New year, same strategy to move metal.

Tesla is reportedly slashing prices across Europe, following similar moves the company made in China and also continuing the strategy the company used successful throughout 2023 to stoke demand at the cost of margins.

Multiple sources, citing Tesla's website, reported on Wednesday morning that Tesla has reduced prices for two variants of its Model Y in Germany by 5,000 euros ($5,439). The Performance version of the Model Y is now available to German buyers at EUR55,990, and the Long Range version is priced at EUR49,990.

Additionally, Tesla has decreased the price of the basic Model Y model by EUR1,900, bringing it to EUR42,990.

As the Wall Street Journal noted Wednesday, this sent the price of other European automaker stocks like Volkswagen, Stellantis and BMW falling by between 1% and 2%. Daiwa Capital Markets analyst Kelvin Lau said in a note that the price cuts are hurting sentiment in the industry and that lackluster sales in China to start 2024 helped fuel the sell off.

Although Tesla did not specify a reason for the recent price reductions, the company faced challenges in Germany in 2023, Yahoo Finance/Reuters reported.

For example, new registrations of Tesla vehicles fell by 9%, totaling 63,685, in contrast to an 11.4% rise in overall electric vehicle sales in Germany, as reported by the German federal motor authority KBA.

Consequently, Tesla was surpassed by Volkswagen as the leading electric vehicle seller in Germany, with Volkswagen capturing 13.5% of the market share compared to Tesla's 12.1%.

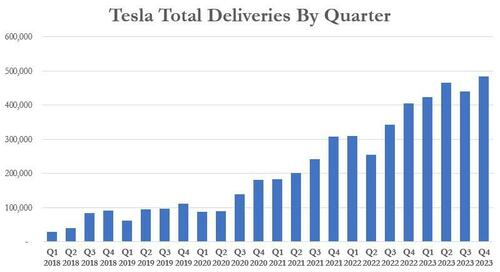

And as we noted earlier this month, competition globally and in China is ramping up as well: BYD has surpassed Tesla in full electric vehicle deliveries for the first time ever in Q1 2024.

The company said it produced more than 3 million new energy vehicles for the year and it marks the second year that BYD has beat out Tesla in total production. BYD produced 1.6 million battery only vehicles, just slightly behind Tesla, and 1.4 million hybrids.

We wrote back in September that BYD and Tesla were the two companies neck and neck leading the EV industry. We noted then that for the first half of 2023, BYD alone sold almost 1.2 million plug-in electric vehicles (incl. plug-in hybrids), roughly double the combined total of BMW, Volkswagen and Mercedes.

By Zerohedge.com

More Top Reads From Oilprice.com:

- Navy SEALs Seize Vessel with Iranian Missile Parts Bound for Houthis

- Is the Texas Grid Ready for This Year’s Polar Vortex?

- Top Oil and Financial Firms Made $424 Billion in Windfall Profits in Two Years