The US economy is rapidly deteriorating and currently experiencing a growth rate cycle downturn in employment, industrials, and inflation. One reason for the slowdown could be due to the oil and gas industry.

Reuters reports oil and gas employment has declined as producers and service firms quickly cut back on operations due to a sharp decline in spot prices since 4Q18.

Mining support activity jobs, a category that includes oil and gas drilling, as well as site preparation and well completion services, have been trending lower since Oct. 2018.

The latest figures from the Bureau of Labor Statistics (BLS) show Aug. employment fell 2% YoY, and down 4% from the peak.

About 11,000 oil and gas jobs have been slashed from the prior year. These jobs were mostly in the "oil and gas support activities."

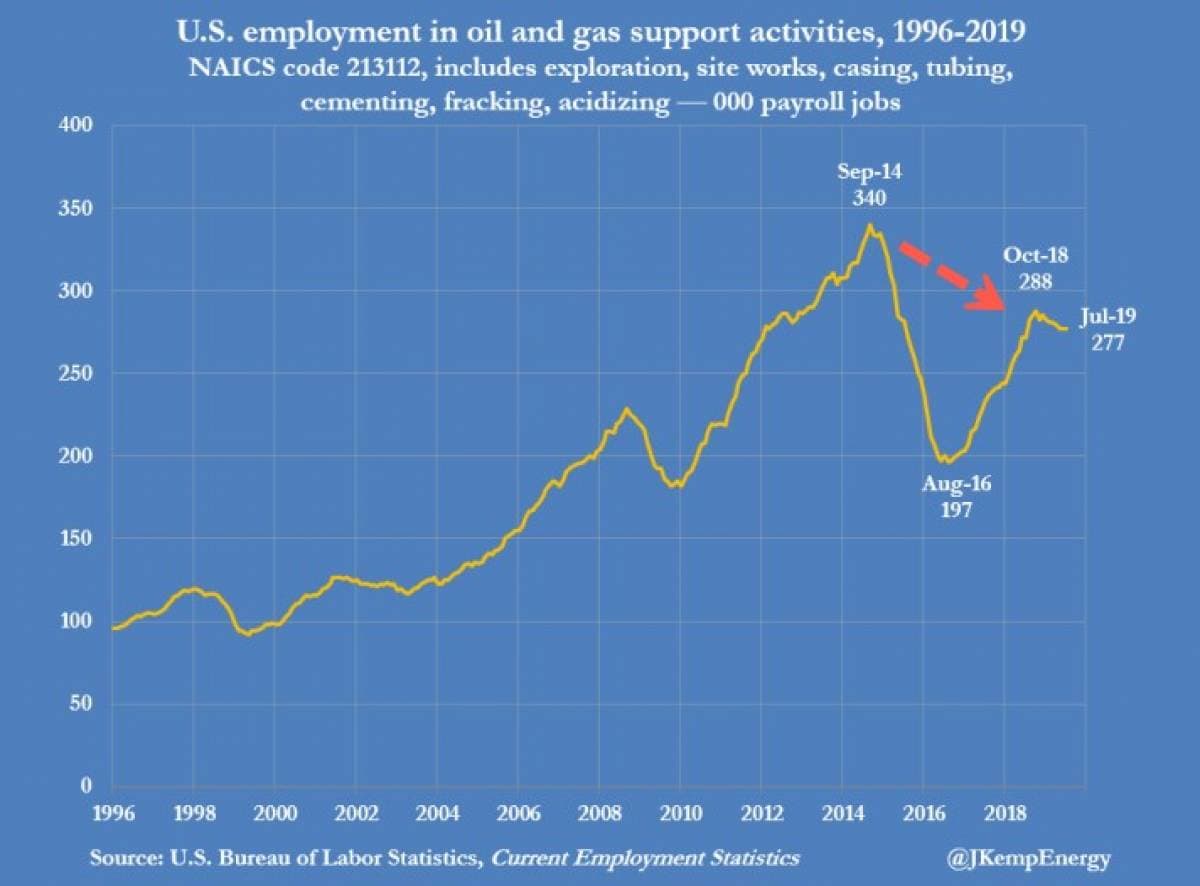

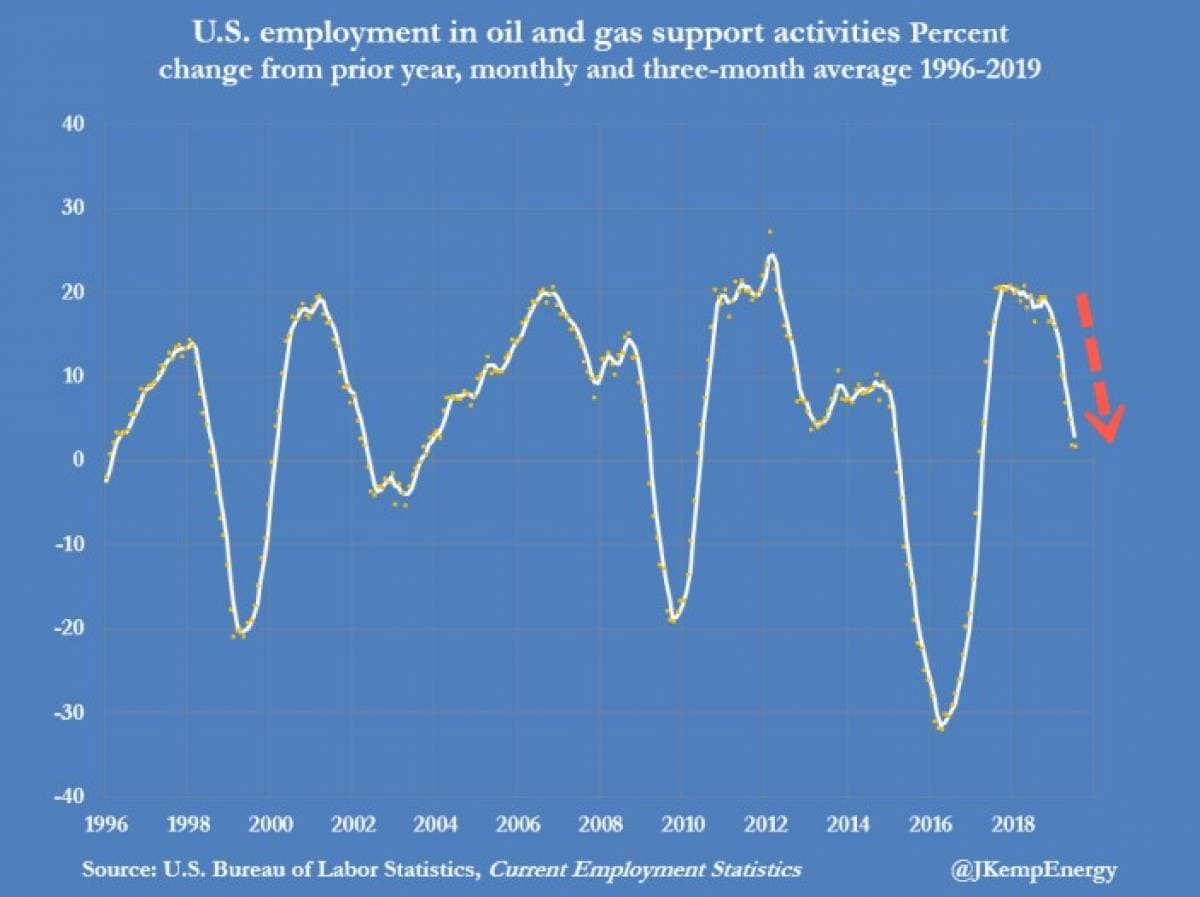

As shown in a series of charts provided by John Kemp, senior market analyst of commodities at Reuters, the shale boom is cooling, and weakness will persist through 2020.

The first chart shows US employment in mining activities, peaked on Oct. 2018 and has been trending lower ever since.

The percentage change of US employment in mining activities on a monthly and 3-month average shows negative growth in employment is imminent.

Diving deeper into the employment story, US employment in oil and gas support activities, which includes site work, casing, tubing, cementing, fracking, and acidizing appear to have stalled as well.

Growth rates from the prior year on a monthly and three-month average show support activity jobs have rapidly declined since the summer of 2018.

And maybe the decline in oil and gas jobs is due to the plunge in the number of drilling rigs, which also started falling in late 2018.

Meanwhile, US crude production has hit record levels with more than 1.2 million barrels per day (bpd).

Crude production percent change from the prior year, monthly and three-month averages tell a different story, one where the growth in production is slowing.

Kemp shows another chart where he expects the growth in oil production to continue falling through 2020, a reflection of a slowing economy and depressed spot prices for crude.

Crude prices have remained depressed for 49-weeks, and since it usually takes 3 to 4 months of declining prices to translate into a drop in rig counts, it's likely that more rigs will be brought offline through 2H19. This will ultimately slow employment in the industry and could be disastrous for President Trump in the 2020 election year, who routinely touts the oil patch as his economic success.

By Zerohedge.com

More Top Reads from Oilprice.com:

- IHS Markit: US Natural Gas Prices To Fall To 50-Year Low

- The US Massively Underestimates The Trade War Blowback

- European Carmakers Face Perfect Storm