September U.S. West Texas Intermediate crude oil futures oil is poised to finish the week about 2.40 percent lower with most of the week’s loss attributed to a steep one-day sell-off on Wednesday. The move was fueled by the escalating trade dispute between the United States and China. Traders fear that additional tariffs from China will lead to lower demand. Furthermore, investors are watching key domestic data from China for further indications of slowing demand.

Uncertainty over Iranian Sanctions

Helping to limit losses are worries that renewed U.S. sanctions against Iran will tighten supplies.

Bullish investors are holding out hope that the Iranian sanctions have not been fully priced into Brent, leaving room for a significant run-up in prices after November 1 when the full effect of the sanctions begin to take place.

Between now and then, the U.S. will use tactics to try to convince all nations to comply with its sanctions. With several major buyers of Iranian crude oil still not complying with the U.S. orders, there is still uncertainty as to how much oil will be removed from the market. Currently, analysts expect the drop-off in Iranian crude exports to range between 500,000 barrels per day (bpd) and 1.3 million bpd.

Fresh IEA Warnings

Besides the Iranian sanctions, which affect supply and the potential for lower demand, traders on Friday are also reacting to the latest monthly report from the International Energy Agency (IEA).

The…

September U.S. West Texas Intermediate crude oil futures oil is poised to finish the week about 2.40 percent lower with most of the week’s loss attributed to a steep one-day sell-off on Wednesday. The move was fueled by the escalating trade dispute between the United States and China. Traders fear that additional tariffs from China will lead to lower demand. Furthermore, investors are watching key domestic data from China for further indications of slowing demand.

Uncertainty over Iranian Sanctions

Helping to limit losses are worries that renewed U.S. sanctions against Iran will tighten supplies.

Bullish investors are holding out hope that the Iranian sanctions have not been fully priced into Brent, leaving room for a significant run-up in prices after November 1 when the full effect of the sanctions begin to take place.

Between now and then, the U.S. will use tactics to try to convince all nations to comply with its sanctions. With several major buyers of Iranian crude oil still not complying with the U.S. orders, there is still uncertainty as to how much oil will be removed from the market. Currently, analysts expect the drop-off in Iranian crude exports to range between 500,000 barrels per day (bpd) and 1.3 million bpd.

Fresh IEA Warnings

Besides the Iranian sanctions, which affect supply and the potential for lower demand, traders on Friday are also reacting to the latest monthly report from the International Energy Agency (IEA).

The IEA report said earlier today that the U.S. plan to impose targeted crude sanctions against Iran could significantly impact global supply and exhaust the world’s spare oil capacity cushion.

“As oil sanctions against Iran effect, perhaps in combination with production problems elsewhere, maintaining global supply might be very challenging and would come at the expense of maintaining an adequate spare capacity cushion,” the Paris-based organization said Friday.

“Thus, the market outlook could be far less calm at that point than it is today,” the IEA added.

The IEA also issued comments on trade tensions.

“Risks introduced by trade tensions have further increased, threatening to significantly reduce growth in some exporting countries,” the IEA said Friday.

“The threat of trade disruptions could recede as fast as they are mounting, however, it is difficult at this stage to make adjustments to our base case assumptions for the economy and oil demand,” the group added.

Key Fundamental Events

To recap this week’s events, on Tuesday, the U.S. renewed sanctions against Iran that are expected to eventually remove about 1 million barrels per day of crude oil from the market. This threatens supply. On Wednesday, China said it will impose tariffs of 25 percent on a further $16 billion in U.S. imports. Among the goods affected are crude oil and other petroleum products. This affects future demand.

In other news, the U.S. Energy Information Administration reported that crude inventories fell 1.4 million barrels in the week-ended August 3, less than half the 3.3 million-barrel draw analysts had expected. Gasoline stocks rose by 2.9 million barrels, compared with an estimate for a drop of 1.7 million-barrel drop.

