against a market cap of roughly $1.5 billion.

Revenue growth remains substantial at the firm, coming in most recently at 13 percent year on year. Yet profits continue to be anemic on a generally accepted accounting principles (GAAP) basis. This is mostly because 3D and its peers have been spending money left and right on growth. This has led to significant inefficiencies, as 3D’s own management attested to recently. Related: Could This Be The Next Great Renewable Energy Source?

Now that hard times are here for the 3D printing industry, I expect a lot of those inefficiencies will get ironed out over the next year and capital allocation will become more disciplined. Most of the firms in the space have plenty of breathing room to make changes at least. 3D Systems, for example, has roughly $200 million in cash and no significant debt. That’s a recipe for a successful restructuring over time. Add to that the likelihood of an eventual energy sector rebound, and the stocks become very interesting for those looking at supply chain type investments.

The 3D printing stocks certainly carry some risk, and that includes DDD. But the benefit to these firms and this industry is that while they have exposure to the energy sector, they also have a broadly diversified business. Even if oil prices remain subdued, the firms are not going out of business and in the long-run they will all continue to grow strongly as manufacturing tech evolves. For a bargain hunter with an eye for safety, you can’t ask for much more than that.

By Michael McDonald of Oilprice.com

More Top Reads From Oilprice.com:

- A September To Remember?

- One Of The Hottest Commodities In Coming Years

- What’s Really At Stake With The Iran Nuclear Deal