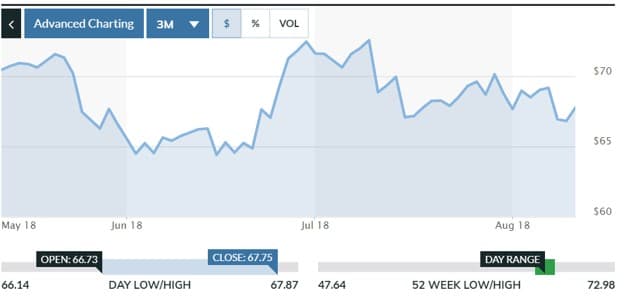

The last quarter has seen increased volatility in oil prices, an increase that I attribute to the growing tensions in international markets as fears of a global trade war intensify. The headlines seem to get starker by the day, and markets loathe this type of uncertainty.

(Click to enlarge)

The intent of this article is to provide some guidance as to where oil prices may be headed in the near term. I think there are some key drivers at play here and will discuss them in some detail in the rest of this article.

Supply and Demand

One of the reasons for the big energy depression that hit in mid-2014 was an oversupply caused by Saudi Arabia ramping up production to drive prices down. They had several goals in doing this as has been discussed in countless articles, but chief among them was the desire to take high cost barrels off the market. Their primary targets were the American frac machine in North America, and deepwater production that was grabbing an increasing share of big IOC dollars.

This worked fairly well over the short run, as energy producers outside Saudi were unprepared. For most of 2016, the frackers in America retooled their portfolios and improved practices, cutting average well costs down to where they were economic with $40-50-dollar oil. U.S. shale was back in business.

The deepwater business is still struggling to regain its momentum.

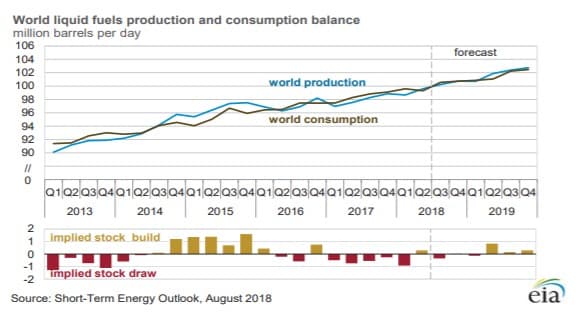

(Click to enlarge)

Demand is likely to increase for the foreseeable future though, with an average annual increase of about 1.6mm BOPD for the years covered in the Global Supply and Demand Chart above (2013-2018). The upward slope continues through 2019 at about the same rate of increase.

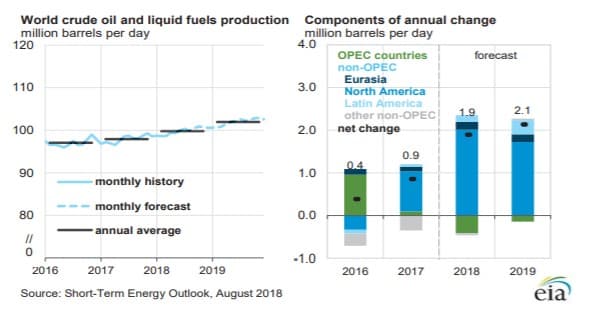

(Click to enlarge)

Figure-2

A field decline rate of about 4.5 percent a year is commonly used for existing oil production. If we apply that decline rate to current world production of ~100mm BOPD, you can see we need to find 4.5mm BOPD of new production just to stay even at today's consumption rate. But with demand set to increase, we will need still more production to break even.

As you can see in Figure-2, the EIA estimates that we have found roughly half of that amount so far in 2018, and its projection for 2019 is even less hopeful.

Related: Oil Prices Hit 7-Week Low As Trade War Heats Up

Now, only a fool tries to predict the future with any specificity, with specificity being the key word in this sentence. That said, and my 4th grade arithmetic being accurate, there is a day of reckoning out there for oil supplies at some point.

The Saudi Factor

The Saudis have always and will always be the swing producer for crude oil. The definition of swing producer includes the capacity to control pricing of a commodity through increased production, and the lowest incremental cost of production. That suits the Saudis to a “T”.

(Click to enlarge)

Over the short run, as shown in Figure-3, the Saudis simply cannot produce much more than they are now. The mythical reserve capacity of which they boast, remains just that. A myth. The Kingdom of Saudi Arabia (KSA) is maxed out.

They are responsive to their friends though, and when President Trump asked for more oil in late June, they obliged as you can see in the last upward run in Fig.3

But, the notion that they will be adding 2 million bpd to replace lost Iranian and Venezuelan production simply is not in the cards.

