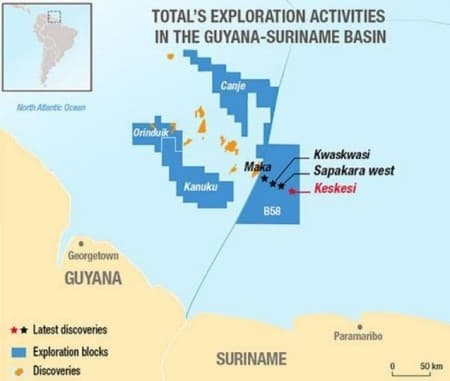

What is fast becoming the world’s hottest offshore oil play, the Guyana-Suriname Basin, has entered the headlines once again. Hot on the heels of ExxonMobil and its partner Malaysian state-controlled oil company Petronas announcing a significant oil discovery in Block 52 offshore Suriname, Apache revealed its fourth consecutive discovery in the basin. Apache and partner French integrated energy major Total announced today they have discovered crude oil at the Keskesi East-1 Block 58 offshore Suriname, confirming the presence of petroleum in the eastern portion of the 1.44 million-acre block.

According to Apache the crude oil at the Cretaceous-aged Campanian and Santonian intervals had an API gravity of 27 to 28 degrees and 35 to 37 degrees respectively. That corresponds to the quality of the three earlier discoveries made in Block 58 during 2020. Apache transferred operatorship of Block 58 to Total at the start of January 2021.

Related: The Oil Industry Is In Dire Need Of Investment

Apache and Total have enjoyed considerable exploration success in Block 58 offshore Suriname and there are signs of further oil discoveries ahead. Block 58 borders Exxon’s prolific Stabroek Block in neighboring offshore Guyana where the international oil supermajor made 18 discoveries since 2015 and estimates that there are recoverable oil resources in excess of 8 billion barrels.

Source: Apache Investor Relations.

The frequency of medium and light grade oil discoveries in the block indicates it has tremendous potential which could see Apache and Total enjoy the considerable success experienced by Exxon, Hess, and CNOOC in the Stabroek block.

In 2000, the United States Geological Survey determined that the Guyana-Suriname Basin held mean undiscovered oil resources of 15 billion barrels along with 42 trillion cubic feet of natural gas. The scale and volume of Exxon’s discoveries in the Stabroek Block saw the USGS announce in late-2019 that it intended to reassess the Guyana-Suriname Basin. There is every likelihood, according to the U.S. government body, that its estimates would increase because of the world-class oil discoveries made by Exxon in the Stabroek Block since May 2015. That review has been delayed by the COVID-19 pandemic but further underscores the considerable petroleum potential of the Guyana-Suriname Basin and the exploration upside which exists for Apache and Total.

Related: Saudi Arabia Starts New Bull Run In Middle East Oil

In September 2020, Apache named Suriname as a clear priority, even if West Texas Intermediate falls below $30 per barrel. Apache and partner Total plan to extend their exploration program into the north of Block 58 during 2021. By changing operatorship to Total, it is possible to tap into the French supermajor’s considerable deepwater drilling expertise further boosting the potential of additional oil discoveries in Block 58.

Exxon’s success in the Stabroek block coupled with a low breakeven price of $35 per barrel produced, which is expected to fall lower, is attracting the attention of offshore drillers to the Guyana-Suriname Basin. It was estimated by industry consultancy Rystad that offshore Guyana will attract at least $10 billion of investment between the start of 2020 and the end of 2022. The attractiveness of offshore Guyana is underscored by a low breakeven price of $35 per barrel for phase one of Exxon’s Liza oilfield. That price is expected to fall, dropping to $25 a barrel for Liza phase two, and even lower as further infrastructure, efficiencies, and improved drilling technology are established. The shared geological structure with offshore Suriname indicates that as projects are developed, they will have similar breakeven prices.

In November late-2020, Rystad announced that Suriname was among the world’s leading locations for oil discoveries that year with 1.39 billion barrels of oil equivalent found by the end of October 2020. Apache and Total’s three Block 58 oil discoveries were estimated to have net recoverable oil resources of 700 million barrels of oil equivalent. When those developments are considered along with Apache and Total’s success in Block 58 it is likely that offshore drillers will ramp-up investment in offshore Suriname. The former Dutch colony possesses considerable petroleum potential. Suriname is well-placed to replicate the burgeoning boom underway in neighboring Guyana, which will give that country’s economy a substantial boost. This is recognized by President Chan Santokhi’s administration with the national oil company and industry regulator Staatsolie launching the 2020/2021 shallow offshore bid round in November last year. That sees eight shallow-water offshore blocks comprised a total of over 13,524 square kilometers, located to the south of Block 58, on offer with bids due by 30 April 2021.

By Matthew Smith for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Bulls Are Back

- Asian Buyers Rush To Secure North Sea Oil After Saudi Surprise Cut

- Oil, Gas Rigs Increase For Seventh Straight Week