After a two-year hiatus, deal-making in the U.S. shale patch has hit high gear with the U.S. energy sector leveraging high stock prices to go on a $250 billion buying spree in 2023. Last quarter alone, U.S. oil majors Exxon Mobil Corp. (NYSE:XOM), Chevron Corp. (NYSE:CVX) and Occidental Petroleum (NYSE:OXY) struck deals worth a combined $125 billion to acquire low-cost oilfields with low breakeven oil price. And, activity is not slowing down in the current year. A couple of weeks ago, Midland, Tex.-based Diamondback Energy, Inc. (NASDAQ:FANG) agreed to buy Permian producer Endeavor Energy Resources in a cash and stock deal valued at $26 billion, an ambitious move for a company with a market cap of $32 billion.

Unfortunately, a pivotal energy industry has been conspicuously missing in the M&A boom: U.S. refining. Virtually no refinery deals have closed ever since independent refiner Par Pacific completed its $310 million acquisition of Exxon Mobil's Billings, Montana, plant in June last year. That price came in at the lower end of expectations with industry insiders estimating the oil major might get twice as much for the 63,000 barrels per day (bpd) plant. The refining sector is missing out despite the presence of plenty of willing sellers mainly due to widespread fears that the energy transition away from fossil fuels will leave many aging refineries as stranded assets.

Distressed Industry

Things are getting quite dire for the beleaguered industry. Shell Plc. (NYSE:SHEL) has been forced to close its 240,000-bpd Convent, Louisiana, refinery, after failing to find a buyer. Delta Airlines has so far had no takers for its 100-year old, 190,000-bpd Trainer, Pennsylvania, refinery despite placing it in the market six years ago. LyondellBasell Industries' (NYSE:LYB) 260,000-bpd Houston refinery is scheduled to close in 2025 after two failed attempts to sell. To aggravate matters, these companies are really struggling with high costs of maintenance for their aging plants leading to increasing breakdowns. Last year, giant refiners Valero Energy Corp. (NYSE:VLO), Marathon Petroleum (NYSE:MPC), and Phillips 66 (NYSE:PSX) together had the equivalent of 280,000 bpd of capacity offline due to planned and unplanned outages, a more than 20% jump from 2019. According to company filings, Phillips 66 spent $786 million on maintenance in 2023 alone. Meanwhile, LyondellBasell estimates its plant requires at least $1 billion in upgrades to continue operations. Related: The U.S. Has Slashed Carbon Emissions by 879 Million Metric Tons

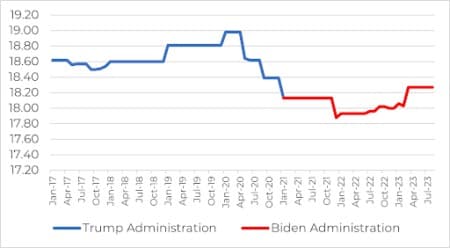

Overall, the U.S. refining industry is in bad shape. The U.S. refines nearly one-fifth of global crude oil, accounting for 18.1 million barrels per day (bdp). The country’s refining capacity surged during the shale boom, peaking at 18.97 million bpd in early 2020. Unfortunately, over the last three years, the U.S. has lost six operable petroleum refineries, with refining capacity falling to 18.27 million bpd as of August 2023. A lot of the damage came during the pandemic with low fuel demand leading to multiple plant closures. Unfortunately, high maintenance costs as well as a government that is not too keen on fossil fuels have hampered recovery in the post-pandemic period.

U.S. Operable Crude Oil Distillation Capacity (Million Barrels per Calendar Day)

Source: America First Policy Institute

But the Biden administration is not solely to blame. After a brief surge of its fossil fuel sector following Russia’s invasion of Ukraine, the energy transition in Europe is back on track with falling demand posing a long-term risk to U.S. refineries. McKinsey estimates that as much as 41% of refining capacity in North America faces negative profit margins in 2040 thus discouraging new investments.

But not everybody believes the refining industry is on its deathbed. The U.S. Energy Information Administration (EIA) has predicted that global demand for liquid fuels is set to increase by nearly 20 million bpd by 2050, from 101 million to more than 120 million bpd. The investing world appears to share that bullishness, with the refining sector’s favorite benchmark VanEck Oil Refiners ETF (NYSEARCA:CRAK) outperforming the broader fossil fuel market with a 12.4% return over the past 12 months compared with -2.6% return by the Energy Select Sector SPDR Fund (NYSEARCA:XLE). CRAK’s top 5 holdings are: Reliance Industries Ltd DR, Phillips 66, Marathon Petroleum, Valero Energy and ENEOS Holdings.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

- Saudi Aramco: 6 Million Bpd of Global Oil Production Is Being Lost Every Year

- Chicago Files Suit Against Big Oil

- Russian Rosneft Posts Nearly 50% Surge in Profits for 2023