I hold the view that KSA is currently fairly happy with the supply/demand balance. At one time they weren’t happy due to an approximate $100 billion budget deficit from low oil prices (we can be forgiven for seeing a delicious irony in this outcome). This was a prime factor in the notion of selling off 5 percent of Aramco in an IPO, that was formally announced in early 2016. The fabled IPO is something that no one speaks about much anymore. Here’s why.

A few things happened on the way to the listing. First, they couldn’t find anyone who would certify just how much oil they had in reserve. That is anyone who came up with a number that matched their own. Worth noting: reserves estimation is a very complicated topic, the outcome of such an estimation is often driven by what the seeker wants the reserves to be. Getting people to agree with you is another matter entirely.

Second, they don't really need the dough anymore. Here's where it gets interesting. You may remember the corruption purge in Riyadh last year? You know the one where a bunch of very well off people were held captive by MBS, in the Riyadh Ritz-Carlton for a month or two? Take a look at the Ritz-Carlton in Riyadh sometime, if you are feeling excessively sorry for any of these folks. If you are going to be held captive some place, this is the place you want it to be.

The foundation for their estimation of ARAMCO's reserves and subsequent valuation of $2-Trillion, was the $100 billion deficit. They were going to put up 5 percent of the business which using their math turned out to be right at $100 billion. Imagine that.

To tie all of this together, a hundred billion is about the amount that various sources reported MBS having collected in the Purge.

This IPO exercise served as an abrupt education for MBS as to the vicissitudes of the transparency requirements of the public markets. Something he's never had to deal with as a private company. You hear less and less about this now that MBS has refilled his coffers courtesy of his well-heeled countrymen. The rise in oil prices over the last couple of years has also lessened the Saudis enthusiasm for the sale of even a tiny fraction of their national mainstay.

While the Saudis will of course pay lip-service to the American government about replacing lost barrels from Iran and Venezuela. The reality is they can't currently do much more than they are already doing.

Hence, in spite of acknowledging their 'swing producer' status, I don't see a big flood of Saudi crude changing the shortage dynamic building in the oil market.

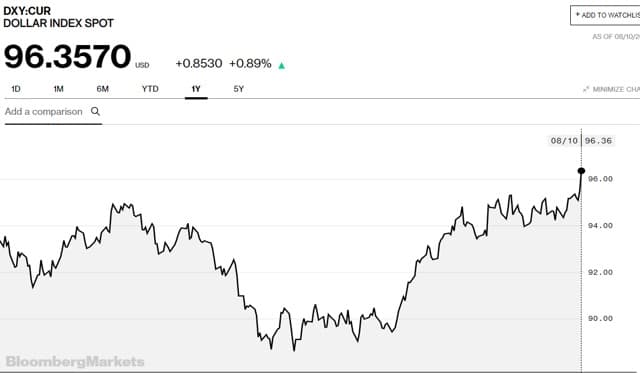

The Strong Dollar

Oil is priced in dollars, for good or ill. The USD is the reserve currency of the world, for good or ill. That is something that's not likely to change. Even folks who don't like us very much buy our bonds, and other government backed securities.

The USD has been ramping up in relation to the market basket of world currencies. There are a plethora of reasons for this, and we will touch on several of them. The real question is, where does it go from here?

(Click to enlarge)

The answer here is we'll have to see. There are both bullish, and bearish factors in play. Most of the key ones we have discussed so far. Exactly how this will play out is anybody’s guess.

Going back to Saudi Arabia for a moment, it is worth noting that they dislike the stronger dollar because it means they get less of them for each barrel of oil they produce.

Related: Global Oil Supply Could Become ‘’Very Challenging’’

My view is that the current trade skirmishes in international markets are inflating the value of the dollar and it will likely fall when these trade disagreements come to an end. This because of the dollar's reserve currency status. As world trade tensions decline, demand for dollars will ease and oil will go up in response!

I don't see the ‘trade wars’ going beyond the fall of this year. A real and lasting trade war would be like a nuclear Armageddon to the world economy. All bets are off in that scenario for all commodities. No one wants this. It is my firm conviction that there are deals to be made, and made they will be. We will know in a few months.

Long term (3-6 months) I think a weakening dollar will return to support oil prices in this general range. They of course could go higher. Much higher. Which will feel like good scotch trickling down your throat initially, but be destructive to demand if they persist. Anyone remember 2008 or 2014? It could happen again.

Capex for big projects

In spite of the oil prices nearly tripling from the 2016 lows, the big players just haven't invested money in the mega-project arena as of yet. The oil mix needs these long-cycle barrels as these wells tend to flow at many time the rate of the unconventional shale plays that are now soaking up the lion’s share of new capex dollars.

