“Everything should be made as simple as possible, but not simpler.”--Albert Einstein

When trying to predict gold prices, investors usually look at one or several drivers: interest rates, U.S. dollar fluctuations, above-ground gold stocks, equities, bonds, commodity prices and even debt levels. But on their own, how reliable is each for predicting either short-or-long-term medium gold price movements?

For instance, you have probably heard that gold bears an inverse correlation to interest rates. The logic here is simple enough: Investors shift their money from non-interest yielding assets like gold to high-yield assets like bonds and stocks when interest rates are climbing.

Yet, there are long periods when gold has moved up in tandem with rising interest rates and vice-versa, suggesting there's something else at play here.

The Correlation Between Gold and Oil

The relationship between gold and oil is probably not understood by investors as well as, say, that between the yellow metal and interest rates or the dollar. Regardless, oil is an important predictor of gold movements. Gold can be considered a commodity because, just like oil and other metals, it's mined from the ground; it's standardized and interchangeable.

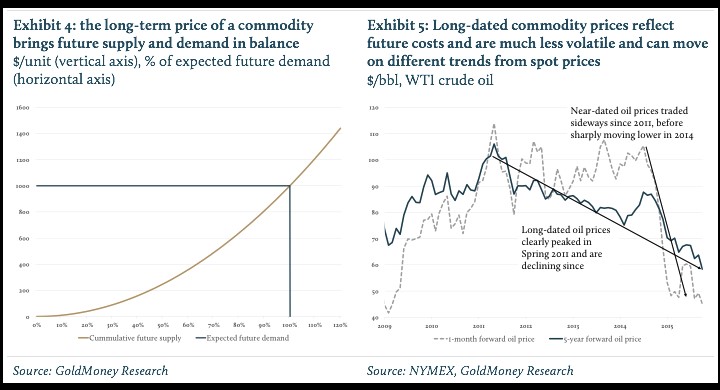

Oil prices play a part in determining the price of gold as well as gold-backed ETFs. Long-time crude price is more stable and reliable when predicting gold prices than spot prices. Longer-dated oil prices peaked in 2011 and have been on a sharp decline ever since, and so has gold.

(Click to enlarge)

Source: GoldMoney

(Click to enlarge)

Source: Market Realist

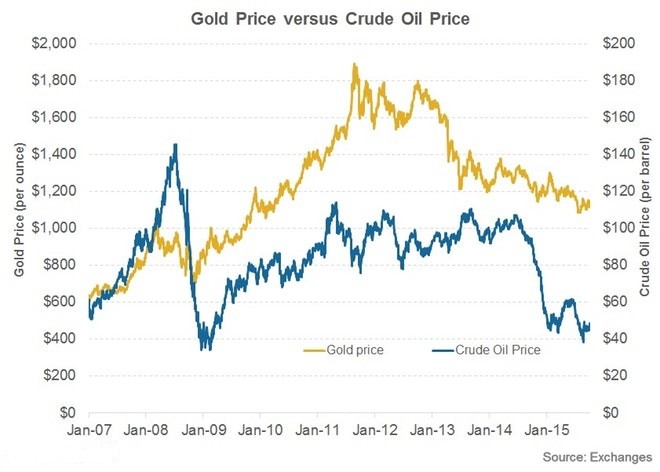

Crude oil prices can be used as a pretty good proxy of gold price movements since the two have a strong direct relationship. Over the long-term, gold prices tend to move up and down in tandem with crude oil prices.

A More Refined Energy Model

Modelling gold prices just like a commodity is, however, not a very accurate approach because unlike commodities, gold is not consumed per se. In a typical year, electronics consume less than 10 percent of gold produced, much of which is later recycled. All other common gold uses-- jewelry, demand by central banks and gold ETFs and consumer demand for gold bars and coins-- are forms of gold inventories.

Related: Court: Petrobras Strike Is Illegal

Above-ground gold inventories are not a major driver of gold prices.

Gold Money Inc. has developed a new model that can be used to explain the majority of gold price movements based on a combination of three drivers:

• Real interest rate expectations

• Central bank policy

• Fluctuations in long-term energy prices

Real interest rates impact gold mine supply in an inverse manner.

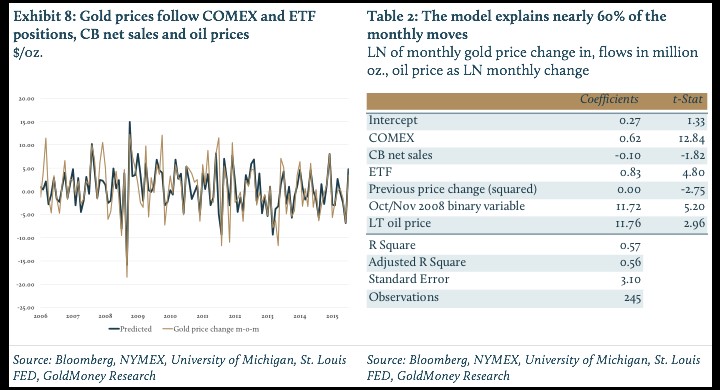

Investors react to real interest rate expectations using COMEX (gold and commodity market) and ETFs. Specifically, the gold trader says net positioning of non-commercial traders is a key driver of gold prices. Gold ETF holdings have a direct relationship with gold prices with 1 million oz. of sale / purchase by ETFs impacting prices by about 0.83 percent.

Changes in central bank holdings impact gold prices depending on whether they are net buyers or net sellers.

Finally, changes in long-term oil prices (3-year forward price for WTI crude oil) bear a direct relationship with gold price movements. This finding is backed by the fact that energy is the dominant production cost for gold. Related: The Biggest Challenge For U.S. Oil Exports

The three factors combined can be used to explain 60 percent of monthly gold price movements.

(Click to enlarge)

Source: GoldMoney

Ultimately, the relationship between gold and energy prices is indisputable as energy costs feed directly through gold prices.

By Alex Kimani for Safehaven.com

More Top Reads From Oilprice.com:

- Goldman: The Oil Price Rally Isn’t Over Yet

- U.S. Oil Companies Look To Skirt Biofuel Quotas

- The Iran Indicator Oil Markets Are Ignoring