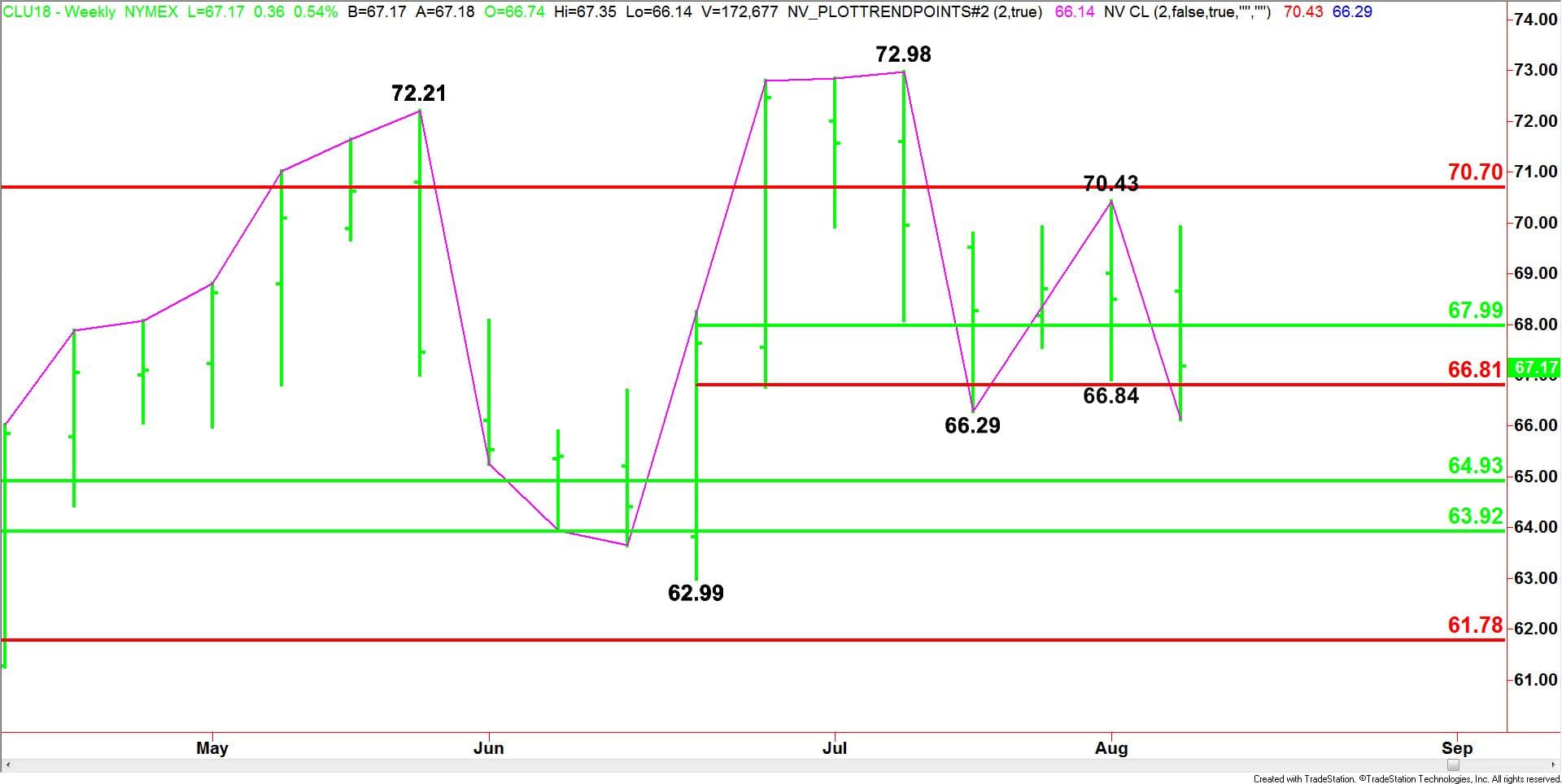

Weekly September WTI Crude Oil Technical Analysis

(Click to enlarge)

The price swings were pretty wild on the daily chart, but the weekly chart shows steady selling throughout the week.

The main trend is down according to the weekly swing chart. The trend turned down on Friday when sellers took out the swing bottom at $66.29. A trade through $70.43 will change the main trend to up.

The September WTI crude oil market remains inside the major long-term 50% to 61.8% retracement zone at $64.93 to $70.70.

The short-term range is $62.99 to $72.98. Its retracement zone $67.99 to $66.81 is controlling the near-term direction of the market.

A sustained move under $66.81 will indicate the presence of sellers. Taking out $66.29 with conviction will indicate the selling is getting stronger with downside targets coming in at $64.93, $63.92 and $62.99.

Holding above $66.81 will indicate the selling pressure is getting weaker. Crossing to the strong side of $67.99 will signal the buying is getting stronger. If this move generates enough upside momentum, we could see a surge into $70.43 to $70.70.

Conclusion

Over the short-run supply and demand is likely to balance, however, the warning from the IEA on Friday indicates there is not much room for error. Therefore, we’re likely to see a rangebound trade on both side of $67.99 to $66.81 unless there is a surprise event like a supply disruption.