In my commentary for Oilprice.com in April, when OPEC+ surprised the markets with production cuts, I maintained that many were misinterpreting the development, as it will not result in higher oil prices due to falling demand—a tacit confession by OPEC+ and its de facto leader, Saudi Arabia.

Moreover, the recent announcement of OPEC+ to cut 1 million barrels a day in July also failed to push oil prices higher, indicating underlying weakness in the global economy.

Today, with Saudi Arabia having pledged to extend its latest cut into July, there are reasons to expect a further decline in oil prices. A combination of global economic indicators, well-supplied oil markets, and the resurgence of the trade war can all be read as bearish for oil markets going forward.

Global Economic Indicators

When examining global economic indicators, it becomes apparent that most of them are either in decline or headed in a downward direction.

Source: Monday Macro View, Primary Vision Network

Europe recently entered a recession, with Germany—the economic powerhouse of the Eurozone—showing signs of a worsening industrial recession. The Ifo Business Climate index fell to 88.5 in June from 91.5 in May, and the country's PMI dropped to 40 from 41.

China, the world's second-largest economy, has also been posting disappointing data, with manufacturing PMI falling to 48.2 in April. Additionally, China's Caixin/S&P Global manufacturing PMI dropped from 50.9 in May to 50.5 in June, reaching an eight-month low in business confidence.

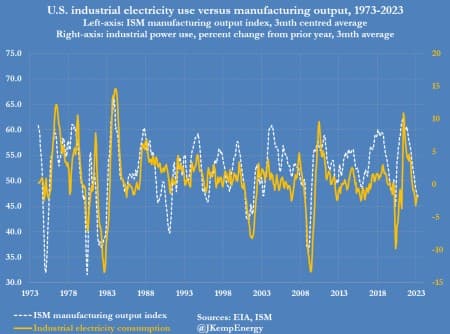

In the United States, the largest economy globally, manufacturing activity has contracted, as indicated by the ISM manufacturing index falling to 46 in June from 46.9 in May. John Kemp, writing for Reuters, highlights that distillates consumption for domestic consumers decreased by 1% compared to 2022, while industrial electricity fell by 1.9%.

Oil Supply

Oil markets appear to be well supplied, as highlighted by Natasha Adams of Vortexa.

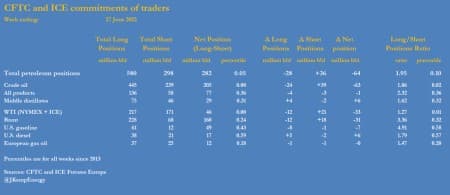

The positioning data from ICE and CFTC indicates considerable bearishness, with hedge fund managers selling the equivalent of 64 million barrels.

Mark Rossano, CEO of C6 Capital Holdings and Senior Analyst at Primary Vision Network, supports this notion, stating that there is a record amount of crude oil on water, with floating storage at seasonal highs and more crude entering the market. Additionally, Nigeria is facing a glut of unsold oil.

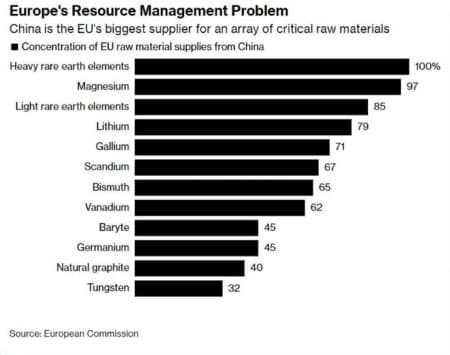

Return of Trade War

The US-China rivalry has resurfaced, posing a significant risk to global economic growth. China's recent restrictions on the export of Gallium and Germanium, metals used in various industries, indicate an intensification of the tech war. The trade war has persisted in the background, with the US adding more companies to the entity list.

The Biden administration is considering retaliation, contemplating restrictions on Chinese access to cloud computing. These ongoing trade tensions contribute to the bearish sentiment in oil markets.

Taking into account factors such as the introduction of Iranian and Venezuelan crude into the markets, continued Russian STS activity, and the aforementioned factors, it can be assumed that oil markets will remain bearish until the global economy starts to recover or undergoes a correction, such as a recession.

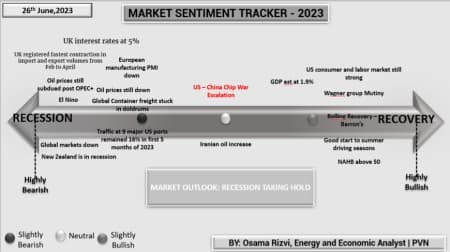

The Market Sentiment Tracker 2023, developed to monitor the overall direction of global markets, continues to lean towards the recessionary cycle.

Considering these factors, the writer believes that oil prices will likely touch the lower 60s before the end of 2023.

By Osama Rizvi for Oilprice.com

More Top Reads From Oilprice.com:

- U.S. Navy Stopped Iran From Seizing Oil Tankers Near Strait Of Hormuz

- Trans Mountain Pipeline Unlikely To Ship Canadian Oil To Asia

- Russia’s Oil And Gas Revenues Drop In June

Weakness in oil prices has nothing to do with market fundamentals and global oil demand as they are robust enough or China’s economy since it is the fastest growing economy among the major economies of the world projected to grow this year at 5.2%-6.5% compared with the United States’ and the EU’s growing at 1.2% and 0.8% respectively.

So the author should avoid falling into the trap of Western disinformation and media claims trying to pin the blame for weak prices on a slowdown of China’s economy when the blame should be laid fairly and squarely on US banking difficulties. Nor should he believe claims that that the global oil market is oversupplied. The market is balanced.

Even a trade war between China and the United States will have very little impact on the global oil market. The first reason is because China has been finding more markets for its exports in the Asia-Pacific region away from the United States and the EU exactly as Russia has very successfully shifted its entire energy exports from West to East. The second reason is that the BRICS group, the Shanghai Cooperation Organization (SCO) and the ASEAN are the new markets for China’s exports. Then there is China’s Belt & Road Initiative (BRI) deepening the integration of its economy in the global trade system and expanding markets for its exports.

China leads the Asia-Pacific region comprising the vibrant and the fastest-growing half of the global economy accounting for 51% of global GDP and the lowest inflation in the world compared with the other half including the United States and the EU burdened by anaemic economic growth and high inflation rate.

Once fears of a global banking crisis disappear have disappeared from the market altogether, prices will waste no time recouping their losses and resuming their surge with Brent crude hitting $90-$100 a barrel before the end of this year.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert