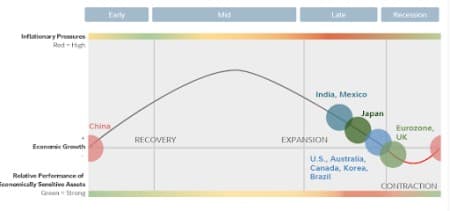

Historically, different market sectors and investments have responded differently as the economy moves from one stage of the business cycle to the next. Understanding how various

financial assets have historically performed at various points in the business cycle can help investors identify opportunities and risks and adjust their portfolios accordingly.

Shifts from one phase of the business cycle to the next have historically taken place every few months or years on average. With the global monetary tightening cycle almost over, many major economies, including the U.S., have advanced into the late stage of the business cycle.

According to Fidelity Investments, technology, financials, and consumer discretionary sectors tend to outperform during the early and mid-stages of the business cycle while energy and commodity stocks tend to be late-stage winners.

Well, the U.S. stock market appears to be largely playing out along those lines, with tech lagging while oil and gas stocks have emerged as some of this year’s best performers.

The energy sector has managed to post a 17.1% return in the year-to-date, the second highest sector return and nearly double the 9.1% return by the S&P 500 and 7.1% gain by the tech sector.

Source: Fidelity Investments

Interestingly, not even a red-hot labor market and diminished prospects for interest rate cuts have slowed the energy sector. Last week, energy and communication were the only sectors to finish in the green while the S&P 500 dropped nearly a percentage point, its biggest weekly loss so far in 2024, following a healthy jobs report. A report released by the Bureau of Labor Statistics revealed that the country added 303,000 new jobs in March, way higher than the 205,000 consensus call among economists surveyed by FactSet or 231,000 jobs added in March 2023. The unemployment rate slipped to 3.8% from 3.9%, marking the 26th consecutive month unemployment has remained below 4%, the longest streak since the 1960s. Related: Iran Examines Options To Widen Israel-Hamas War After Strike on its Consulate

The markets, however, reacted negatively to the solid jobs report because it’s likely to make the U.S. Federal Reserve even more hesitant to be urgent or aggressive with interest rate cuts. Indeed, some economists now say recent data has pushed a summer cut completely off the table while others are saying to expect zero cuts in 2024.

“Personally, I wouldn’t be surprised if we saw less rate cuts and pushed more towards the end of the year. This is a strong economy. Make no mistake, it is backed by debt and somewhat by overburdened credit cards, but it is a strong economy. So the Fed will struggle to find the case to cut rates soon,” George Lagarias, chief economist at Mazars, told CNBC on Monday.

According to the CME’s FedWatch tool, the market is pricing a less than 50% probability of a rate cut in June and July, significantly lower than a month ago. Whereas high interest rates tend to hurt many sectors of the economy, clean energy companies are much more sensitive to interest rates than oil and gas companies. It’s the reason why the iShares Global Clean Energy ETF (ICLN) has returned -11.2% vs. 17.0% YTD gain by the Energy Select Sector SPDR Fund (XLE).

Robust Fundamentals

Another interesting development: even the bears now recognize the energy sector’s momentum. To wit, Morgan Stanley remains pessimistic about the U.S. stock market overall; however, MS has upgraded energy stocks to overweight from neutral, noting that energy companies have lagged the performance of oil, and the sector remains favorably valued. With a PE ratio of 13.4, the U.S. energy sector is the cheapest of the 11 market sectors.

However, the most important catalyst working in favor of the energy sector is robust market fundamentals. Commodity analysts at Standard Chartered have reported that fundamentals in the oil markets remain strong and can support Brent prices in the $90s. According to StanChart, there’s ample room for OPEC to increase output in Q3 without either causing inventories to rise or prices to weaken.

According to StanChart, the U.S. market swung into a deficit of over 1.7 mb/d in both February and March, with the seasonal recovery in demand offsetting the recovery in U.S. output from its January low. The analysts estimate there was a counter-seasonal Q1 inventory draw of 1.12 mb/d, which led to a significant tightening compared with the inventory build recorded in Q1-2023. StanChart attributes the ongoing oil price rally to the 3 mb/d relative improvement from Q1-2023, and sees further price gains coming in Q2-2024.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

- Top Coal Province in China to Curb Output for First Time in Years

- Saudi Arabia Hikes Oil Prices in Increasingly Tight Market

- StanChart: Oil Demand Set for All-Time High in May