Intuitively we know long-cycle production must return. But, as the EIA supply graphs show, it is way past due if we are to have any hope of replacing barrels lost to the decline of fields currently on stream.

So, the good news is it will happen. But no one is calling for a meaningful return to higher capex levels for a year or two. And that is exactly why I believe there is a price super-spike in the offing. My guess is it’s a couple of years out, but I could be wrong both on the short and the long side.

Summary

We are living on borrowed time in the area of oil supply. The glut of mega-projects completed in the run up to 2014 is aging rapidly, and declines will start to be felt. There is a gap in the pipeline to replace these supplies that cannot be filled in the short run.

We seem to keep re-learning the same lessons. I may sit my young grandson down soon. He will be driving age in a couple of years. Perhaps by then I will have figured out a way to tell him about gas lines.

By David Messler for Oilprice.com

More Top Reads From Oilprice.com:

- Why Saudi Arabia Cut July Oil Production

- Is This The Most Important Geopolitical Deal Of 2018?

- Are The Saudis Involved In The Tesla Buyout Plan?

I was among the first world experts if not the very first who has been saying for the last eight months that Saudi Arabia will withdraw the IPO of Saudi Aramco altogether. I was proven right and the many analysts and experts who have been consistently saying it will go through were proven wrong.

My reasoning was based on three market realities. The first is risk of American litigation. Saudi investments in the United States could be at risk of litigation by the legislation passed by the US Senate and the US House of Representative in May 2016 that would allow families of 9/11 victims to sue the Saudi government for damages. The law removes the sovereign immunity, preventing lawsuits against countries whose citizens were found to be involved in the attacks. The minute one law case is launched by an American citizen against the Saudi government, all Saudi assets in the US will be frozen.

The second reason is that the Saudis valued the 5% of the IPO at $100 bn based on their claim of proven oil reserves of 266 billion barrels (bb). The Saudis are claiming 266 bb of proven reserves when my research and research by other outstanding experts have shown that their remaining reserves amount to no more than 74-80 bb. Based on this, the value of the IPO could be between $28-$30 bn. Furthermore, no investor will even consider buying into the IPO without an independent auditing of the Saudi reserves.

The third reason is that the Saudis no longer need the money from the sale of the IPO as improving oil prices have filled their coffers. Moreover, eliminating the remaining subsidies on water, gasoline and electricity could save them $80 bn while reaching a peaceful settlement in Yemen will also save them $72 bn annually being the cost of the war.

The current fundamentals of the global economy are positive enough to support oil prices above $80 a barrel this year. My projection is that oil prices will go higher than $80 before the end of this year based on a global economy growing at 3.9% this year and next compared with 3.4% last year, a global oil demand growing by 1.5 mbd over last year and rising Chinese oil imports projected to top 10 mbd this year. All these factors are being slightly aided by geopolitical concerns.

Saudi Arabia has been living a lie in relation to its claims about its proven reserves, production capacity and spare capacity. As mentioned before, Saudi remaining proven reserves could not be more than 74-80 bn and even this is on the high side. Their claim that they could produce 12.5 mbd when in needed would not stand scrutiny. Their oil production peaked in 2005 at 9.6 mbd and has been in decline since then. Out of the 10.4 mbd they claim they are producing now, 1 mbd is not actual production but oil withdrawn from their stored oil on tankers and on land. Their claim of a spare capacity of 2 mbd is also not true.

A rising value of the dollar decelerates global oil demand because it makes oil more expensive in other currencies. The US has for years used alternations in the value of the dollar to manipulate oil prices.

The world could be heading towards a global oil supply gap by 2020 resulting from a drought of investment since the 2014 oil price crash. The global oil market needs 15 mbd by 2020 to meet global demand and also to offset a 5% annual depletion rate almost equivalent to Iraq’s current oil production.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London

However, I take issue with MGS's statements regarding SA reserves. No doubt there was a "reserve war" when reserves determined production quotas in the 1970's and 1980's. But the apocalyptic predictions of Matt Simmons and others have been thoroughly debunked (anybody seen Charlie Maxwll and his Peak Oil $300 price on WALL STREET WEEK or CNBC anytime lately ?).

Saudi Arabia is producing more oil today than in 2005 so I don't know what MGS is referring to. Production levels don't include tanker withdrawls. Chart 3 above shows 10.5 mmboe/d. And their reserves might be less than 250 billion barrels, but no way is it in Kuwait territory of 70 billion.

In 1974, SA talked about producing 20 mmboe/d by 1980 (the market didn't need it). I am sure they can produce 12.5 mmboe/d in a few years with the required CAPX. Just look at Iraq, producing 3x the levels of the early-2000's and nearly double the levels under Saddam when things were stable.