At a certain point in its lifecycle, every industry faces its moment of reckoning with growing pressure to transform due to factors such as increasing competition, changing consumer preferences, government policy, and other secular headwinds. The transformation usually takes the shape of improved supply chain discipline as well as streamlining business operations in order to achieve better operating margins. For the oil and gas industry, the moment of truth has finally arrived.

Years of weak benchmark prices, shrinking margins and massive capital flight are forcing the sector to seriously rethink the way it does business, with energy companies increasingly turning toward tech heavyweights for help in cutting costs and streamlining operations.

A good case in point is last year's partnership between Haliburton Co. (NYSE:HAL), Microsoft Inc. (NASDAQ:MSFT), and Accenture Plc. (NYSE:ACN). For years, Haliburton, one of the world's largest oilfield services companies, has been plagued by shrinking margins and chronic underperformance.

Halliburton partnered with the cloud giants to migrate its existing data centers to the cloud and enhance digital offerings.

Big savings

Source: CNBC

After years of dilly-dallying, oil and gas companies are now rapidly moving their IT infrastructure out to the cloud as well as adopting Business Process Management (BPM) systems. This frequently results in a leaner, more agile organizational model whilst delivering significant cost savings.

Indeed, Barclays has reported that the last two years have seen a "dramatic shift" in partnership adoption, which the bank says are just "early signs of things to come."

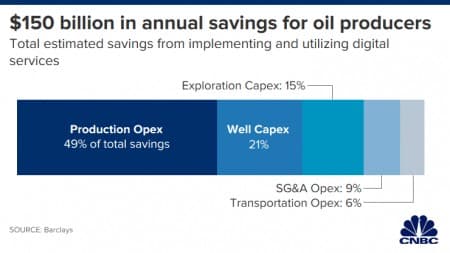

Barclays estimates that the upstream market digital services industry will grow from less than $5 billion in 2020 to more than $30 billion annually over the next five years, leading to $150 billion in annual savings for oil producers.

Related: The World Still Needs Hundreds Of Billions Of Barrels Of Oil|

Opportunities for cost savings include cutting capital expenditures (capex) as well as selling, general and administrative (SG&A) costs and transportation operating costs.

According to Barclays, the digital age is finally dawning for the energy sector, with the market poised to erupt over the next five years. In the last year alone, Microsoft struck cloud partnerships with several Big Oil companies such as ExxonMobil (NYSE:XOM), Chevron Inc. (NYSE:CVX), and Haliburton, while Google's parent company Alphabet Inc. (NASDAQ:GOOG) significantly expanded its partnership with Schlumberger Ltd. (NYSE:SLB), another oilfield services giant. Meanwhile, Amazon Inc. (NASDAQ:AMZN) offers digital services to the industry through Amazon Web Services oil and gas division, and counts BP Plc. (NYSE:BP) and Royal Ducth Shell (NYSE:RDS.A) among its top clients.

In many cases, Big Oil's digital makeover is quite extensive.

For instance, Halliburton kicked off multiple digital transformation projects during the pandemic.

Last year, Thailand's PTT Exploration and Production and Kuwait Oil Company were among the notable oil and gas companies that awarded Halliburton contracts to implement digital transformation and enhance efficiency and production at their oilfields.

Halliburton provides diverse production solutions in exploration, drilling, production software, and data management services to upstream oil companies through its Landmark Software and Services product line. Further, the company's Testing & Subsea and Project Management product line specializes in reservoir optimization and associated technologies.

New digital trend

For years, Big Oil has been using tech companies' enterprise software in their highly complex operating systems--including rig management operations and precise drilling techniques. However, they have traditionally been somewhat reluctant to hand over their treasure troves of valuable data mainly on cybersecurity concerns as well as the need to maintain competitive advantages, preferred instead to develop most of their software was developed in-house or by companies within the oilfield services sector such as Haliburton.

However, this is changing with low oil prices forcing them to look for ways to improve operational efficiencies in a bid to squeeze higher cash flows and profits from their existing operations.

Is the new approach working? The evidence seems to suggest so, with shale drilling costs on an encouraging downtrend. J.P. Morgan estimates that Permian's Delaware Basin oil drillers now require oil prices of just ~$33/bbl to break even down from $40/bbl in 2019. JPM says most U.S. onshore operators are economic at current oil prices, and many operators are even likely to ramp up activity in H2 and build solid momentum for higher volumes in 2022.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

- Forget OPEC Production Cuts, It’s Exports That Matter

- World’s Largest Lithium Producer: Get Ready For A Mega-Rally

- U.S. Oil Production Is About To Climb

Anyhow natural pricing held up "okay" this week but the USA continues to flood the World with food and energy product and in point of fact now "Transportation goods"(commercial vehicles, battery powered transit, Boeing's, Gulfstream Jets, even Space Launch now!) and for some time now "Transportation Services"(Uber, Lyft, Turo, etc.)