The U.S. export boom continues apace. And not only from crude exports, which clambered above 2 million barrels per day in recent weeks, but from the product piece of the pie too. Joining rising gasoline and distillate exports from the U.S. has been LPG. And not just propane or butane, but ethane as well - as our ClipperData illustrate below.

With the start up of Enterprise' Morgan's Point terminal on the Gulf Coast last year, as well as Sunoco's Marcus Hook terminal on the East Coast, ethane exports have gradually risen from averaging just under 30,000 bpd in Q3 of last year to nearly 140,000 bpd in Q3 just passed.

Ethane production in the U.S is expected to average ~1.45 million bpd this year, up from 1.25 million bpd last year. It is set to maintain its upward trajectory in the coming years, driven by higher domestic consumption (from the petrochemical industry) and increasing demand for exports.

Marcus Hook has export capacity of 35,000 bpd, while Morgan's Point has capacity of 200,000 bpd. The export trade is going so well that Enterprise is planning a second ethane export terminal on the Gulf Coast. India has been the leading destination for U.S. ethane exports this year, followed by the U.K., Norway and Sweden.

(Click to enlarge)

Propane exports have been on a similar upward trajectory. After averaging just shy of 600,000 bpd in 2015, they rose to 770,000 bpd in 2016, and are currently at 970,000 bpd for the first ten months of the year.

East Asia is the leading destination for U.S. propane, accounting for over 40 percent of exports, with Japan, South Korea and China being the top three recipients of U.S. propane globally. Mexico is fourth. U.S. propane exports have averaged above 1 million barrels per day in five out of ten months of this year.

(Click to enlarge)

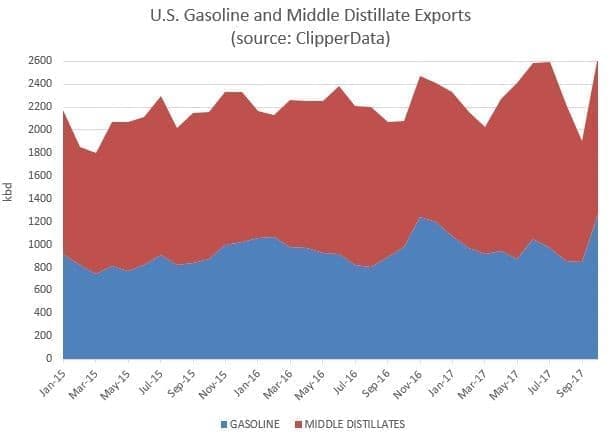

Gasoline and middle distillate exports join LPG in continuing to push higher. After a blip in September due to hurricane activity, exports of both are on the rise again, pushing to a new combined record. Even with the September blip, exports of the two have averaged over 2.3 million bpd this year, after 2.2 million bpd in 2016, 2.1 million bpd in 2015.

Related: Does The U.S. Lead The World In Carbon Emissions Reduction?

(Click to enlarge)

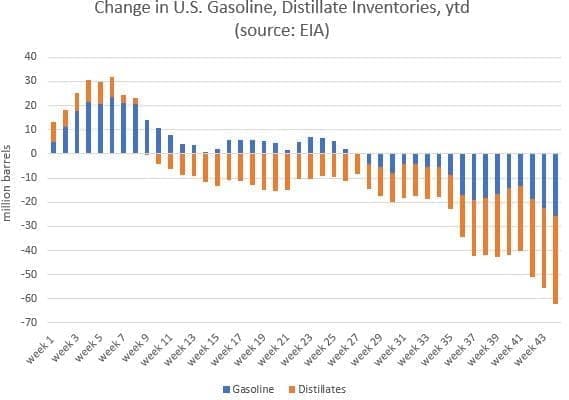

As domestic demand ticks higher along with exports, and as imports into the U.S. East Coast drop, total U.S. gasoline and distillate inventories are falling - despite a record year of refinery runs so far in 2017.

Gasoline inventories have fallen by 26 million barrels since the start of the year, dropping 11 percent, while distillate inventories have now dropped by 36 million barrels, down 22 percent. These two retracements make oil's inventory drop of 5 percent drop seem less significant in comparison.

(Click to enlarge)

By Matt Smith

More Top Reads From Oilprice.com:

- Oil Tycoons Make Billions In Saudi Purge

- Blockchain Isn’t the Only Tech Disrupting Global Energy

- The Kurdish Oil Gamble Has Backfired